In 2004 Françoise Chombar was appointed CEO of Melexis NV (EBR:MELE). This report will, first, examine the CEO compensation levels in comparison to CEO compensation at companies of similar size. Next, we'll consider growth that the business demonstrates. And finally - as a second measure of performance - we will look at the returns shareholders have received over the last few years. This process should give us an idea about how appropriately the CEO is paid.

See our latest analysis for Melexis

How Does Françoise Chombar's Compensation Compare With Similar Sized Companies?

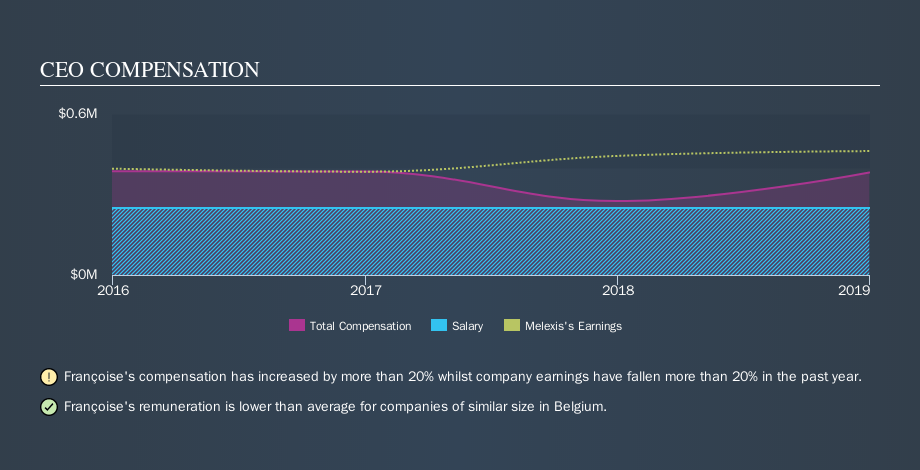

Our data indicates that Melexis NV is worth €2.6b, and total annual CEO compensation was reported as €382k for the year to December 2018. We think total compensation is more important but we note that the CEO salary is lower, at €250k. When we examined a selection of companies with market caps ranging from €1.8b to €5.9b, we found the median CEO total compensation was €577k.

This would give shareholders a good impression of the company, since most similar size companies have to pay more, leaving less for shareholders. Though positive, it's important we delve into the performance of the actual business.

You can see a visual representation of the CEO compensation at Melexis, below.

Is Melexis NV Growing?

Over the last three years Melexis NV has grown its earnings per share (EPS) by an average of 3.1% per year (using a line of best fit). Its revenue is down 3.0% over last year.

I would argue that the lack of revenue growth in the last year is less than ideal, but I'm happy with the EPS growth. In conclusion we can't form a strong opinion about business performance yet; but it's one worth watching. Shareholders might be interested in this free visualization of analyst forecasts.

Has Melexis NV Been A Good Investment?

Melexis NV has not done too badly by shareholders, with a total return of 8.1%, over three years. But they probably don't want to see the CEO paid more than is normal for companies around the same size.

In Summary...

It looks like Melexis NV pays its CEO less than similar sized companies.

Françoise Chombar is paid less than what is normal at similar size companies, and but overall performance has left me uninspired. But on this analysis I see no issue with the CEO compensation. So you may want to check if insiders are buying Melexis shares with their own money (free access).

Important note: Melexis may not be the best stock to buy. You might find something better in this list of interesting companies with high ROE and low debt.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About ENXTBR:MELE

Melexis

Designs, develops, tests, and markets advanced integrated semiconductor devices primarily for the automotive industry in Europe, the Middle East, Africa, the Asia Pacific, and North and Latin America.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

GE Vernova revenue will grow by 13% with a future PE of 64.7x

A buy recommendation

Growing between 25-50% for the next 3-5 years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026