A Look at argenx (ENXTBR:ARGX) Valuation Following Clinical Pipeline Progress and FUJIFILM Manufacturing Expansion

Reviewed by Kshitija Bhandaru

Argenx (ENXTBR:ARGX) has drawn fresh attention from investors after two key developments: a promising update on its ARGX-119 program for rare neuromuscular diseases and the deepening of a global manufacturing partnership with FUJIFILM Biotechnologies.

See our latest analysis for argenx.

argenx’s recent updates around clinical progress and supply chain expansion have helped fuel renewed optimism, even as momentum has remained measured. Its latest share price sits at $668.8, with a 1-year total shareholder return of just 0.34%. While headlines around partnerships and R&D have kept the spotlight on its long-term growth potential, the stock’s performance has been steady rather than explosive, suggesting the market is watching for further catalysts before momentum really builds.

If the innovation in biopharma piqued your curiosity, it could be the perfect time to explore other standout companies with our See the full list for free.

With argenx shares treading water despite analyst optimism and a wave of promising updates, investors now face a crucial question: Is the current price a rare entry point, or has the market already factored in future growth?

Most Popular Narrative: 7.7% Undervalued

According to the most widely followed narrative, argenx’s fair value sits at €724.38 compared to the last close of €668.8. This modest gap signals that analyst models see more near-term upside, but only if their growth assumptions play out as projected.

“Analysts cite accelerating Vyvgart uptake, global expansion, and additional pipeline opportunities as drivers of potential quadrupling of sales and strong operating cash flow by decade's end.”

Want to know why earnings forecasts are driving this bullish view? The narrative hinges on explosive revenue growth, huge cash flow ramp-ups, and a future profit multiple bolder than most in healthcare. Curious how analysts see these targets coming together? Click to reveal the full blueprint behind this valuation forecast.

Result: Fair Value of €724.38 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent pricing pressures or regulatory setbacks for Vyvgart could quickly shift sentiment. These factors serve as potential catalysts that test analyst optimism.

Find out about the key risks to this argenx narrative.

Another View: What About the Market’s Pricing?

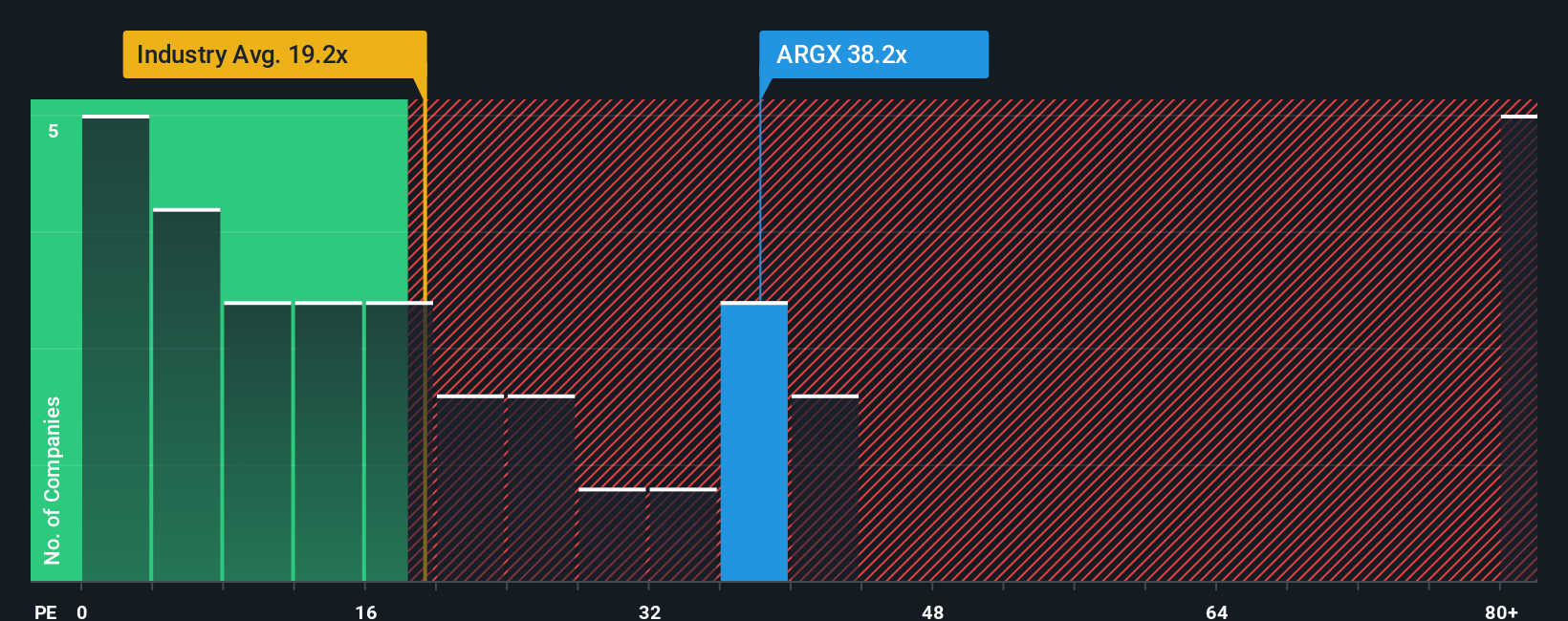

Looking at argenx through the lens of its price-to-earnings ratio, things look quite different. At 37.5x, argenx trades higher than both the European Biotechs industry average of 20.3x and its own fair ratio of 35.6x. This reveals a premium investors currently pay for its growth story. This puts the spotlight on expectations, but also raises the question: what happens if the momentum slows or expectations shift?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own argenx Narrative

If you have your own angle, or want to test different assumptions against the numbers, you can build your personal narrative in just a few minutes. Do it your way

A great starting point for your argenx research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Want to uncover tomorrow’s winners before everyone else? Let Simply Wall Street’s powerful screener spotlight unique stocks, trends, and opportunities you won’t want to overlook.

- Supercharge your watchlist by targeting these 910 undervalued stocks based on cash flows with high intrinsic value that the market has yet to fully recognize.

- Capitalize on compounding returns with these 19 dividend stocks with yields > 3%, featuring stocks offering strong yields and reliable payouts above 3%.

- Position yourself early by following these 24 AI penny stocks as they capture the AI innovation wave and transform entire industries every day.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTBR:ARGX

argenx

A commercial-stage biopharma company, develops various therapies for the treatment of autoimmune diseases in the United States, Japan, China, the Netherlands, and internationally.

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives