A Fresh Look at argenx (ENXTBR:ARGX) Valuation Following Major Myasthenia Gravis Trial Results

Reviewed by Kshitija Bhandaru

argenx (ENXTBR:ARGX) is generating buzz after announcing pivotal ADAPT SERON results and interim findings from the ADAPT Jr study at major neuromuscular conferences. These presentations highlight progress in treating difficult myasthenia gravis cases.

See our latest analysis for argenx.

argenx’s wave of new data and high-profile conference presentations has clearly fueled buying momentum. The stock’s share price has jumped 44.7% over the past three months, and its total shareholder return is up nearly 40% for the last year. That kind of performance, paired with ongoing product innovation, suggests investors remain optimistic on its long-term potential.

If you’re keen to spot other biotech leaders on the move, our healthcare stocks discovery tool could be your next stop — See the full list for free.

The question now is whether, after such a run in both price and expectations, argenx shares are still trading at an attractive entry point or if the market has already factored in every bit of anticipated growth.

Most Popular Narrative: 1.7% Undervalued

With argenx trading just below the consensus fair value of €724.38 and a last close of €711.80, market sentiment appears nearly aligned with the most widely followed growth narrative. The close proximity between price and valuation highlights heightened analyst confidence, yet leaves little room for error or surprise.

“Increasing peak sales estimates for Vyvgart in myasthenia gravis, with models projecting up to $6.4B in gMG by 2034 and an expanded role for new indications, are materially raising valuations.

Analysts cite accelerating Vyvgart uptake, global expansion, and additional pipeline opportunities as drivers of potential quadrupling of sales and strong operating cash flow by decade's end.”

Curious which blockbuster launches are crucial to this valuation? The blueprint relies on rapid expansion, bold pipeline bets, and a profit trajectory few companies dare to target. What are the hidden assumptions fueling this price? Peek under the hood to uncover the forecasting details and key numbers behind this high-stakes growth story.

Result: Fair Value of €724.38 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing competition and increased rebate pressures remain potential stumbling blocks. These factors remind investors that argenx’s story still carries real execution risks.

Find out about the key risks to this argenx narrative.

Another View: Market Ratios Offer a Cautionary Counterpoint

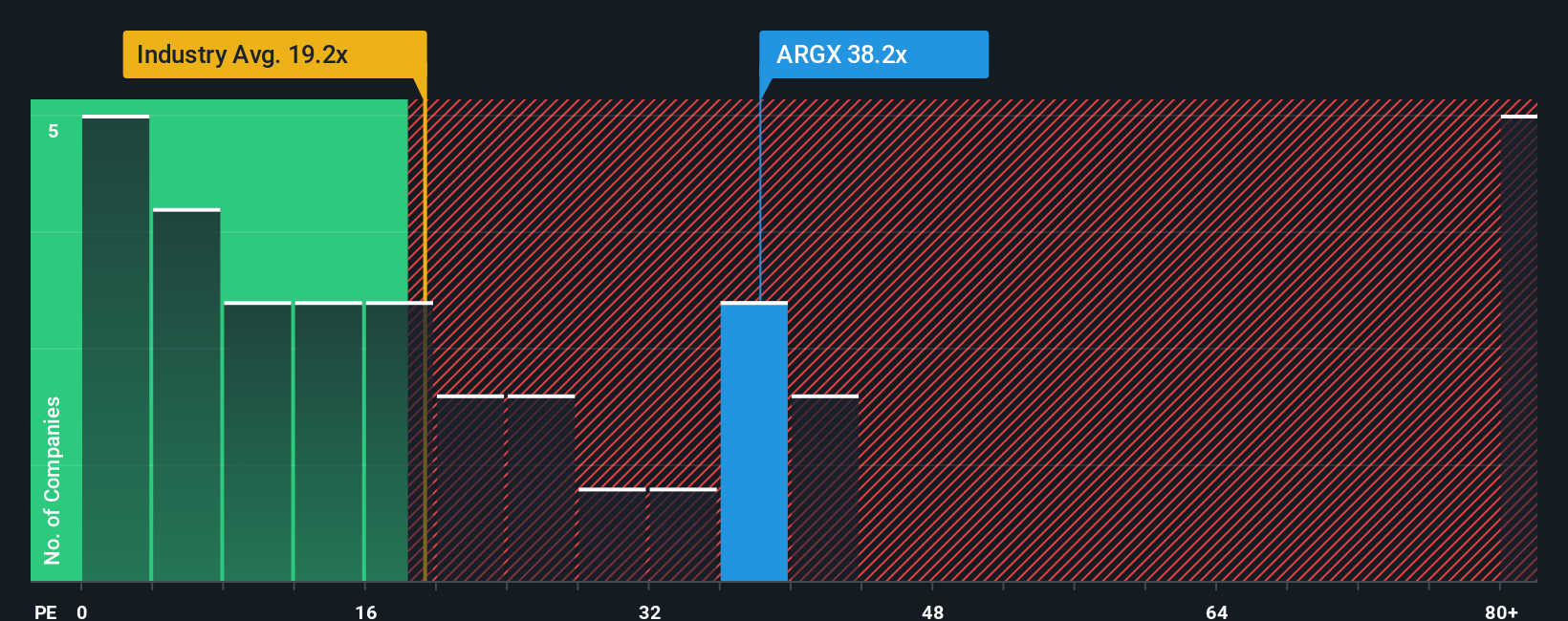

Looking at valuation through the lens of price-to-earnings, argenx’s ratio stands at 39.8x, which is far higher than the European Biotechs industry average of 17.4x and peers at 72.3x. It also exceeds the fair ratio of 35.9x. This suggests the shares are trading at a premium and offering less room for upside if forecasts change. Is this a warning flag, or a sign of quality priced in?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own argenx Narrative

If you would rather chart your own course or see the numbers for yourself, you can develop a personal perspective in just a few minutes. Do it your way

A great starting point for your argenx research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart opportunities are everywhere if you know where to look. Act now to get a jump on top-performing stocks that others might miss.

- Uncover hidden value by checking out these 868 undervalued stocks based on cash flows that the market has yet to fully recognize for their true cash flow potential.

- Capture new trends in artificial intelligence by targeting these 24 AI penny stocks that are poised to rewrite the rules of tech growth and innovation.

- Accelerate your income strategy by tapping into these 20 dividend stocks with yields > 3% that consistently deliver yields above 3% and reward shareholders through every market cycle.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTBR:ARGX

argenx

A commercial-stage biopharma company, develops various therapies for the treatment of autoimmune diseases in the United States, Japan, China, the Netherlands, and internationally.

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives