- Sweden

- /

- Interactive Media and Services

- /

- OM:ACAST

High Growth Tech Stocks In Europe To Watch May 2025

Reviewed by Simply Wall St

The European market has recently seen a positive shift, with the pan-European STOXX Europe 600 Index rising by 3.44% as easing tariff concerns have bolstered investor confidence. Against this backdrop of improving economic growth and heightened optimism, identifying high growth tech stocks involves looking for companies that demonstrate strong innovation potential, robust financial health, and the ability to adapt to evolving market dynamics.

Top 10 High Growth Tech Companies In Europe

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Archos | 21.07% | 36.58% | ★★★★★★ |

| Digital Value | 29.11% | 29.54% | ★★★★★★ |

| KebNi | 21.29% | 66.10% | ★★★★★★ |

| Pharma Mar | 25.21% | 43.09% | ★★★★★★ |

| Yubico | 20.12% | 25.70% | ★★★★★★ |

| Elicera Therapeutics | 63.53% | 97.24% | ★★★★★★ |

| Ascelia Pharma | 43.57% | 70.39% | ★★★★★★ |

| CD Projekt | 33.78% | 37.39% | ★★★★★★ |

| XTPL | 86.66% | 143.68% | ★★★★★★ |

| Elliptic Laboratories | 49.76% | 88.21% | ★★★★★★ |

Let's review some notable picks from our screened stocks.

Promotora de Informaciones (BME:PRS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Promotora de Informaciones, S.A. operates in the media industry both in Spain and internationally, with a market capitalization of €546.53 million.

Operations: The company generates revenue primarily through media exploitation activities across Spain and international markets.

Promotora de Informaciones, despite a challenging backdrop with a revenue growth of 5.6% per year, is setting the stage for profitability with an expected earnings surge of 79.63% annually over the next three years. Recent strategic moves like the €40 million follow-on equity offering and redemption of convertible notes underline efforts to stabilize finances amidst shareholder dilution concerns. The company's adaptation in a volatile market, coupled with its forecast to outpace Spanish market growth, positions it intriguingly for future shifts in the media landscape.

Kinepolis Group (ENXTBR:KIN)

