- Belgium

- /

- Entertainment

- /

- ENXTBR:KIN

European Stocks Trading Below Estimated Intrinsic Values

Reviewed by Simply Wall St

As the European market navigates a mixed landscape, with the STOXX Europe 600 Index recently pulling back after reaching new highs and interest rate expectations from the ECB remaining steady, investors are increasingly focused on identifying opportunities among undervalued stocks. In such an environment, a good stock is often characterized by its potential to trade below its estimated intrinsic value, offering room for appreciation as market conditions evolve.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Vinext (BIT:VNXT) | €3.38 | €6.56 | 48.5% |

| Verbio (XTRA:VBK) | €15.27 | €30.30 | 49.6% |

| tonies (DB:TNIE) | €8.67 | €17.05 | 49.2% |

| Roche Bobois (ENXTPA:RBO) | €36.00 | €70.39 | 48.9% |

| Nokian Panimo Oyj (HLSE:BEER) | €2.455 | €4.91 | 50% |

| KB Components (OM:KBC) | SEK41.00 | SEK81.64 | 49.8% |

| Ferrari Group (ENXTAM:FERGR) | €7.98 | €15.59 | 48.8% |

| eDreams ODIGEO (BME:EDR) | €7.19 | €14.19 | 49.3% |

| doValue (BIT:DOV) | €2.69 | €5.24 | 48.6% |

| DEUTZ (XTRA:DEZ) | €8.335 | €16.24 | 48.7% |

Let's explore several standout options from the results in the screener.

Kinepolis Group (ENXTBR:KIN)

Overview: Kinepolis Group NV operates and manages cinemas across Belgium, France, Canada, Spain, the Netherlands, the United States, Luxembourg, and internationally with a market cap of €809.15 million.

Operations: The company's revenue is primarily derived from the Box Office (€308.55 million), In-Theatre Sales (€191.65 million), Business-To-Business services (€64.72 million), Real Estate (€14.73 million), and Film Distribution (€3.26 million).

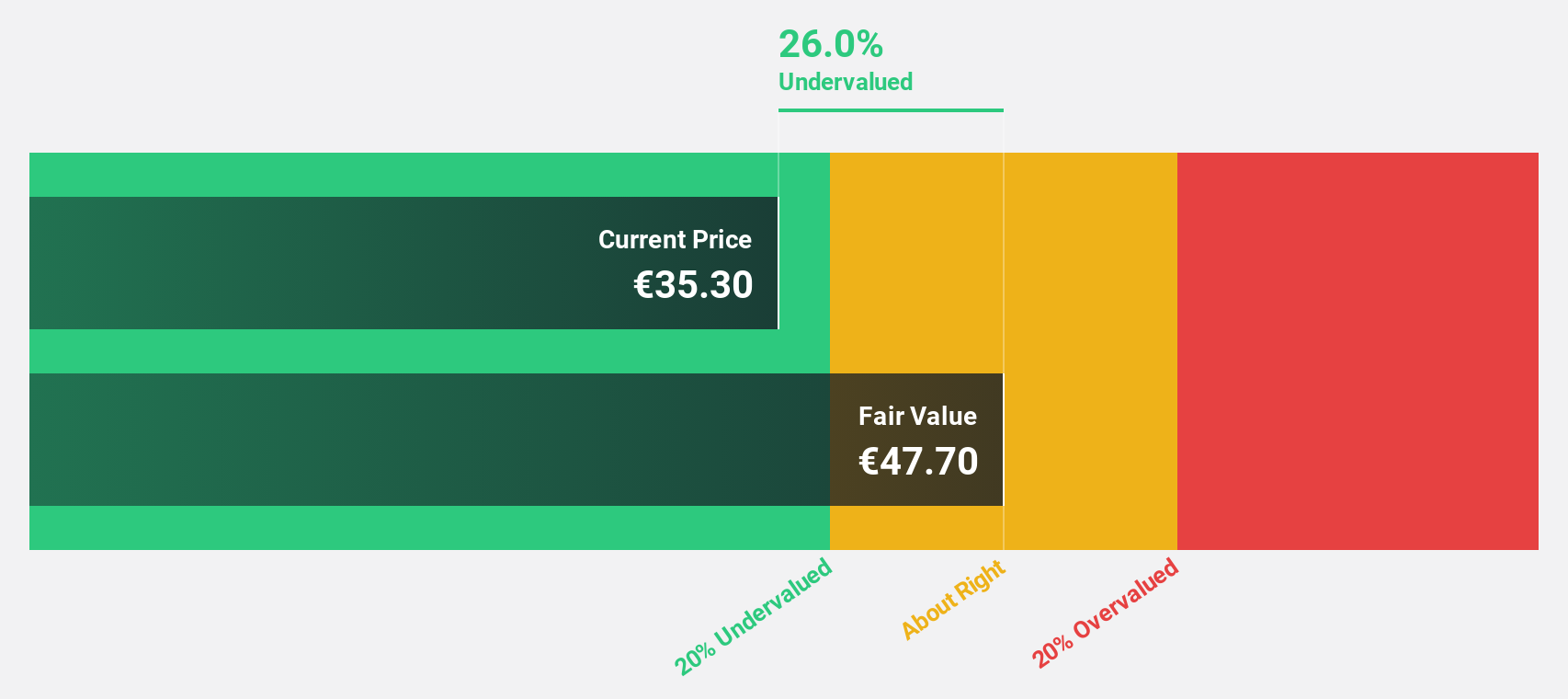

Estimated Discount To Fair Value: 34.2%

Kinepolis Group's recent earnings report showed a significant increase in net income to €6.97 million, indicating strong performance compared to the previous year. The stock is trading at €30.25, which is 34.2% below its estimated fair value of €46, suggesting it may be undervalued based on cash flows. Despite high debt levels and slower revenue growth forecasts than the Belgian market, earnings are expected to grow significantly at 20.5% annually over the next three years.

- In light of our recent growth report, it seems possible that Kinepolis Group's financial performance will exceed current levels.

- Take a closer look at Kinepolis Group's balance sheet health here in our report.

Exosens (ENXTPA:EXENS)

Overview: Exosens develops, manufactures, and sells electro-optical technologies for amplification, detection, and imaging globally, with a market cap of €2.42 billion.

Operations: The company generates revenue through its electro-optical technologies, with €304.60 million from amplification and €129.40 million from detection and imaging.

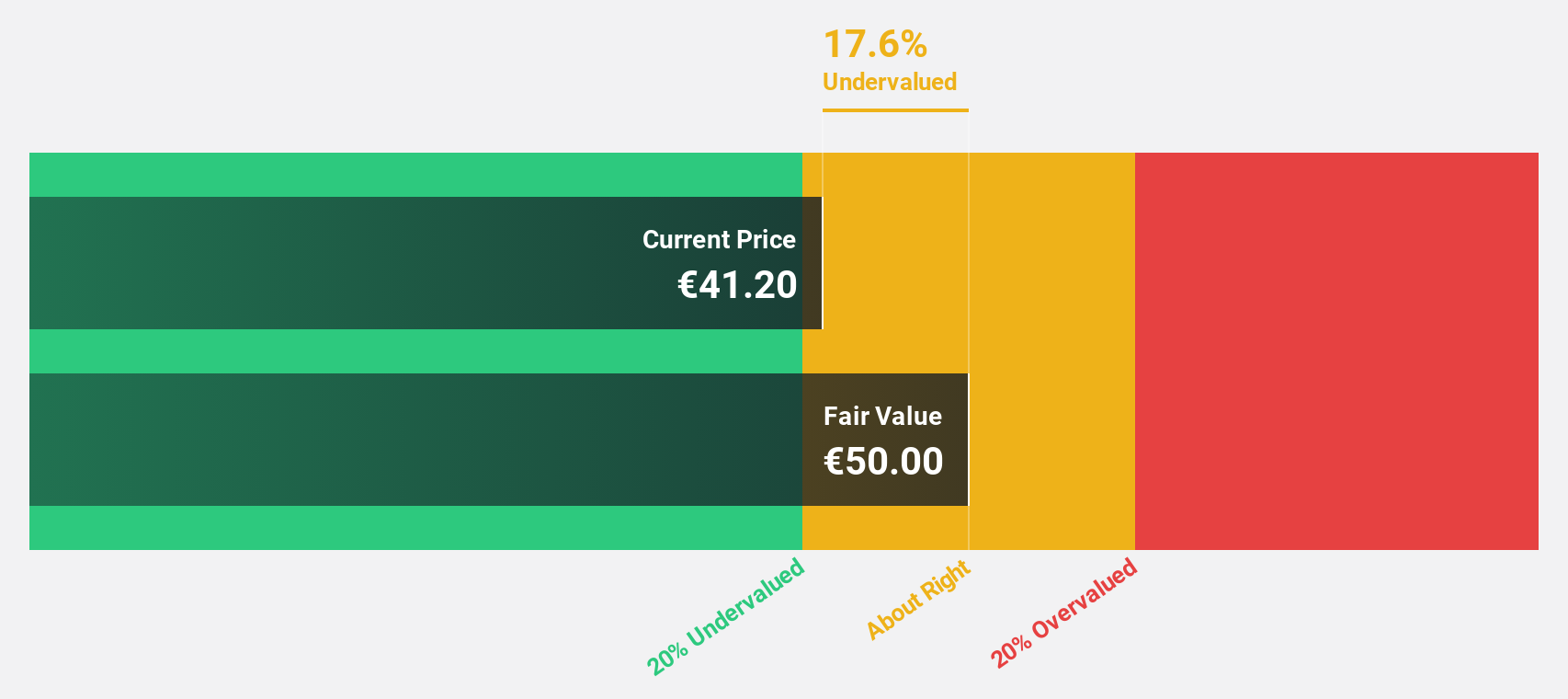

Estimated Discount To Fair Value: 16.7%

Exosens, trading at €47.65, is valued below its estimated fair value of €57.18, reflecting potential undervaluation based on cash flows despite recent volatility. Earnings are projected to grow significantly at 21.1% annually, outpacing the French market's growth rate. Recent developments include a major contract with the Spanish Ministry of Defense for night vision equipment and a strategic acquisition by Theon International Plc, which could enhance Exosens' market position and financial stability in the defense sector.

- Insights from our recent growth report point to a promising forecast for Exosens' business outlook.

- Dive into the specifics of Exosens here with our thorough financial health report.

Gofore Oyj (HLSE:GOFORE)

Overview: Gofore Oyj is a company that offers digital transformation consultancy services to both private and public sectors in Finland and internationally, with a market cap of €223.70 million.

Operations: The company generates revenue of €182.19 million from its computer services segment, focusing on digital transformation consultancy for various sectors.

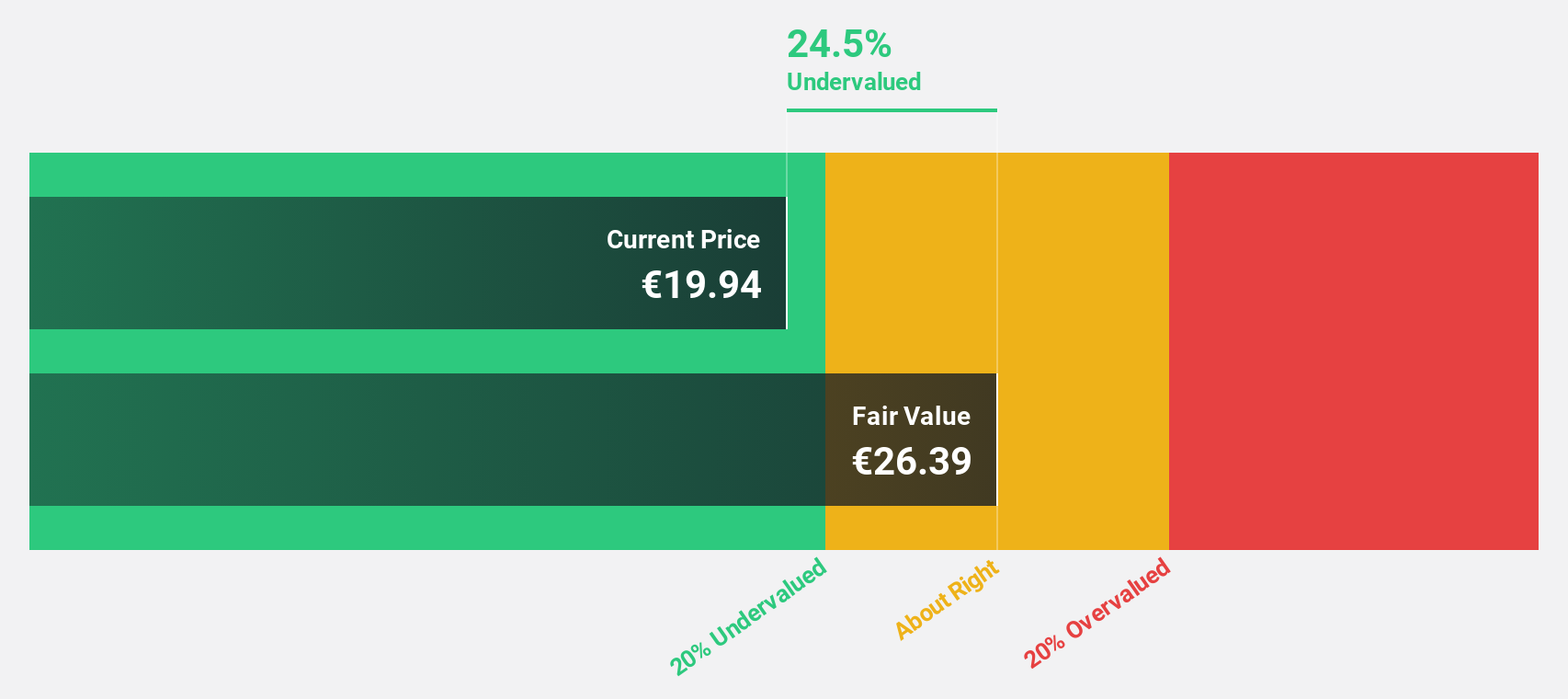

Estimated Discount To Fair Value: 24.3%

Gofore Oyj, trading at €14.04, is priced below its estimated fair value of €18.55, indicating potential undervaluation based on cash flows. Despite a challenging year with declining profit margins from 9.7% to 4%, earnings are forecasted to grow significantly at 26.57% annually, surpassing the Finnish market's rate. Recent sales figures show growth with net sales reaching €215.1 million over the last twelve months, while share repurchases could enhance shareholder value amid fluctuating earnings performance.

- The analysis detailed in our Gofore Oyj growth report hints at robust future financial performance.

- Navigate through the intricacies of Gofore Oyj with our comprehensive financial health report here.

Make It Happen

- Navigate through the entire inventory of 198 Undervalued European Stocks Based On Cash Flows here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Kinepolis Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTBR:KIN

Kinepolis Group

Operates and manages cinemas in Belgium, France, Canada, Spain, the Netherlands, the United States, Luxembourg, and internationally.

High growth potential and good value.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion