- China

- /

- Electronic Equipment and Components

- /

- SHSE:688768

Exploring These 3 High Growth Tech Stocks For Potential Portfolio Enhancement

Reviewed by Simply Wall St

As global markets continue to navigate the implications of recent political developments and economic indicators, major indexes like the S&P 500 have reached new highs, fueled by optimism surrounding potential trade deals and AI investments. In this dynamic environment, identifying high-growth tech stocks can be a strategic move for investors looking to enhance their portfolios, especially as growth stocks have recently outperformed value shares.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Pharma Mar | 25.50% | 55.11% | ★★★★★★ |

| AVITA Medical | 33.20% | 51.87% | ★★★★★★ |

| TG Therapeutics | 29.48% | 43.58% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| Alnylam Pharmaceuticals | 21.37% | 56.70% | ★★★★★★ |

| Elliptic Laboratories | 61.01% | 121.13% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

| Travere Therapeutics | 30.46% | 62.05% | ★★★★★★ |

| Dmall | 29.53% | 88.37% | ★★★★★★ |

Click here to see the full list of 1228 stocks from our High Growth Tech and AI Stocks screener.

Let's dive into some prime choices out of from the screener.

Kinepolis Group (ENXTBR:KIN)

Simply Wall St Growth Rating: ★★★★☆☆

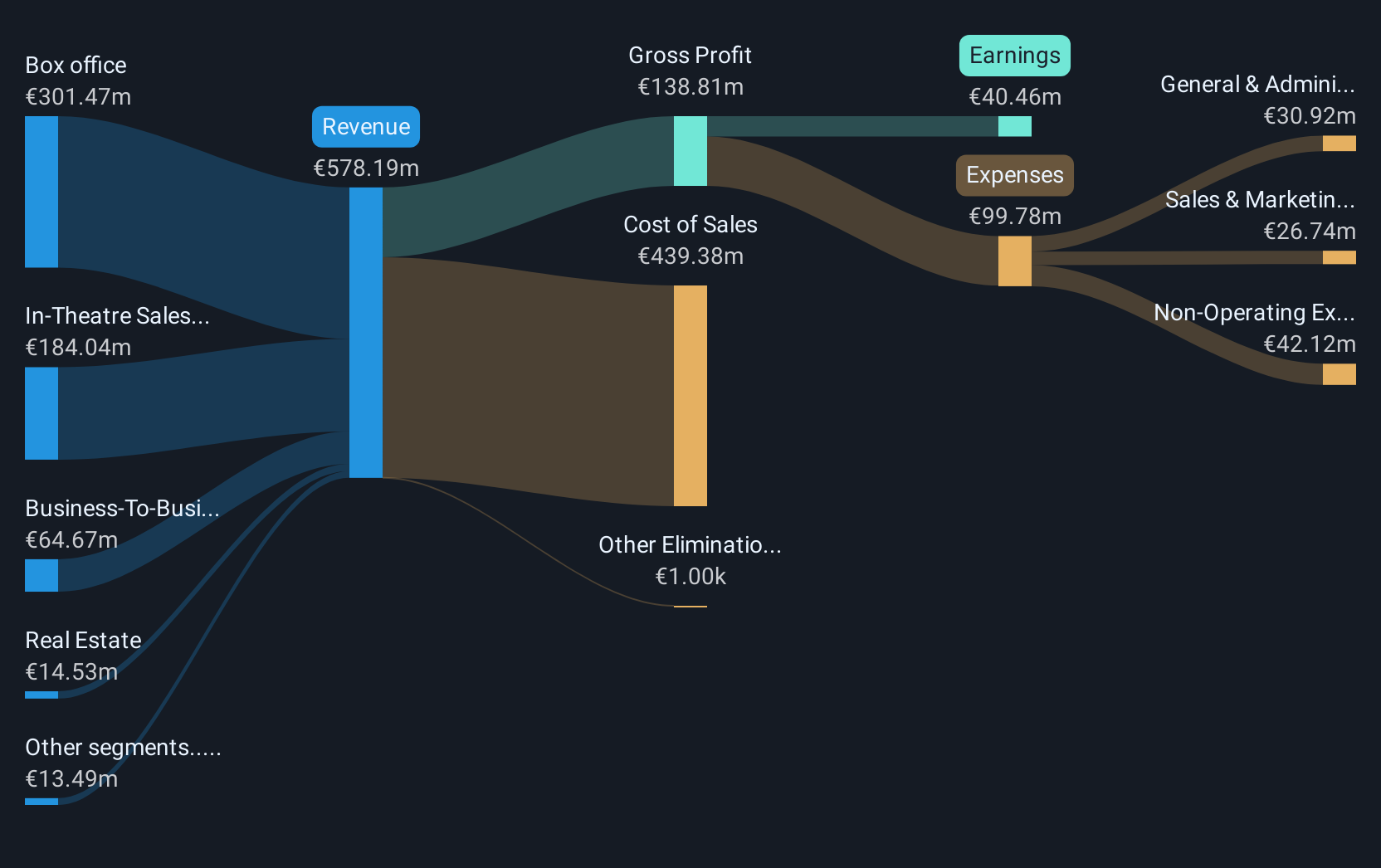

Overview: Kinepolis Group NV operates cinema complexes across several countries, including Belgium, the Netherlands, France, Spain, Luxembourg, Switzerland, Poland, Canada, and the United States with a market cap of approximately €997 million.

Operations: The company's revenue streams primarily comprise box office sales (€294.05 million) and in-theatre sales (€177.61 million), with additional contributions from real estate and film distribution activities. The cinema operator also benefits from a segment adjustment of €73.33 million, enhancing its overall financial structure.

Kinepolis Group, with its anticipated 25.7% annual earnings growth over the next three years, outpaces the Belgian market forecast of 19%. Despite a challenging past year with a -9.8% earnings dip against an industry average of 7.1%, Kinepolis is poised for recovery, bolstered by robust return on equity projections at 23.8%. This growth trajectory is supported by strategic R&D investments that enhance its competitive edge in the entertainment sector, although revenue growth projections at 4.8% annually trail behind the market's 6.8%. The company's ability to generate positive free cash flow amidst high debt levels underscores a resilient operational framework that could favor future scalability and market adaptation.

- Navigate through the intricacies of Kinepolis Group with our comprehensive health report here.

Assess Kinepolis Group's past performance with our detailed historical performance reports.

Chengdu Zhimingda Electronics (SHSE:688636)

Simply Wall St Growth Rating: ★★★★★☆

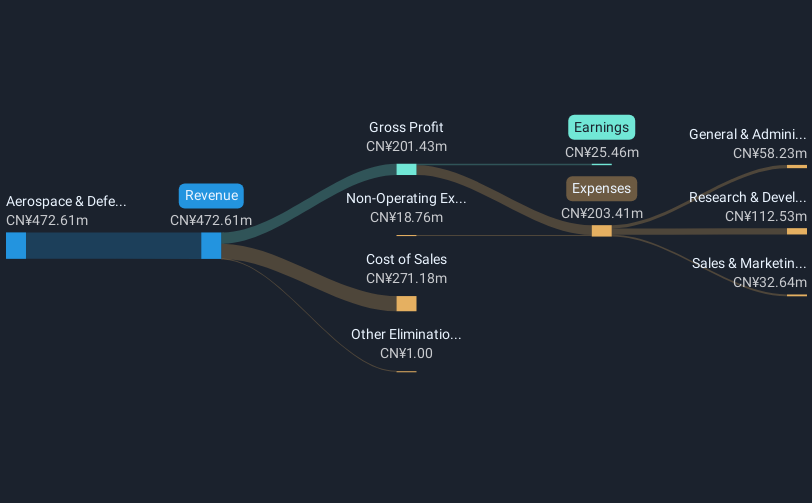

Overview: Chengdu Zhimingda Electronics Co., Ltd. specializes in providing customized embedded modules and solutions in China, with a market capitalization of approximately CN¥3.09 billion.

Operations: Zhimingda Electronics generates revenue primarily from its Aerospace & Defense segment, which contributes CN¥472.61 million. The company's focus on customized embedded modules and solutions supports its operations in China.

Chengdu Zhimingda Electronics is navigating a complex landscape with its revenue projected to surge by 30.6% annually, outstripping the Chinese market's growth of 13.3%. Despite a recent dip in earnings by 72.4% over the past year, future prospects appear robust with an anticipated earnings growth of 63.7% per year, significantly higher than the market average of 25%. This growth trajectory is underpinned by a substantial R&D investment which has been crucial in maintaining competitive edge and innovation in tech development. However, challenges persist as evidenced by a decline in net profit margin from 15.5% to just 5.4%, and concerns about sustainability due to one-off gains skewing recent financial results.

Anhui Ronds Science & Technology (SHSE:688768)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Anhui Ronds Science & Technology Incorporated Company offers machinery condition monitoring solutions for predictive maintenance in China and has a market cap of CN¥3.56 billion.

Operations: Ronds specializes in machinery condition monitoring solutions, focusing on predictive maintenance within China. The company's revenue streams are primarily derived from providing these technological solutions.

Amidst a dynamic tech landscape, Anhui Ronds Science & Technology has demonstrated significant financial momentum, with revenue and earnings growth rates soaring at 22.6% and 30.8% annually, respectively—outpacing the Chinese market averages significantly. This growth is bolstered by strategic R&D investments which have enabled continuous innovation and competitive edge in its sector. The company recently enhanced its financial flexibility through a private placement, raising approximately CNY 160 million at CNY 27.58 per share, reflecting robust investor confidence and paving the way for further technological advancements and market expansion.

Where To Now?

- Unlock more gems! Our High Growth Tech and AI Stocks screener has unearthed 1225 more companies for you to explore.Click here to unveil our expertly curated list of 1228 High Growth Tech and AI Stocks.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688768

Anhui Ronds Science & Technology

Provides solutions for machinery condition monitoring in the predictive maintenance field in China.

High growth potential with solid track record.

Market Insights

Community Narratives