Simply Wall St Growth Rating: ★★★★☆☆

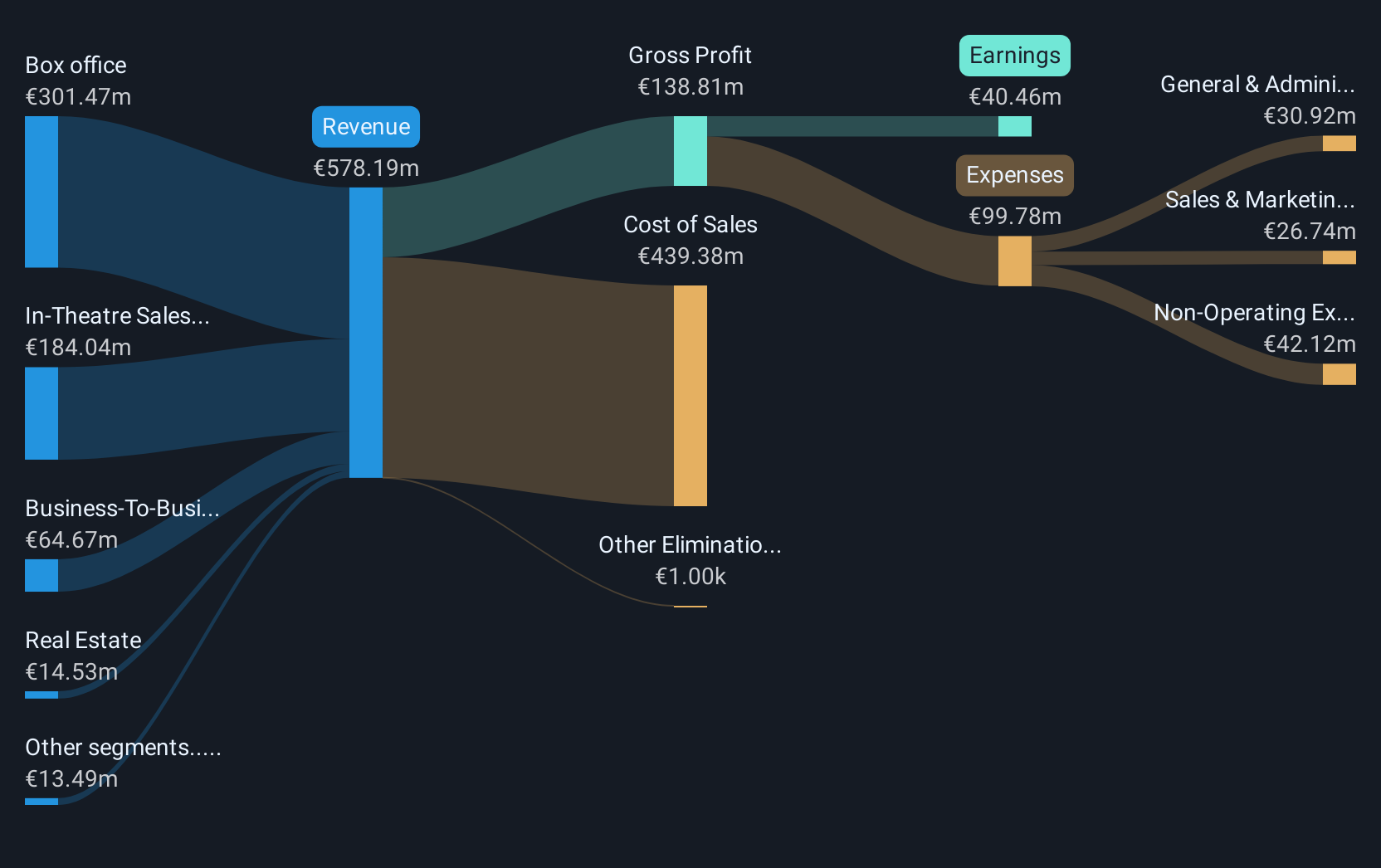

Overview: Kinepolis Group NV operates cinema complexes across several countries including Belgium, the Netherlands, France, Spain, Luxembourg, Switzerland, Poland, Canada, and the United States with a market cap of €847.93 million.

Operations: Kinepolis Group generates revenue primarily from box office sales (€301.47 million) and in-theatre sales (€184.04 million), with additional income from business-to-business services (€64.67 million), real estate activities (€14.53 million), Brightfish advertising (€10.39 million), and film distribution (€3.10 million).

Kinepolis Group, navigating a challenging landscape with a 4.7% annual revenue growth, faces slower expansion compared to the broader Belgian market's 7.1%. Despite this, the company is poised for significant earnings recovery, projecting an increase of 22.4% annually over the next three years. This resurgence is shadowed by a recent downturn in net income from EUR 56.06 million to EUR 40.46 million year-over-year and a dip in EPS from EUR 2.08 to EUR 1.51 in its latest fiscal report for 2024. Kinepolis' financial trajectory suggests resilience with potential uplifts driven by strategic adaptations and market positioning that could redefine its competitive edge within Europe's entertainment sector.

- Delve into the full analysis health report here for a deeper understanding of Kinepolis Group.

Evaluate Kinepolis Group's historical performance by accessing our past performance report.

Acast (OM:ACAST)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Acast AB (publ) is a podcasting company with operations in Europe, North America, and internationally, and has a market capitalization of approximately SEK2.76 billion.

Operations: Acast AB generates revenue primarily through podcast advertising and subscriptions, leveraging its platform to connect creators with advertisers. The company focuses on expanding its international presence, particularly in Europe and North America.

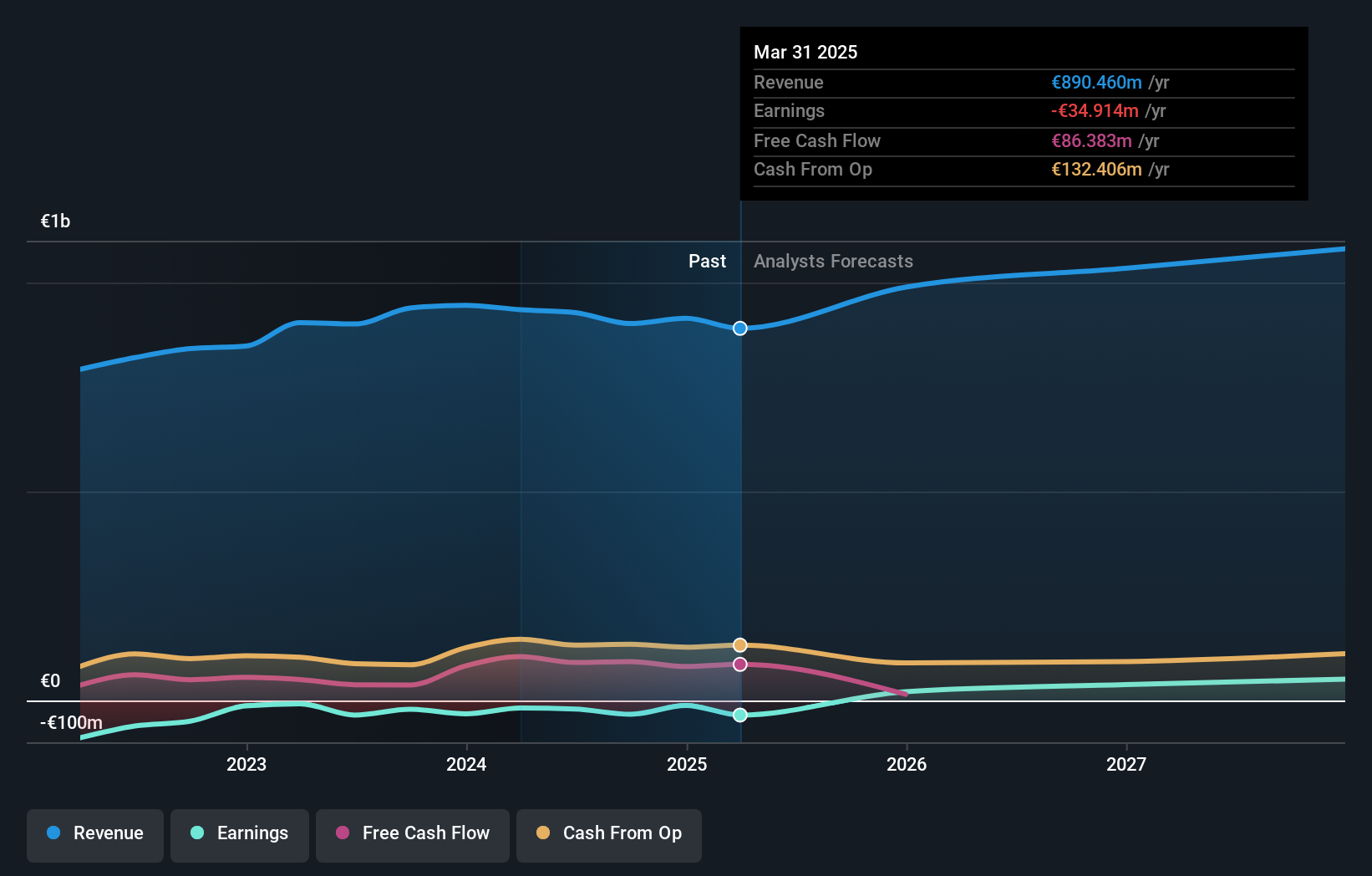

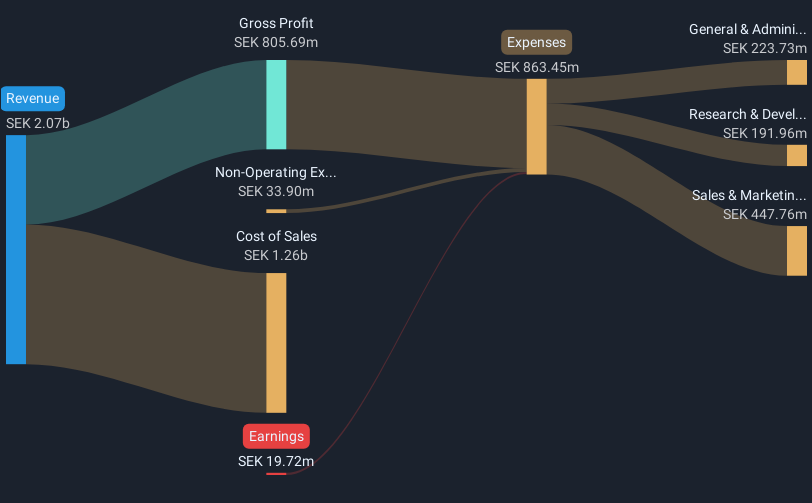

Amidst a challenging tech landscape, Acast stands out with its strategic partnerships and robust revenue growth. With an annual revenue increase of 12.5%, surpassing Sweden's market growth of 4.3%, the company is on a path to profitability within three years, showcasing an impressive forecasted earnings growth of 149.33% annually. The recent partnership with The Athletic enhances Acast’s market position, leveraging exclusive sales rights that could significantly boost future revenues and brand positioning in the competitive podcasting space. Despite a current unprofitability status reflected by a net loss in Q1 2025, these strategic moves and strong revenue trajectory indicate promising prospects for Acast’s role in shaping digital media dynamics.

- Take a closer look at Acast's potential here in our health report.

Gain insights into Acast's past trends and performance with our Past report.

Summing It All Up

- Unlock our comprehensive list of 224 European High Growth Tech and AI Stocks by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:ACAST

Acast

Operates as a podcasting company in Europe, North America, and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives