This article will reflect on the compensation paid to Jan De Nys who has served as CEO of Retail Estates N.V. (EBR:RET) since 1998. This analysis will also evaluate the appropriateness of CEO compensation when taking into account the earnings and shareholder returns of the company.

Note: The company does not report funds from operations, and as a result, we have used earnings per share in our analysis.

Check out our latest analysis for Retail Estates

How Does Total Compensation For Jan De Nys Compare With Other Companies In The Industry?

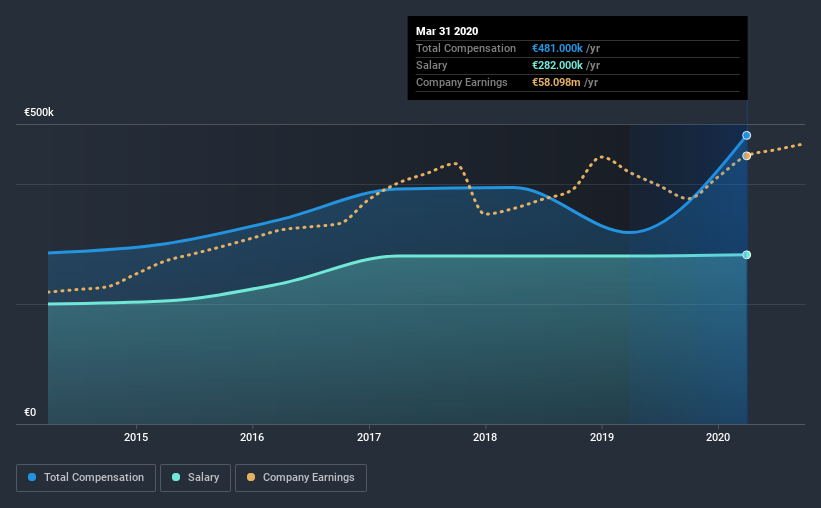

At the time of writing, our data shows that Retail Estates N.V. has a market capitalization of €756m, and reported total annual CEO compensation of €481k for the year to March 2020. That's a notable increase of 51% on last year. We note that the salary portion, which stands at €282.0k constitutes the majority of total compensation received by the CEO.

On comparing similar companies from the same industry with market caps ranging from €326m to €1.3b, we found that the median CEO total compensation was €478k. So it looks like Retail Estates compensates Jan De Nys in line with the median for the industry.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | €282k | €280k | 59% |

| Other | €199k | €39k | 41% |

| Total Compensation | €481k | €319k | 100% |

On an industry level, around 59% of total compensation represents salary and 41% is other remuneration. Our data reveals that Retail Estates allocates salary more or less in line with the wider market. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

Retail Estates N.V.'s Growth

Over the last three years, Retail Estates N.V. has shrunk its earnings per share by 8.1% per year. It achieved revenue growth of 4.7% over the last year.

Overall this is not a very positive result for shareholders. The fairly low revenue growth fails to impress given that the EPS is down. It's hard to argue the company is firing on all cylinders, so shareholders might be averse to high CEO remuneration. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has Retail Estates N.V. Been A Good Investment?

Since shareholders would have lost about 5.8% over three years, some Retail Estates N.V. investors would surely be feeling negative emotions. This suggests it would be unwise for the company to pay the CEO too generously.

To Conclude...

As we noted earlier, Retail Estates pays its CEO in line with similar-sized companies belonging to the same industry. On the other hand, EPS growth and total shareholder return have been negative for the last three years. Considering overall performance, shareholders will likely hold off support for a raise until results improve.

CEO compensation can have a massive impact on performance, but it's just one element. We've identified 1 warning sign for Retail Estates that investors should be aware of in a dynamic business environment.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

If you’re looking to trade Retail Estates, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

If you're looking to trade Retail Estates, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ENXTBR:RET

Retail Estates

The Belgian public real estate investment trust Retail Estates nv is a niche player specialised in making out-of town retail properties located on the periphery of residential areas or along main access roads to urban centres available to users.

6 star dividend payer and good value.

Similar Companies

Market Insights

Community Narratives