How Much Did Roularta Media Group's (EBR:ROU) Shareholders Earn On Their Investment Over The Last Five Years?

Roularta Media Group NV (EBR:ROU) shareholders should be happy to see the share price up 17% in the last month. No-one would rejoice in the loss of 41% over five years. But the market returned an even less impressive return of 12%.

Check out our latest analysis for Roularta Media Group

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Roularta Media Group became profitable within the last five years. That would generally be considered a positive, so we are surprised to see the share price is down. Other metrics may better explain the share price move.

The revenue decline of 0.07% isn't too bad. But if the market expected durable top line growth, then that could explain the share price weakness.

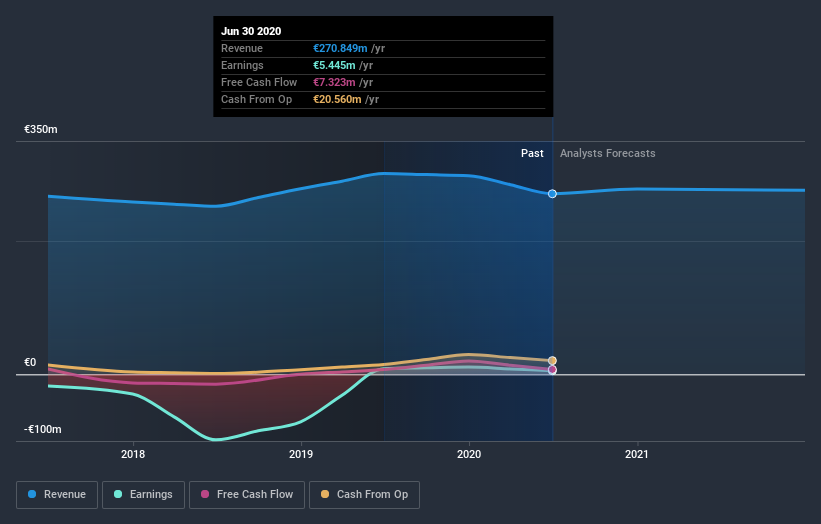

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. So we recommend checking out this free report showing consensus forecasts

What about the Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between Roularta Media Group's total shareholder return (TSR) and its share price return. Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. Dividends have been really beneficial for Roularta Media Group shareholders, and that cash payout explains why its total shareholder loss of 4.0%, over the last 5 years, isn't as bad as the share price return.

A Different Perspective

While it's never nice to take a loss, Roularta Media Group shareholders can take comfort that their trailing twelve month loss of 1.4% wasn't as bad as the market loss of around 8.6%. Given the total loss of 0.8% per year over five years, it seems returns have deteriorated in the last twelve months. While some investors do well specializing in buying companies that are struggling (but nonetheless undervalued), don't forget that Buffett said that 'turnarounds seldom turn'. It's always interesting to track share price performance over the longer term. But to understand Roularta Media Group better, we need to consider many other factors. For example, we've discovered 2 warning signs for Roularta Media Group (1 is potentially serious!) that you should be aware of before investing here.

Of course Roularta Media Group may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on BE exchanges.

If you decide to trade Roularta Media Group, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About ENXTBR:ROU

Roularta Media Group

Operates as a multimedia company in Belgium, the Netherlands, and Germany.

Adequate balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives