- Belgium

- /

- Entertainment

- /

- ENXTBR:KIN

High Growth Tech Stocks To Watch In November 2024

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by mixed earnings reports and fluctuating economic indicators, small-cap stocks have shown resilience, particularly in the technology sector where innovation continues to drive interest. In this environment, identifying high-growth tech stocks involves looking for companies that not only demonstrate strong fundamentals but also possess the agility to adapt to rapid changes in market dynamics and consumer demands.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Sarepta Therapeutics | 23.80% | 44.01% | ★★★★★★ |

| eWeLLLtd | 26.52% | 27.53% | ★★★★★★ |

| TG Therapeutics | 30.63% | 46.00% | ★★★★★★ |

| Medley | 24.98% | 30.36% | ★★★★★★ |

| Scandion Oncology | 40.71% | 75.34% | ★★★★★★ |

| Pharma Mar | 26.94% | 55.09% | ★★★★★★ |

| Alnylam Pharmaceuticals | 22.45% | 70.50% | ★★★★★★ |

| Adveritas | 57.98% | 144.21% | ★★★★★★ |

| Travere Therapeutics | 31.33% | 69.07% | ★★★★★★ |

| UTI | 114.97% | 134.60% | ★★★★★★ |

Click here to see the full list of 1292 stocks from our High Growth Tech and AI Stocks screener.

Let's dive into some prime choices out of from the screener.

Kinepolis Group (ENXTBR:KIN)

Simply Wall St Growth Rating: ★★★★☆☆

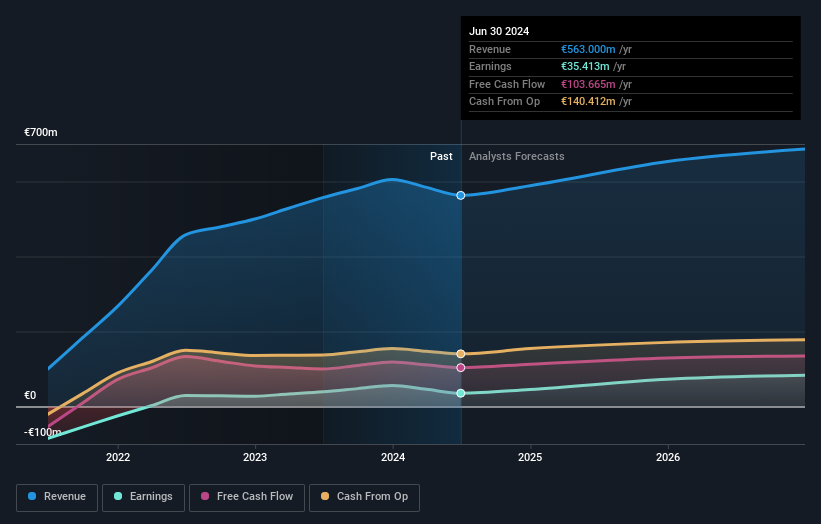

Overview: Kinepolis Group NV operates cinema complexes across several countries including Belgium, the Netherlands, France, Spain, Luxembourg, Switzerland, Poland, Canada, and the United States with a market cap of €1.05 billion.

Operations: Kinepolis Group generates revenue primarily from box office sales (€294.05 million) and in-theatre sales (€177.61 million), supplemented by real estate and film distribution activities.

Despite a challenging environment, Kinepolis Group NV has demonstrated resilience with a forecasted earnings growth of 27.8% per year, outpacing the Belgian market's 19.2%. This growth is supported by strategic executive changes, including the appointment of a new CFO in August 2024, which could signal a fresh perspective on financial management and innovation within the company. However, it's important to note that while their revenue growth at 6% per year lags behind the market average of 7.2%, their commitment to enhancing shareholder value is evident from their significant R&D investment aimed at refining viewer experiences and expanding service offerings. This dual approach of administrative vigor and focused R&D spending might well position Kinepolis for future opportunities despite current underperformance in revenue growth compared to industry peers.

- Delve into the full analysis health report here for a deeper understanding of Kinepolis Group.

Evaluate Kinepolis Group's historical performance by accessing our past performance report.

