- China

- /

- Life Sciences

- /

- SZSE:300347

Discovering argenx And 2 More Stocks That May Be Priced Below Estimated Value

Reviewed by Simply Wall St

As global markets react to China's robust stimulus measures, with U.S. stocks reaching record highs and European indices rebounding, investors are keenly observing the shifting economic landscape. In this context of heightened market activity and optimism around technological advancements, identifying undervalued stocks becomes crucial for those looking to capitalize on potential growth opportunities.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| First Internet Bancorp (NasdaqGS:INBK) | US$31.37 | US$62.52 | 49.8% |

| Gaming Realms (AIM:GMR) | £0.382 | £0.76 | 49.8% |

| Zhejiang Great Shengda PackagingLtd (SHSE:603687) | CN¥7.11 | CN¥14.16 | 49.8% |

| HSS Engineers Berhad (KLSE:HSSEB) | MYR1.07 | MYR2.14 | 50% |

| TSE (KOSDAQ:A131290) | ₩50200.00 | ₩100124.32 | 49.9% |

| Sejin Heavy Industries (KOSE:A075580) | ₩7480.00 | ₩14914.79 | 49.8% |

| Ta-Yuan Cogeneration (TPEX:8931) | NT$49.20 | NT$97.85 | 49.7% |

| ABCO Electronics (KOSDAQ:A036010) | ₩5760.00 | ₩11488.39 | 49.9% |

| Akeso (SEHK:9926) | HK$67.30 | HK$133.87 | 49.7% |

| Digital China Holdings (SEHK:861) | HK$2.96 | HK$5.88 | 49.7% |

We'll examine a selection from our screener results.

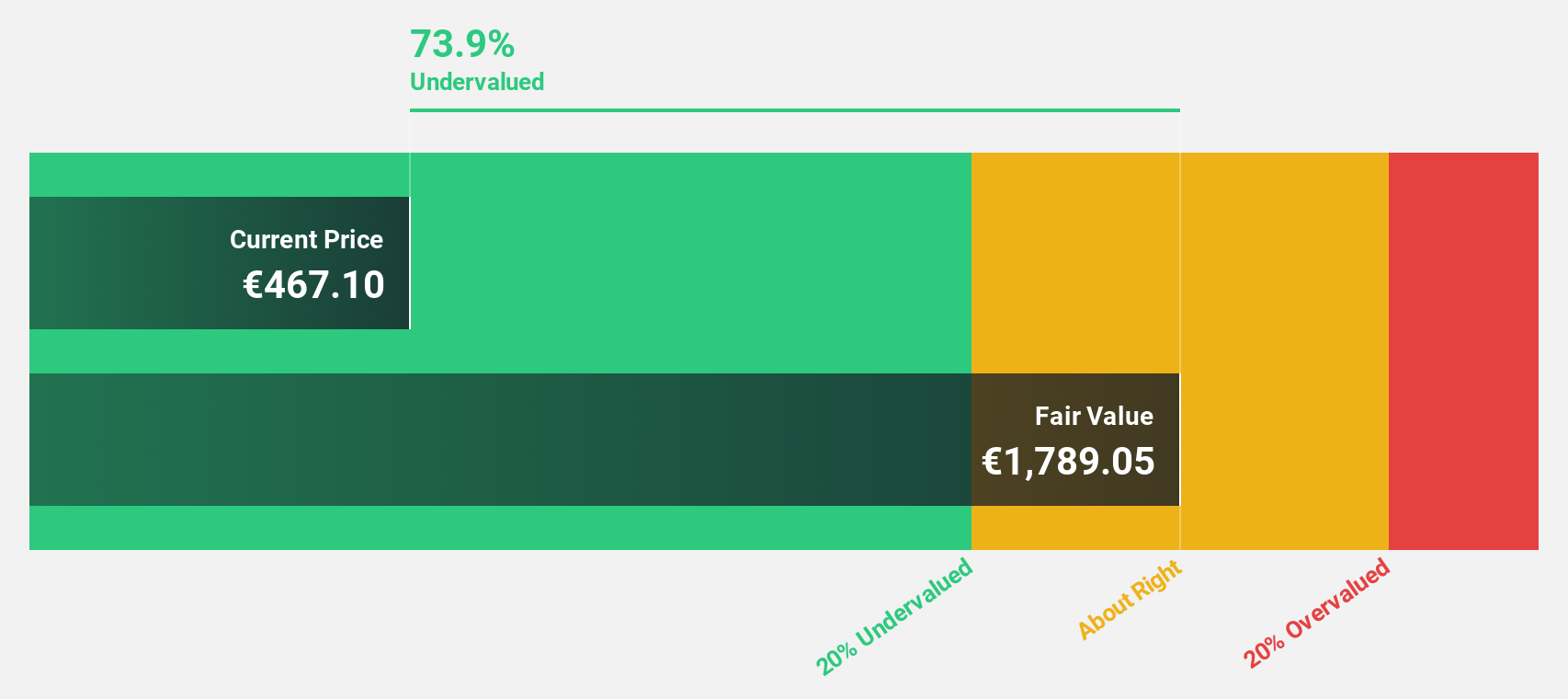

argenx (ENXTBR:ARGX)

Overview: argenx SE is a biotechnology company focused on developing therapies for autoimmune diseases across the United States, Japan, Europe, the Middle East, Africa, and China, with a market cap of €29.70 billion.

Operations: The company generates its revenue primarily from its biotechnology segment, which amounted to $1.66 billion.

Estimated Discount To Fair Value: 41.9%

argenx is trading significantly below its estimated fair value, with a discounted cash flow analysis suggesting it is highly undervalued. Recent earnings show strong revenue growth, reaching US$489.43 million in Q2 2024, up from US$281.04 million a year ago, and a shift to profitability with a net income of US$29.07 million. The approval of VYVGART Hytrulo for CIDP enhances its product portfolio and potential cash flows despite past shareholder dilution and insider selling concerns.

- Our expertly prepared growth report on argenx implies its future financial outlook may be stronger than recent results.

- Navigate through the intricacies of argenx with our comprehensive financial health report here.

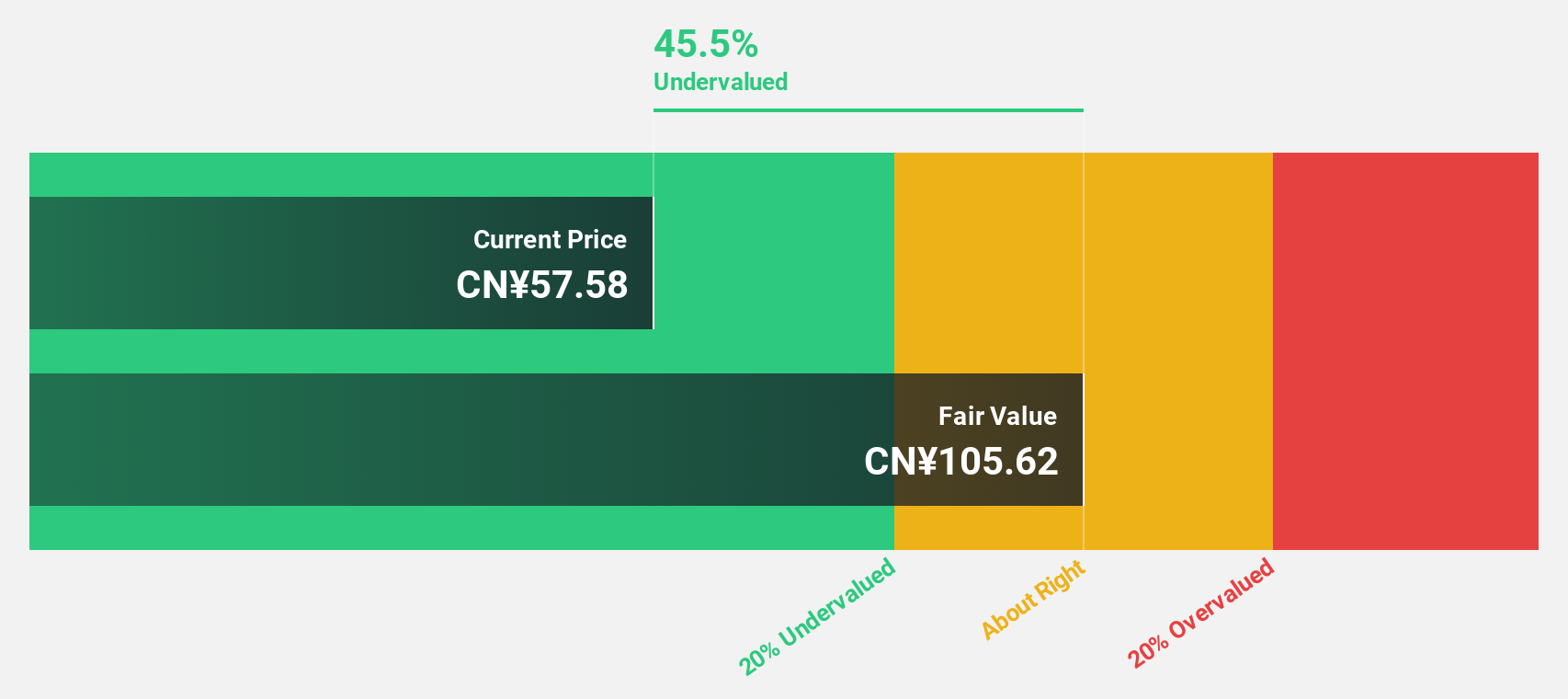

Hangzhou Tigermed Consulting (SZSE:300347)

Overview: Hangzhou Tigermed Consulting Co., Ltd offers contract research organization services both within China and internationally, with a market capitalization of CN¥56.69 billion.

Operations: Revenue Segments (in millions of CN¥): Clinical Trial Solutions: 3,500; Laboratory Services: 1,200; Data Management and Statistical Analysis: 800.

Estimated Discount To Fair Value: 24%

Hangzhou Tigermed Consulting is trading 24% below its fair value estimate of CN¥90.72, indicating potential undervaluation based on cash flows. Despite a recent decline in revenue and net income, with earnings per share dropping to CN¥0.57 from CN¥1.61, the company forecasts significant earnings growth of 25.9% annually over three years, outpacing the market average. Recent private placements raised HKD 11.82 billion, potentially bolstering financial flexibility amidst volatile share prices and reduced profit margins.

- In light of our recent growth report, it seems possible that Hangzhou Tigermed Consulting's financial performance will exceed current levels.

- Take a closer look at Hangzhou Tigermed Consulting's balance sheet health here in our report.

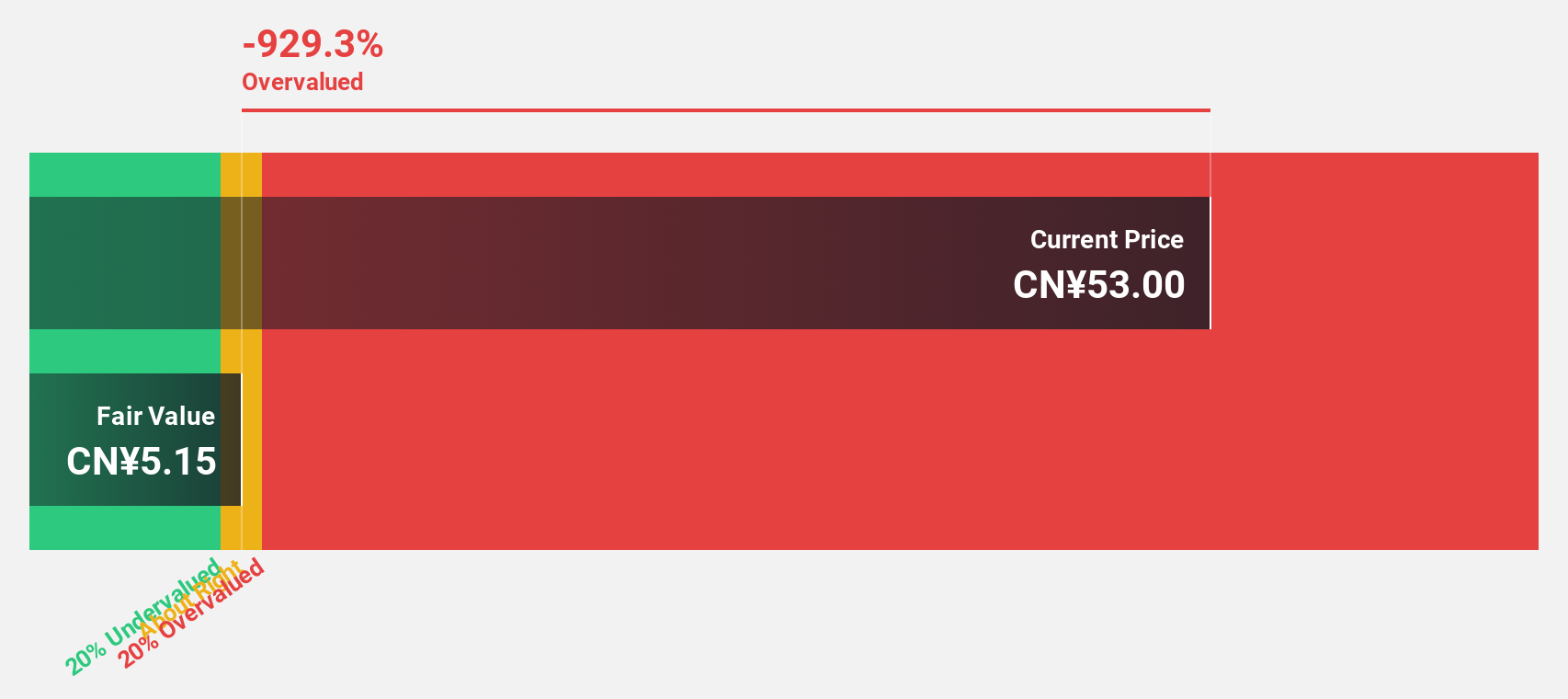

iSoftStone Information Technology (Group) (SZSE:301236)

Overview: iSoftStone Information Technology (Group) Co., Ltd. operates as a technology services provider, focusing on IT consulting and solutions, with a market cap of approximately CN¥49.10 billion.

Operations: iSoftStone generates its revenue primarily through IT consulting and solutions services.

Estimated Discount To Fair Value: 13.1%

iSoftStone Information Technology is trading at CN¥51.52, below its fair value estimate of CN¥59.26, suggesting it may be undervalued based on cash flows. Despite a significant forecasted earnings growth of 47% annually and revenue growth of 22.4%, the company reported a net loss of CN¥154.33 million for the first half of 2024 due to large one-off items affecting financial results, with profit margins declining from last year’s figures.

- The analysis detailed in our iSoftStone Information Technology (Group) growth report hints at robust future financial performance.

- Click to explore a detailed breakdown of our findings in iSoftStone Information Technology (Group)'s balance sheet health report.

Seize The Opportunity

- Navigate through the entire inventory of 956 Undervalued Stocks Based On Cash Flows here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Hangzhou Tigermed Consulting might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300347

Hangzhou Tigermed Consulting

Provides contract research organization services in the People’s Republic of China and internationally.

Excellent balance sheet average dividend payer.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)