MDxHealth's (EBR:MDXH) Stock Price Has Reduced 75% In The Past Five Years

It is doubtless a positive to see that the MDxHealth SA (EBR:MDXH) share price has gained some 35% in the last three months. But will that repair the damage for the weary investors who have owned this stock as it declined over half a decade? Probably not. In fact, the share price has tumbled down a mountain to land 75% lower after that period. It's true that the recent bounce could signal the company is turning over a new leaf, but we are not so sure. The million dollar question is whether the company can justify a long term recovery.

Check out our latest analysis for MDxHealth

MDxHealth isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last five years MDxHealth saw its revenue shrink by 4.1% per year. That's not what investors generally want to see. If a business loses money, you want it to grow, so no surprises that the share price has dropped 12% each year in that time. We're generally averse to companies with declining revenues, but we're not alone in that. That is not really what the successful investors we know aim for.

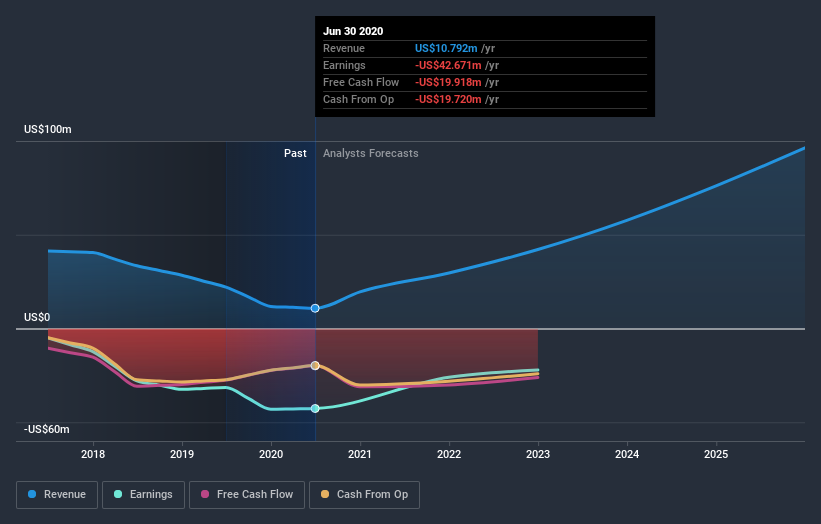

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

We're pleased to report that MDxHealth shareholders have received a total shareholder return of 4.9% over one year. That certainly beats the loss of about 12% per year over the last half decade. The long term loss makes us cautious, but the short term TSR gain certainly hints at a brighter future. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider for instance, the ever-present spectre of investment risk. We've identified 4 warning signs with MDxHealth (at least 2 which are a bit concerning) , and understanding them should be part of your investment process.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on BE exchanges.

When trading MDxHealth or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ENXTBR:MDXH

MDxHealth

A commercial-stage precision diagnostics company, provides urologic solutions in the United States, Europe, and internationally.

Adequate balance sheet and fair value.