Paradox Interactive (OM:PDX)

Simply Wall St Growth Rating: ★★★★★☆

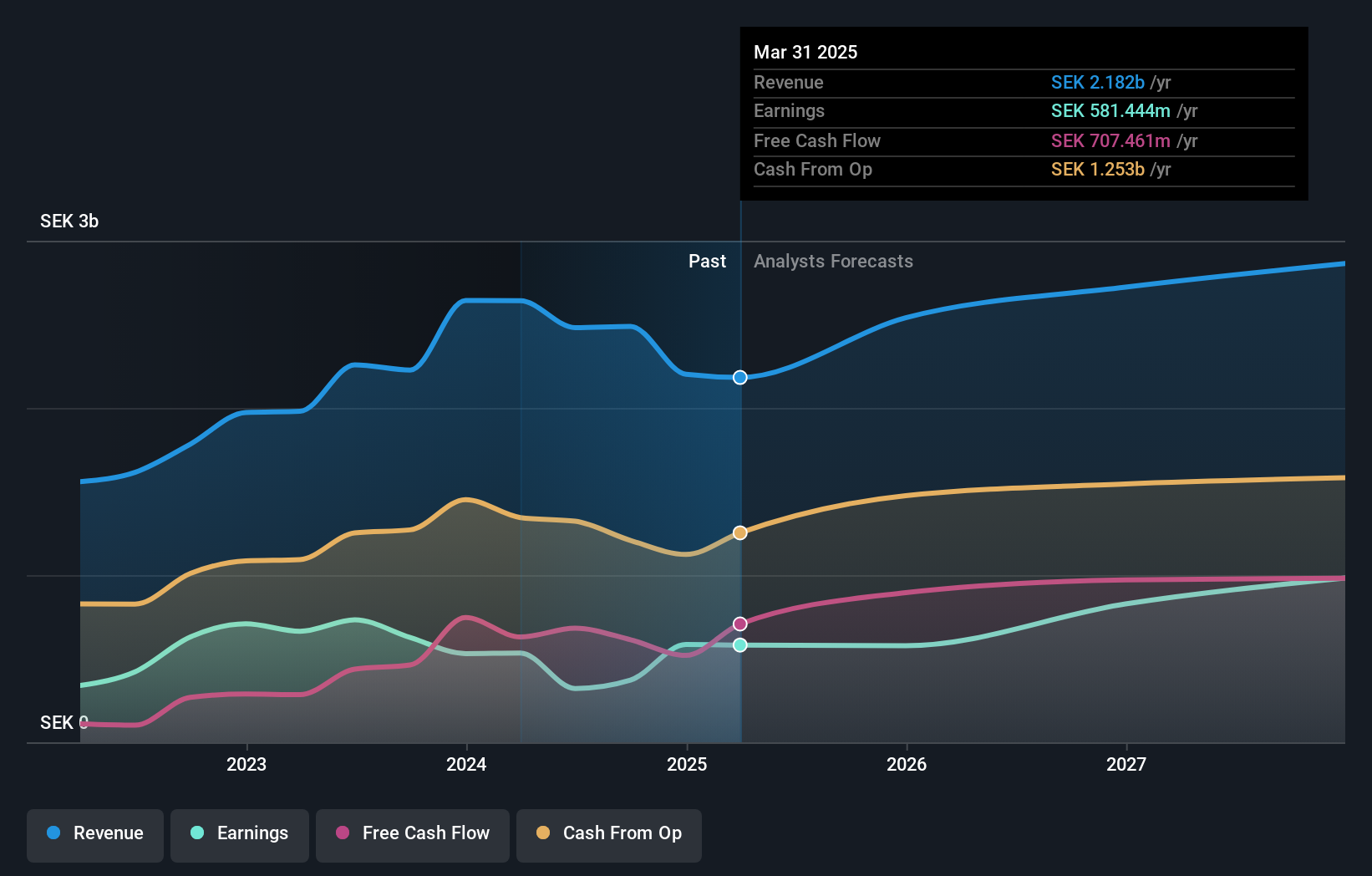

Overview: Paradox Interactive AB (publ) is a company that develops and publishes strategy and management games for PC and consoles across various regions including North and Latin America, Europe, the Middle East, Africa, and the Asia Pacific, with a market cap of SEK21.12 billion.

Operations: The company generates revenue primarily from its computer graphics segment, amounting to SEK2.49 billion. It focuses on developing and publishing strategy and management games for both PC and consoles across multiple global regions.

Paradox Interactive has demonstrated robust financial performance with a notable increase in net income to SEK 119.66 million from SEK 69.29 million year-over-year, reflecting a solid earnings per share growth from SEK 0.66 to SEK 1.13 in the third quarter of 2024. This surge aligns with their strategic R&D investment, which is pivotal in driving innovation and maintaining competitive advantage within the tech sector; notably, their recent launch of the Grand Archive for Stellaris showcases their commitment to enhancing game content through significant R&D efforts. Despite a challenging market environment where overall sales dipped slightly year-on-year to SEK 1,491.85 million from SEK 1,646.55 million, Paradox's forward-looking initiatives suggest a strong potential for future revenue streams and market share expansion, particularly as they continue to explore new gaming frontiers and expand their product offerings through strategic collaborations like those with Abrakam.

- Click to explore a detailed breakdown of our findings in Paradox Interactive's health report.

Gain insights into Paradox Interactive's past trends and performance with our Past report.

Stillfront Group (OM:SF)

Simply Wall St Growth Rating: ★★★★☆☆

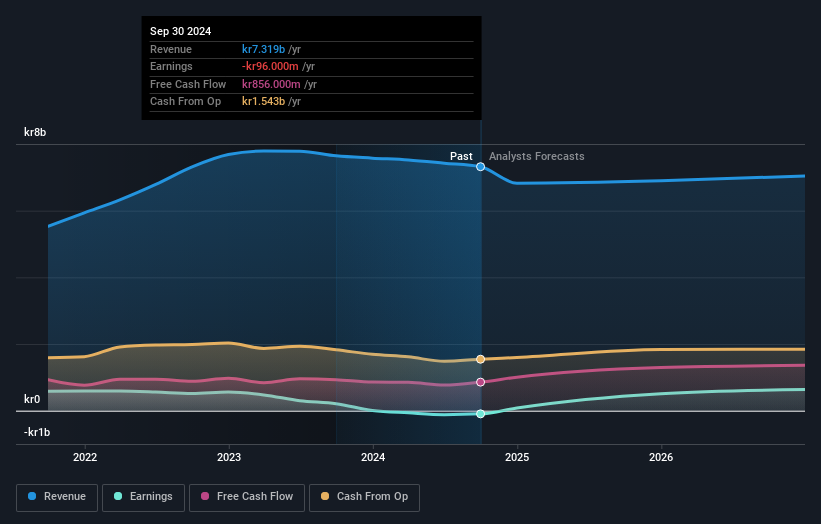

Overview: Stillfront Group AB (publ) is a company that designs, develops, markets, publishes, and sells digital games across Europe, North America, the United Kingdom, and the Middle East and North Africa region with a market cap of approximately SEK3.75 billion.

Operations: The group generates revenue primarily from its computer graphics segment, amounting to SEK7.32 billion.

Stillfront Group's recent pivot towards profitability is underscored by a swing from a net loss of SEK 7 million to a net income of SEK 16 million in Q3 2024, alongside an earnings per share improvement from a loss of SEK 0.01 to a gain of SEK 0.03. This financial rebound is part of broader strategic adjustments, including the reorganization into three distinct business areas aimed at enhancing operational efficiency and focus on high-performing games—measures expected to save up to SEK 250 million annually by Q4 2025. Despite these positive steps, revenue dipped slightly year-on-year, and the company's share price has shown significant volatility over the past three months. However, with R&D expenses maintaining robust levels aligned with industry standards and an anticipated annual profit growth forecast at an impressive rate of 111.3%, Stillfront appears strategically positioned for future growth in the evolving tech landscape.

Summing It All Up

- Unlock more gems! Our High Growth Tech and AI Stocks screener has unearthed 1289 more companies for you to explore.Click here to unveil our expertly curated list of 1292 High Growth Tech and AI Stocks.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kinepolis Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTBR:KIN

Kinepolis Group

Operates cinema complexes in Belgium, the Netherlands, France, Spain, Luxembourg, Switzerland, Poland, Canada, and the United States.

Undervalued with reasonable growth potential.