Umicore (ENXTBR:UMI): Exploring Current Valuation After Strategic Battery Materials Pause

Reviewed by Simply Wall St

Umicore (ENXTBR:UMI) shares have posted mixed returns across different periods, with a recent monthly dip but a strong rebound so far this year. Investors might be weighing how these swings reflect current market sentiment and the company’s valuation.

See our latest analysis for Umicore.

Umicore’s 42% year-to-date share price return signals that momentum has really picked up lately, especially compared to its steep total shareholder return losses over the past few years. That kind of rebound suggests investors see renewed growth potential or are re-evaluating the risks ahead, even though the recent one-month dip hints at some short-term volatility.

If recent swings make you curious about what else is gathering steam, it could be the right time to discover fast growing stocks with high insider ownership.

With share prices bouncing back and analyst targets just above current levels, the real question is whether Umicore is genuinely undervalued at this point or if the market has already factored in future growth expectations.

Most Popular Narrative: 2.2% Undervalued

The narrative consensus places Umicore’s fair value slightly above the recent close, hinting that analysts see modest upside even as sector headwinds persist. Let’s examine one key driver shaping their view.

The company is strategically realigning its operations and pausing the Battery Materials plant construction in Canada, while consolidating customer contracts in Korea. This decision, coupled with a 35% reduction in CapEx for Battery Materials, may have a near-term impact on cash flow but aims to optimize long-term revenue growth and EBITDA through better capacity utilization.

Curious how analysts justify this calculated optimism? The appeal lies in bold margin recovery and a sharp corporate pivot expected to transform cash flow. Want the surprising assumptions behind these numbers and why it could matter for Umicore’s future? Dive deeper into the full narrative and unlock the backstory behind this fair value estimate.

Result: Fair Value of €14.79 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent weakness in EV demand and the significant Battery Materials write-down could quickly reshape Umicore’s recovery story if these trends deepen.

Find out about the key risks to this Umicore narrative.

Another View: A Look at Earnings Multiples

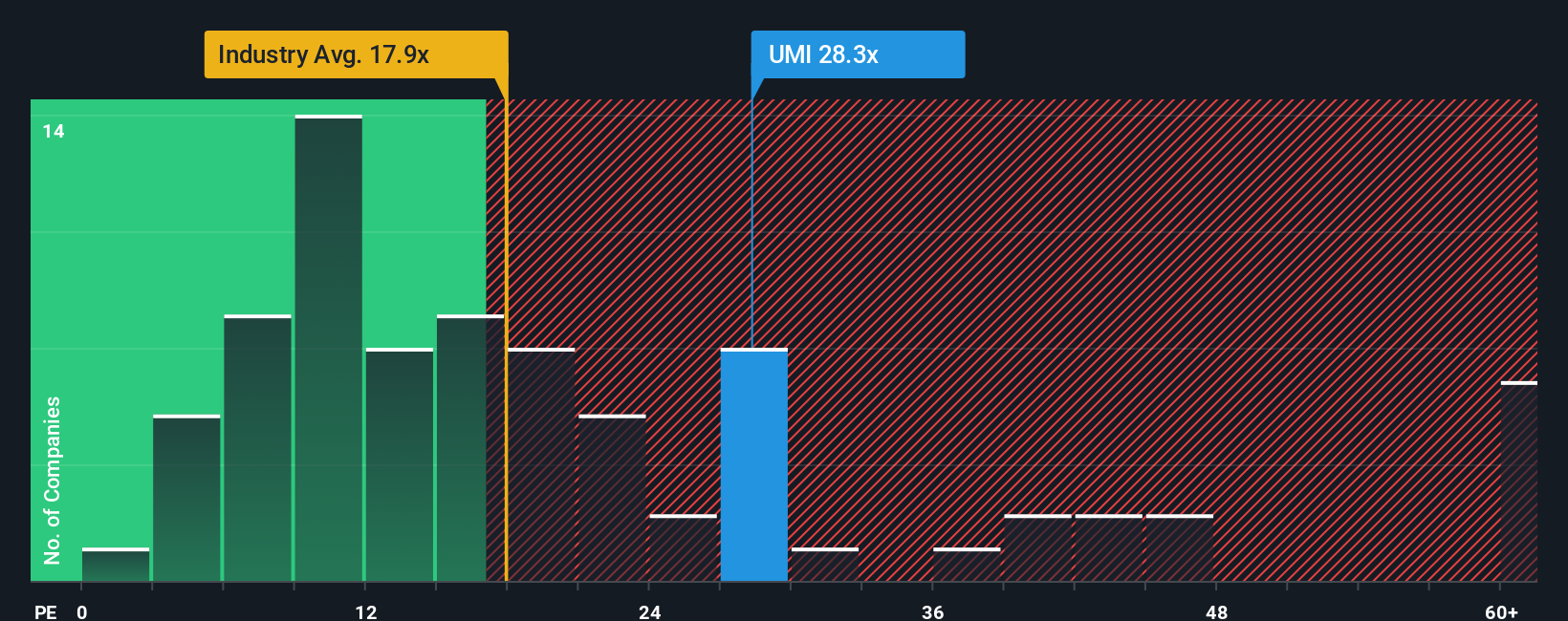

Looking from an earnings multiple perspective, Umicore trades at a 27x price-to-earnings ratio. This is well above both the European Chemicals industry average of 17.8x and the peer average of 17.4x. Even compared to the fair ratio of 19.2x, shares are expensive, suggesting the market might be pricing in more optimism than current fundamentals support. Could this premium leave investors vulnerable if expectations are not met?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Umicore Narrative

If you want to dig into the trends and create your own perspective, it only takes a few minutes to uncover the data and build your story. So why not Do it your way.

A great starting point for your Umicore research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors know that having fresh opportunities on your radar is key to staying ahead. Get a jump on the next wave by checking out these hand-picked ideas from the Simply Wall Street Screener. Your next winning stock could be waiting.

- Uncover high-yield opportunities in stocks that deliver income and outpace inflation by reviewing these 14 dividend stocks with yields > 3%.

- Tap into the latest breakthroughs and find innovators making waves in healthcare technology by exploring these 30 healthcare AI stocks.

- Capitalize on value with companies trading below their true worth. Start analyzing these 928 undervalued stocks based on cash flows now and don’t let great deals slip by.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTBR:UMI

Umicore

Operates as a materials technology and recycling company in Belgium, Europe, the Asia-Pacific, North America, South America, and Africa.

Slight risk with moderate growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

CEO: We are winners in the long term in the AI world

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.