- Belgium

- /

- Semiconductors

- /

- ENXTBR:MELE

European Dividend Stocks And 3 Top Picks

Reviewed by Simply Wall St

As European markets show resilience with the pan-European STOXX Europe 600 Index climbing 2.77% amid easing trade tensions, investors are increasingly looking at dividend stocks as a stable source of income. In light of current market conditions, a good dividend stock typically offers consistent payouts and demonstrates strong financial health, making it an attractive option for those seeking reliable returns amidst economic uncertainties.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Julius Bär Gruppe (SWX:BAER) | 5.00% | ★★★★★★ |

| Zurich Insurance Group (SWX:ZURN) | 4.51% | ★★★★★★ |

| Bredband2 i Skandinavien (OM:BRE2) | 4.72% | ★★★★★★ |

| OVB Holding (XTRA:O4B) | 4.46% | ★★★★★★ |

| Deutsche Post (XTRA:DHL) | 4.96% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 4.86% | ★★★★★★ |

| Cembra Money Bank (SWX:CMBN) | 4.22% | ★★★★★★ |

| Rubis (ENXTPA:RUI) | 7.18% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.46% | ★★★★★★ |

| UNIQA Insurance Group (WBAG:UQA) | 5.92% | ★★★★★☆ |

Click here to see the full list of 247 stocks from our Top European Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

Mapfre (BME:MAP)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Mapfre, S.A., along with its subsidiaries, operates in the investment, insurance, property, financial, and services sectors in Spain and has a market cap of approximately €9.71 billion.

Operations: Mapfre, S.A. generates its revenue from several segments including EMEA (€1.72 billion), Brazil (€5.23 billion), Iberia (€8.72 billion), Global Risks (€2.48 billion), and North America (€3.12 billion).

Dividend Yield: 5.1%

Mapfre's recent earnings report showed a net income of €275.9 million for Q1 2025, up from €216.3 million the previous year, supporting its dividend sustainability with a payout ratio of 50.8%. The company's dividends are well-covered by cash flows, maintaining stability over the past decade. Although its current yield of 5.06% is slightly below Spain's top quartile dividend payers, Mapfre trades at an attractive valuation relative to peers and industry benchmarks.

- Click to explore a detailed breakdown of our findings in Mapfre's dividend report.

- In light of our recent valuation report, it seems possible that Mapfre is trading behind its estimated value.

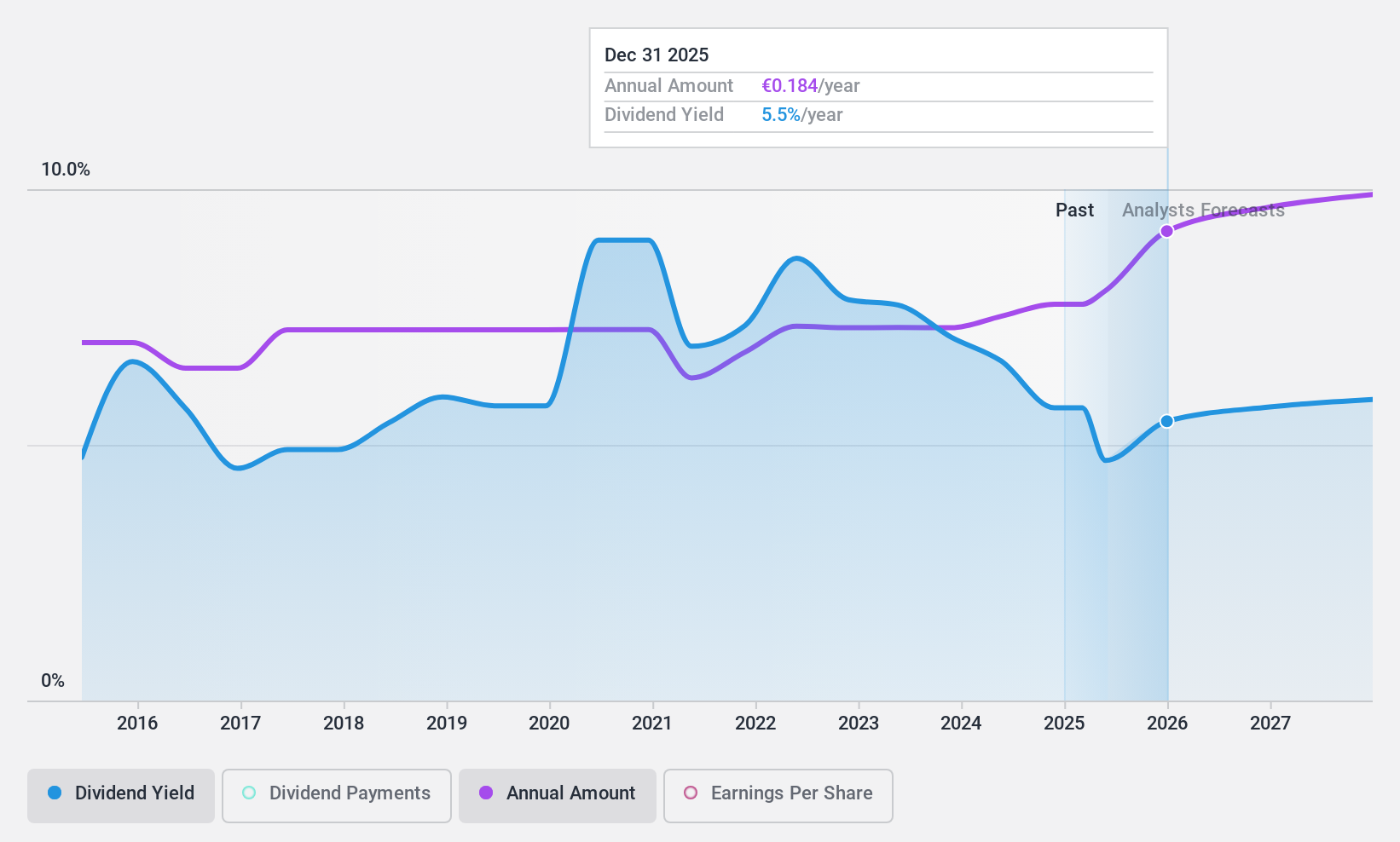

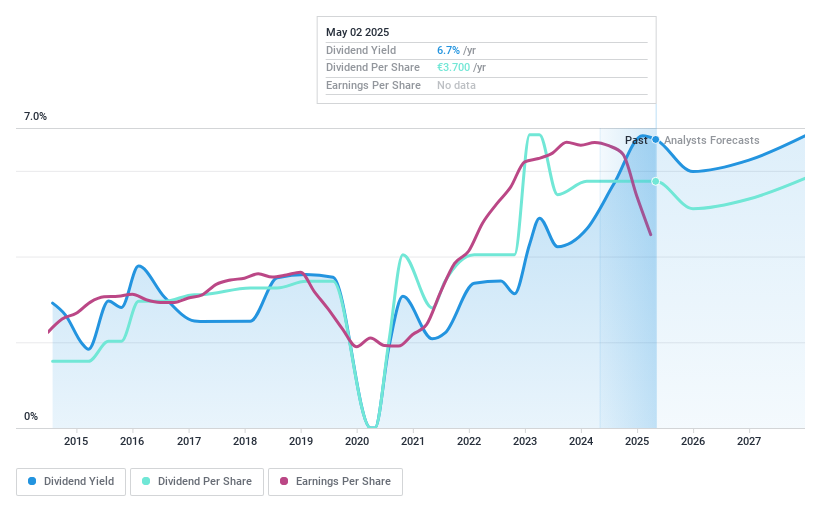

Melexis (ENXTBR:MELE)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Melexis NV designs, develops, tests, and markets advanced integrated semiconductor devices mainly for the automotive industry across Europe, the Middle East, Africa, the Asia Pacific, and North and Latin America with a market cap of €2.20 billion.

Operations: Melexis NV generates its revenue primarily from the automotive segment, with reported earnings of €932.81 million.

Dividend Yield: 6.8%

Melexis offers a high dividend yield of €3.7 per share, placing it in the top 25% of Belgian dividend payers. However, its dividends are not well-covered by cash flows, with a cash payout ratio of 119.5%, indicating potential sustainability issues despite being covered by earnings at an 87.2% payout ratio. Recent earnings guidance suggests modest sales growth in 2025, but past dividend volatility and declining profits may concern investors seeking reliable income streams.

- Take a closer look at Melexis' potential here in our dividend report.

- The analysis detailed in our Melexis valuation report hints at an deflated share price compared to its estimated value.

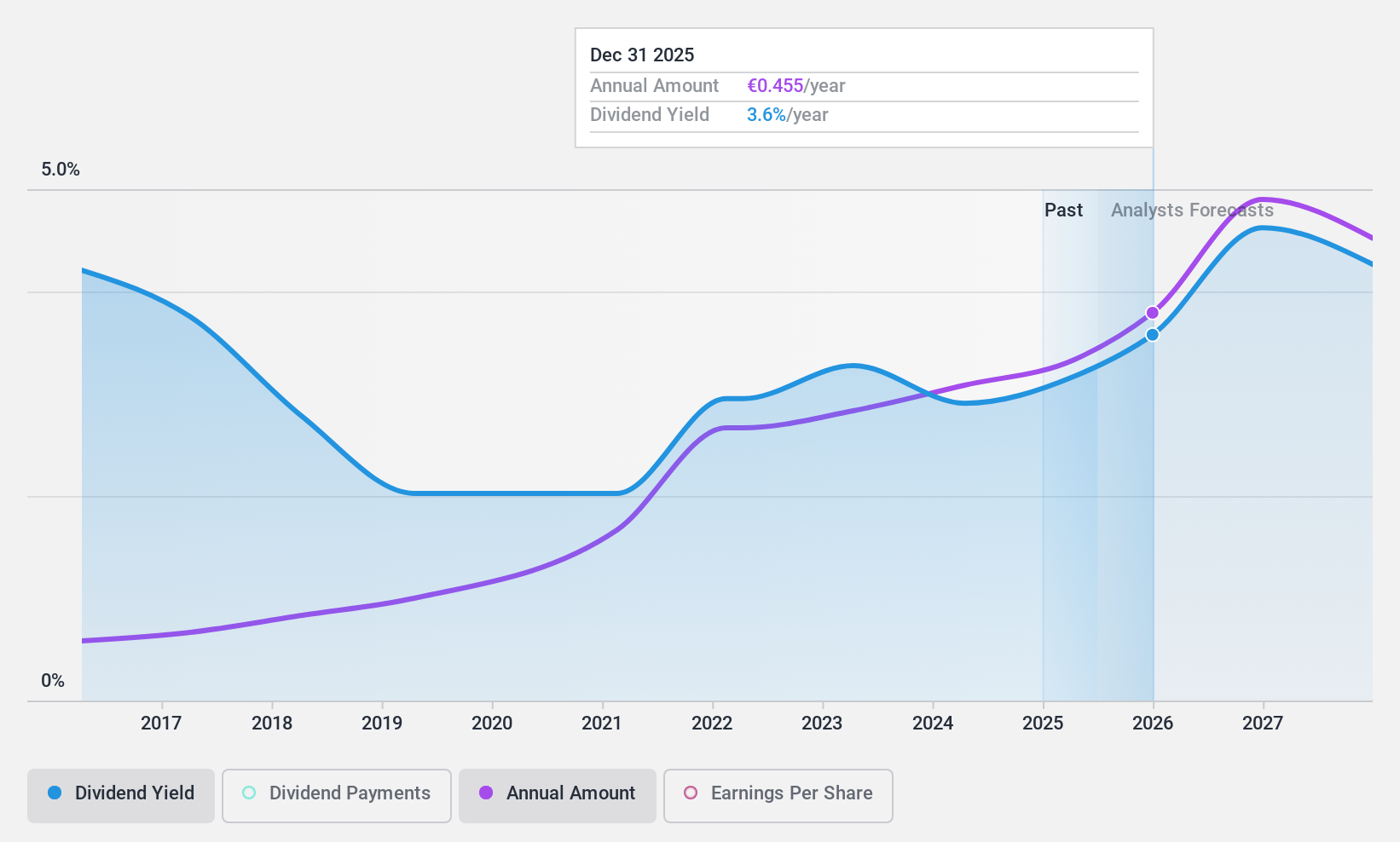

Marimekko Oyj (HLSE:MEKKO)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Marimekko Oyj is a lifestyle design company that designs, manufactures, and sells clothing, bags and accessories, and interior decoration products globally with a market cap of €497.41 million.

Operations: Marimekko Oyj generates revenue of €182.60 million from its business operations, which include the design, manufacture, and sale of clothing, bags and accessories, and interior decoration products worldwide.

Dividend Yield: 3.3%

Marimekko Oyj offers a stable dividend, recently approving a regular dividend of €0.40 and an extraordinary dividend of €0.25 per share for 2024, both payable on April 28, 2025. The company's dividends have been reliable over the past decade with a payout ratio of 66.6%, indicating earnings coverage. While its yield is lower than top Finnish payers, Marimekko's dividends are sustainable, supported by cash flows with a cash payout ratio of 60.6%.

- Navigate through the intricacies of Marimekko Oyj with our comprehensive dividend report here.

- Our comprehensive valuation report raises the possibility that Marimekko Oyj is priced lower than what may be justified by its financials.

Make It Happen

- Delve into our full catalog of 247 Top European Dividend Stocks here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTBR:MELE

Melexis

Designs, develops, tests, and markets advanced integrated semiconductor devices primarily for the automotive industry in Europe, the Middle East, Africa, the Asia Pacific, and North and Latin America.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives