- Denmark

- /

- Medical Equipment

- /

- CPSE:COLO B

European Stocks Priced Below Estimated Value In June 2025

Reviewed by Simply Wall St

As European markets face challenges with the pan-European STOXX Europe 600 Index ending 1.54% lower amid concerns over Middle East tensions, investors are keenly observing opportunities in stocks that may be undervalued despite the broader economic uncertainties. In such a climate, identifying stocks priced below their estimated value can offer potential for growth, making them attractive to those looking to capitalize on market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| TTS (Transport Trade Services) (BVB:TTS) | RON4.36 | RON8.49 | 48.6% |

| Qt Group Oyj (HLSE:QTCOM) | €54.95 | €107.96 | 49.1% |

| Pluxee (ENXTPA:PLX) | €17.88 | €34.83 | 48.7% |

| PFISTERER Holding (XTRA:PFSE) | €39.50 | €78.15 | 49.5% |

| Lingotes Especiales (BME:LGT) | €6.00 | €11.87 | 49.4% |

| Laboratorios Farmaceuticos Rovi (BME:ROVI) | €53.50 | €104.47 | 48.8% |

| Koskisen Oyj (HLSE:KOSKI) | €8.84 | €17.31 | 48.9% |

| Galderma Group (SWX:GALD) | CHF113.20 | CHF221.57 | 48.9% |

| Absolent Air Care Group (OM:ABSO) | SEK209.00 | SEK415.74 | 49.7% |

| ABO Energy GmbH KGaA (XTRA:AB9) | €36.00 | €70.33 | 48.8% |

Let's explore several standout options from the results in the screener.

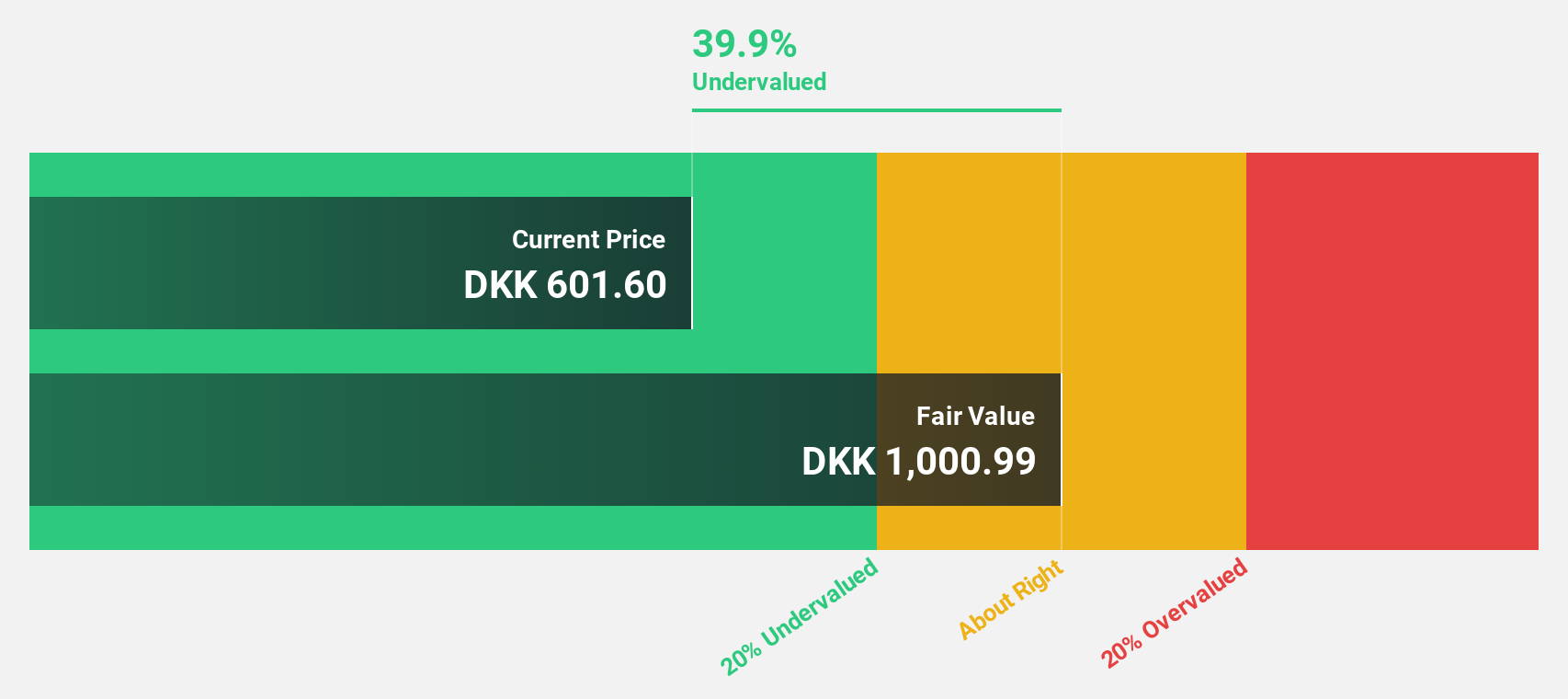

Coloplast (CPSE:COLO B)

Overview: Coloplast A/S develops and sells intimate healthcare products and services across Denmark, the United States, the United Kingdom, France, and internationally with a market cap of DKK135.96 billion.

Operations: Coloplast's revenue segments consist of Chronic Care (DKK18.67 billion), Interventional Urology (DKK2.79 billion), Advanced Wound Dressings (DKK2.95 billion), Voice and Respiratory Care (DKK2.20 billion), and Biologics (DKK1.18 billion).

Estimated Discount To Fair Value: 39.8%

Coloplast is trading at DKK 603.8, significantly below its estimated fair value of DKK 1003.29, indicating potential undervaluation based on cash flows. Despite a high debt level and a dividend yield of 3.64% not fully covered by earnings or free cash flows, the company's revenue growth of 7.4% annually surpasses the Danish market average. Recent executive changes and revised guidance have impacted investor sentiment, but analysts still foresee a potential stock price increase of 23.1%.

- In light of our recent growth report, it seems possible that Coloplast's financial performance will exceed current levels.

- Click to explore a detailed breakdown of our findings in Coloplast's balance sheet health report.

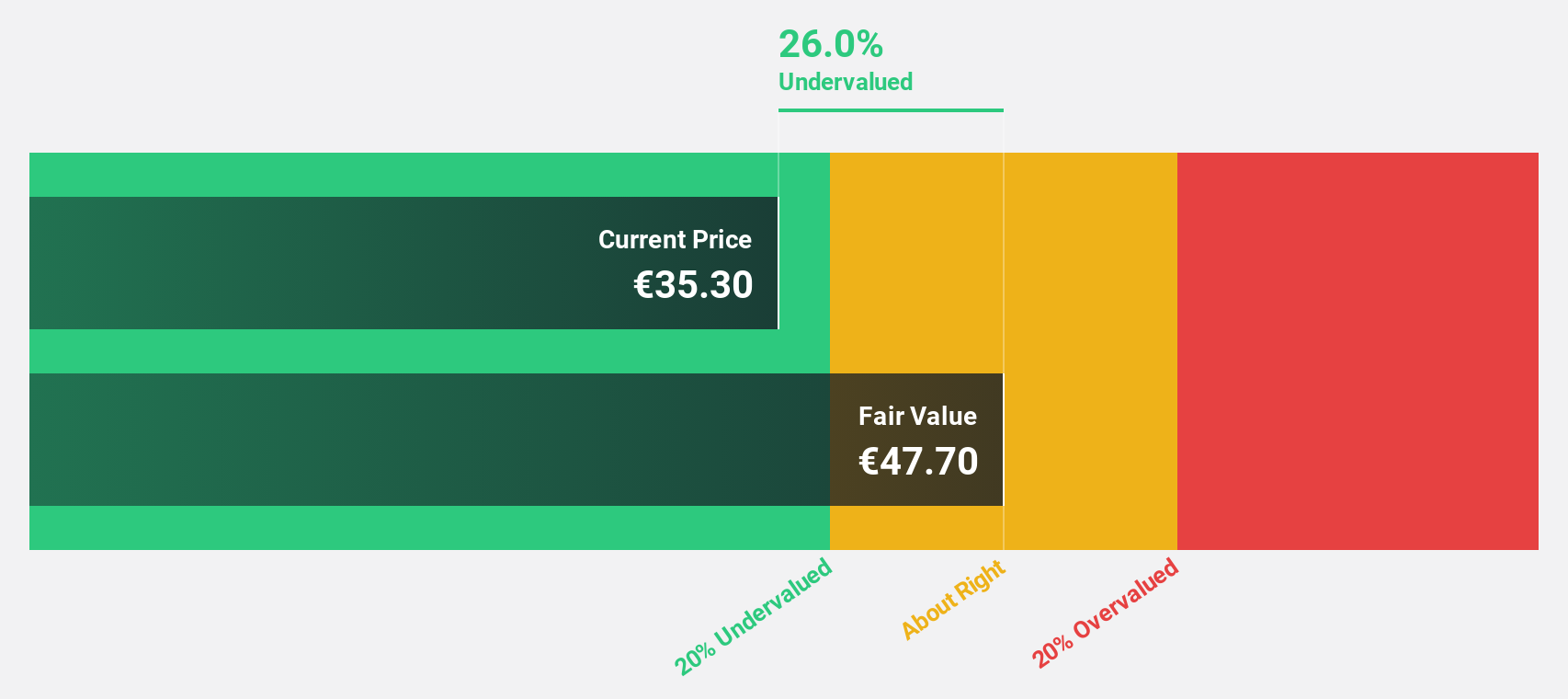

Kinepolis Group (ENXTBR:KIN)

Overview: Kinepolis Group NV operates cinema complexes across several countries including Belgium, the Netherlands, France, Spain, Luxembourg, Switzerland, Poland, Canada, and the United States with a market cap of €964.29 million.

Operations: The company's revenue is primarily derived from several segments, including Box Office (€301.47 million), In-Theatre Sales (€184.04 million), Business-To-Business (€64.67 million), Real Estate (€14.53 million), Brightfish (€10.39 million), and Film Distribution (€3.10 million).

Estimated Discount To Fair Value: 24.9%

Kinepolis Group is trading at €36.05, 24.9% below its fair value estimate of €48.01, suggesting potential undervaluation based on cash flows despite high debt levels. Analysts predict a stock price increase of 34.5%, supported by earnings growth forecasts of 21.8% annually, outpacing the Belgian market average of 12.2%. Recent financials show a decline in revenue to €578.19 million and net income to €40.46 million for 2024 compared to the previous year.

- Our expertly prepared growth report on Kinepolis Group implies its future financial outlook may be stronger than recent results.

- Take a closer look at Kinepolis Group's balance sheet health here in our report.

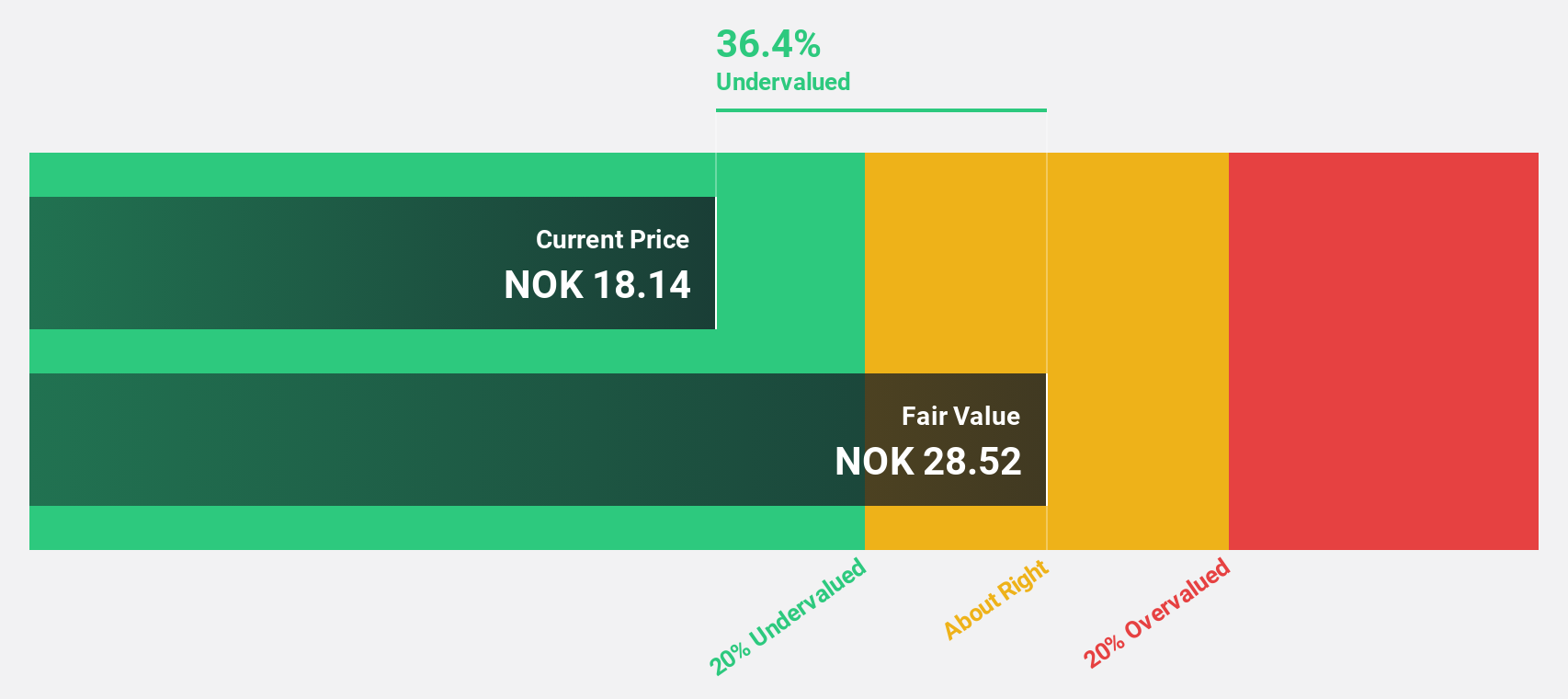

Hexagon Composites (OB:HEX)

Overview: Hexagon Composites ASA, with a market cap of NOK3.51 billion, provides alternative fuel systems and solutions to commercial vehicles and gas distribution companies worldwide.

Operations: Hexagon Composites generates revenue through its segments, with Hexagon Agility contributing NOK4.69 billion and Hexagon Digital Wave adding NOK157.39 million.

Estimated Discount To Fair Value: 39.7%

Hexagon Composites is trading at NOK 17.04, significantly below its fair value estimate of NOK 28.28, indicating potential undervaluation based on cash flows despite recent financial challenges. The company reported a net loss of NOK 835.85 million in Q1 2025, yet analysts forecast profitability within three years with revenue growth outpacing the Norwegian market at 14.8% annually. However, its share price has been highly volatile recently and Return on Equity is expected to remain low at 7.8%.

- The growth report we've compiled suggests that Hexagon Composites' future prospects could be on the up.

- Unlock comprehensive insights into our analysis of Hexagon Composites stock in this financial health report.

Next Steps

- Navigate through the entire inventory of 182 Undervalued European Stocks Based On Cash Flows here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About CPSE:COLO B

Coloplast

Engages in the development and sale of intimate healthcare products and services in Denmark, the United States, the United Kingdom, France, and internationally.

Very undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives