UCB (ENXTBR:UCB): Assessing Valuation After Recent Strong Share Price Gains

Reviewed by Simply Wall St

Most Popular Narrative: 6.5% Undervalued

According to the most widely followed analysis, UCB is currently trading at a notable discount to its fair value estimate. This suggests some upside potential from today’s prices.

“UCB’s deep and advancing innovation pipeline, along with its focus on differentiated products in neurology and immunology, supports the ability to launch multiple new indications, address rare/orphan diseases, and leverage advances in personalized medicine. All of these factors underpin sustained long-term revenue growth and margin expansion.”

Can UCB deliver breakthrough returns and outperform the market? The leading narrative is built around an ambitious sequence of projected earnings growth, margin expansion, and confidence in the company's innovation engine. Want to see which aggressive assumptions are driving the fair value calculation? Explore the narrative's bold blueprint for UCB’s future.

Result: Fair Value of €225 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, significant risks remain, including potential pricing pressure in the U.S. market and looming patent expiries. These factors could impact UCB's long-term growth outlook.

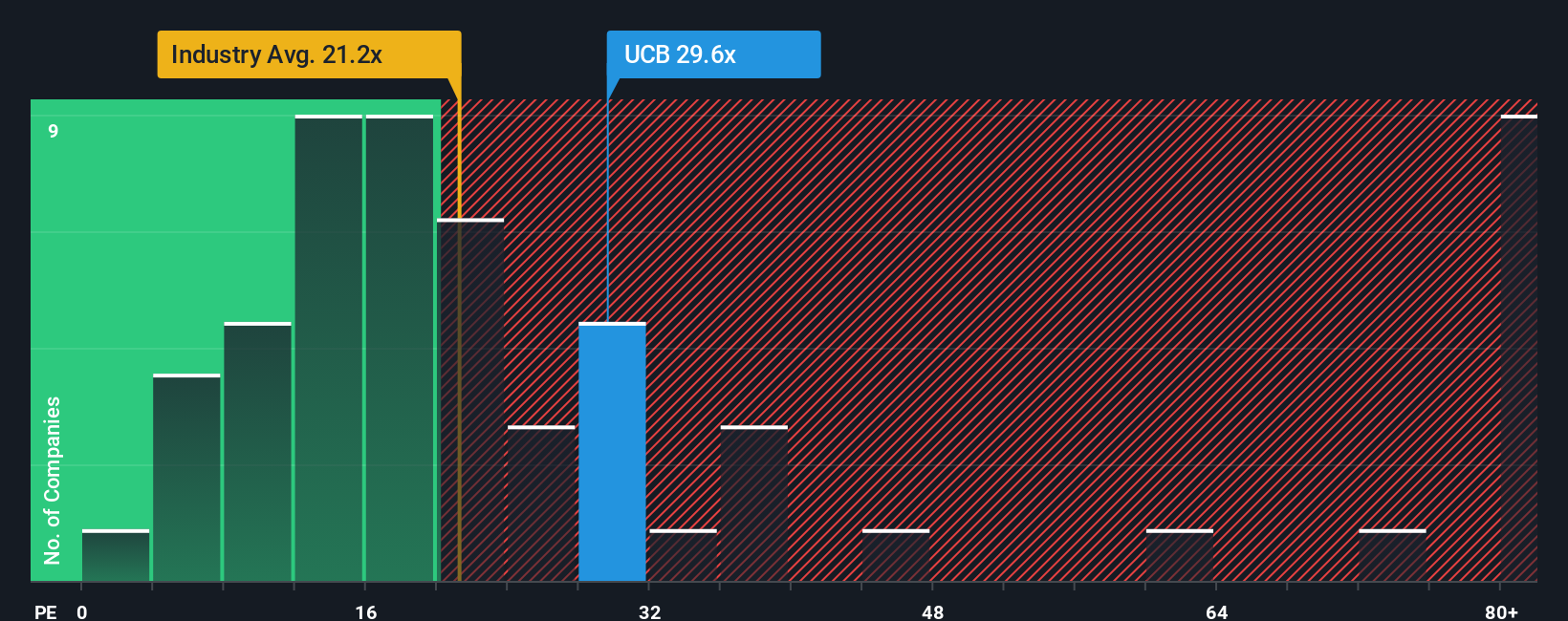

Find out about the key risks to this UCB narrative.Another View: Price Relative to Industry

While our first look painted UCB as undervalued, another common approach reveals a different story. Compared to others in its sector, UCB’s current share price appears more expensive. Which narrative will prove right?

See what the numbers say about this price — find out in our valuation breakdown.

Stay updated when valuation signals shift by adding UCB to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own UCB Narrative

For those who want to dig into the numbers and shape their own story, the tools are available to piece together a complete perspective in just a few minutes. Do it your way

A great starting point for your UCB research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Moves?

Why settle for one strong idea when you could put your capital to work in other promising themes? The market's most exciting opportunities are just a click away.

- Boost your income focus, and find shares with consistently high payouts by using our selection of dividend stocks with yields > 3%.

- Ride the AI wave and tap into companies set to benefit from emerging technology. See this handpicked group of AI penny stocks.

- Unearth hidden gems trading below their worth by checking stocks that stand out for value with our tailored list of undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About ENXTBR:UCB

UCB

A biopharmaceutical company, develops products and solutions for people with neurology and immunology diseases worldwide.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives