- France

- /

- Commercial Services

- /

- ENXTPA:BB

Top 3 European Dividend Stocks To Consider

Reviewed by Simply Wall St

Amidst a backdrop of easing trade tensions and potential economic stimulus in Europe, the pan-European STOXX Europe 600 Index recently saw a notable rise, reflecting renewed investor optimism. In this environment, dividend stocks can offer an appealing combination of income and stability, making them a worthwhile consideration for investors looking to navigate the current market landscape.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Zurich Insurance Group (SWX:ZURN) | 4.51% | ★★★★★★ |

| Rubis (ENXTPA:RUI) | 7.29% | ★★★★★★ |

| OVB Holding (XTRA:O4B) | 4.59% | ★★★★★★ |

| Les Docks des Pétroles d'Ambès -SA (ENXTPA:DPAM) | 5.73% | ★★★★★★ |

| Julius Bär Gruppe (SWX:BAER) | 4.81% | ★★★★★★ |

| Holcim (SWX:HOLN) | 5.21% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 4.48% | ★★★★★★ |

| Bredband2 i Skandinavien (OM:BRE2) | 3.96% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.72% | ★★★★★★ |

| Allianz (XTRA:ALV) | 4.52% | ★★★★★★ |

Click here to see the full list of 237 stocks from our Top European Dividend Stocks screener.

We'll examine a selection from our screener results.

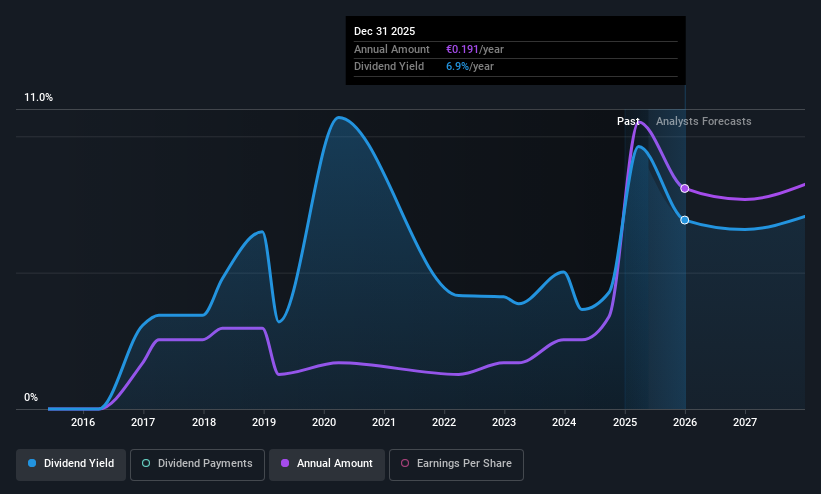

Banco de Sabadell (BME:SAB)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Banco de Sabadell, S.A. offers a range of banking products and services to personal, business, and private customers both in Spain and internationally, with a market cap of approximately €15.03 billion.

Operations: Banco de Sabadell's revenue segments include €1.29 billion from its Banking Business in the United Kingdom and €189 million from its Banking Business in Mexico.

Dividend Yield: 8.8%

Banco de Sabadell's dividend yield is among the top 25% in Spain, supported by a reasonable payout ratio of 57.3%, indicating dividends are covered by earnings. However, its dividend history is volatile with unreliable payments over the past nine years. Recent M&A activity, including BBVA's takeover bid and potential sale of TSB, could impact future dividends. Despite trading below estimated fair value and recent profit growth, high bad loans remain a concern for investors seeking stability.

- Dive into the specifics of Banco de Sabadell here with our thorough dividend report.

- Our comprehensive valuation report raises the possibility that Banco de Sabadell is priced lower than what may be justified by its financials.

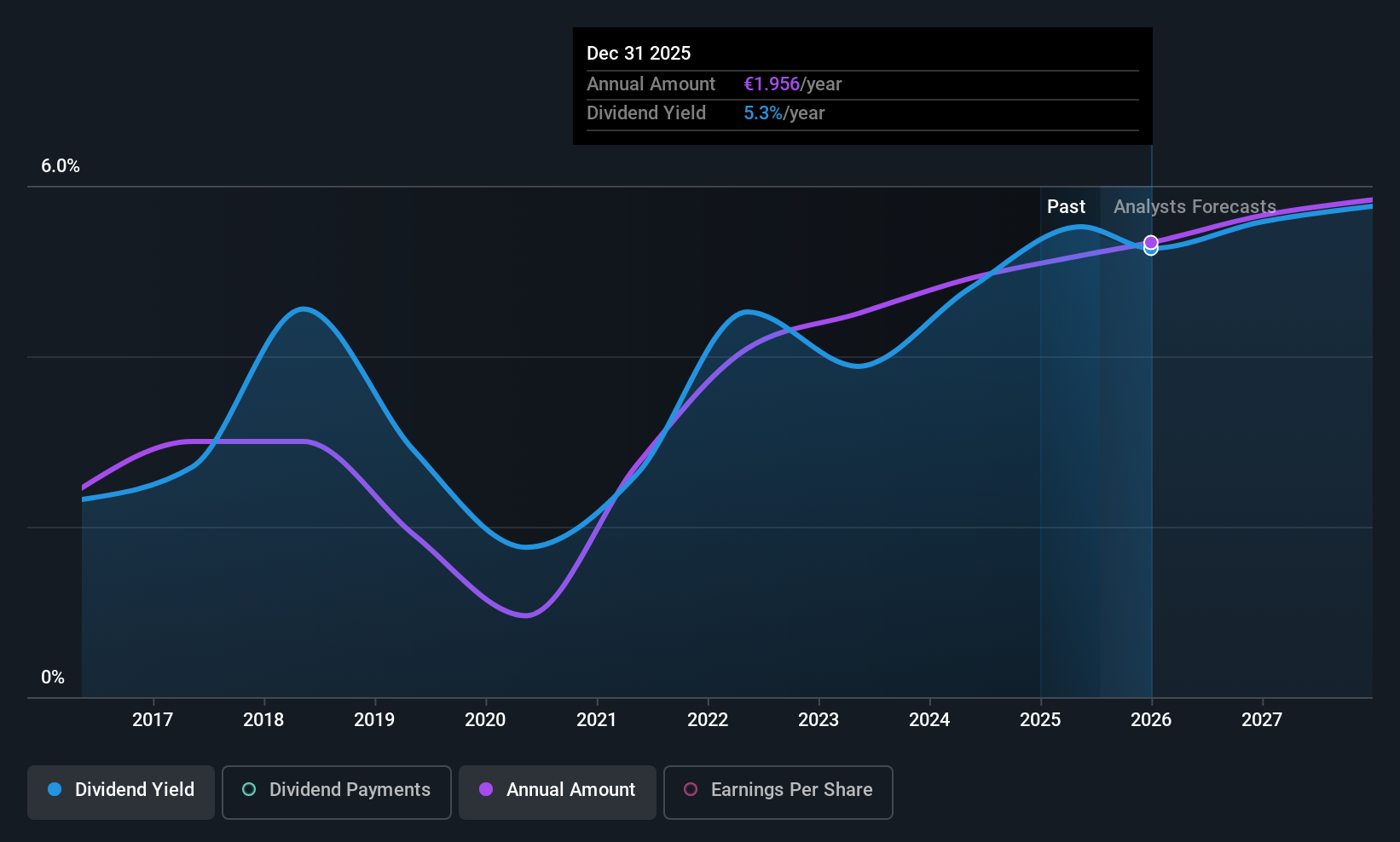

NV Bekaert (ENXTBR:BEKB)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: NV Bekaert SA is a global company specializing in steel wire transformation and coating technologies, with a market cap of €1.83 billion.

Operations: NV Bekaert's revenue is primarily derived from its Rubber Reinforcement segment at €1.73 billion, followed by Steel Wire Solutions at €1.10 billion, Specialty Businesses contributing €638.04 million, and the Bridon-Bekaert Ropes Group adding €555.23 million.

Dividend Yield: 5.3%

NV Bekaert's dividends are well-covered by earnings and cash flows, with payout ratios of 41.7% and 63.2%, respectively. However, its dividend history is volatile and unreliable over the past decade despite growth in payments. The current yield of 5.27% is below Belgium's top quartile payers at 6.6%. Trading significantly below estimated fair value, it offers good relative value compared to peers, though recent buyback plans have expired as of May 2025.

- Take a closer look at NV Bekaert's potential here in our dividend report.

- Our valuation report unveils the possibility NV Bekaert's shares may be trading at a discount.

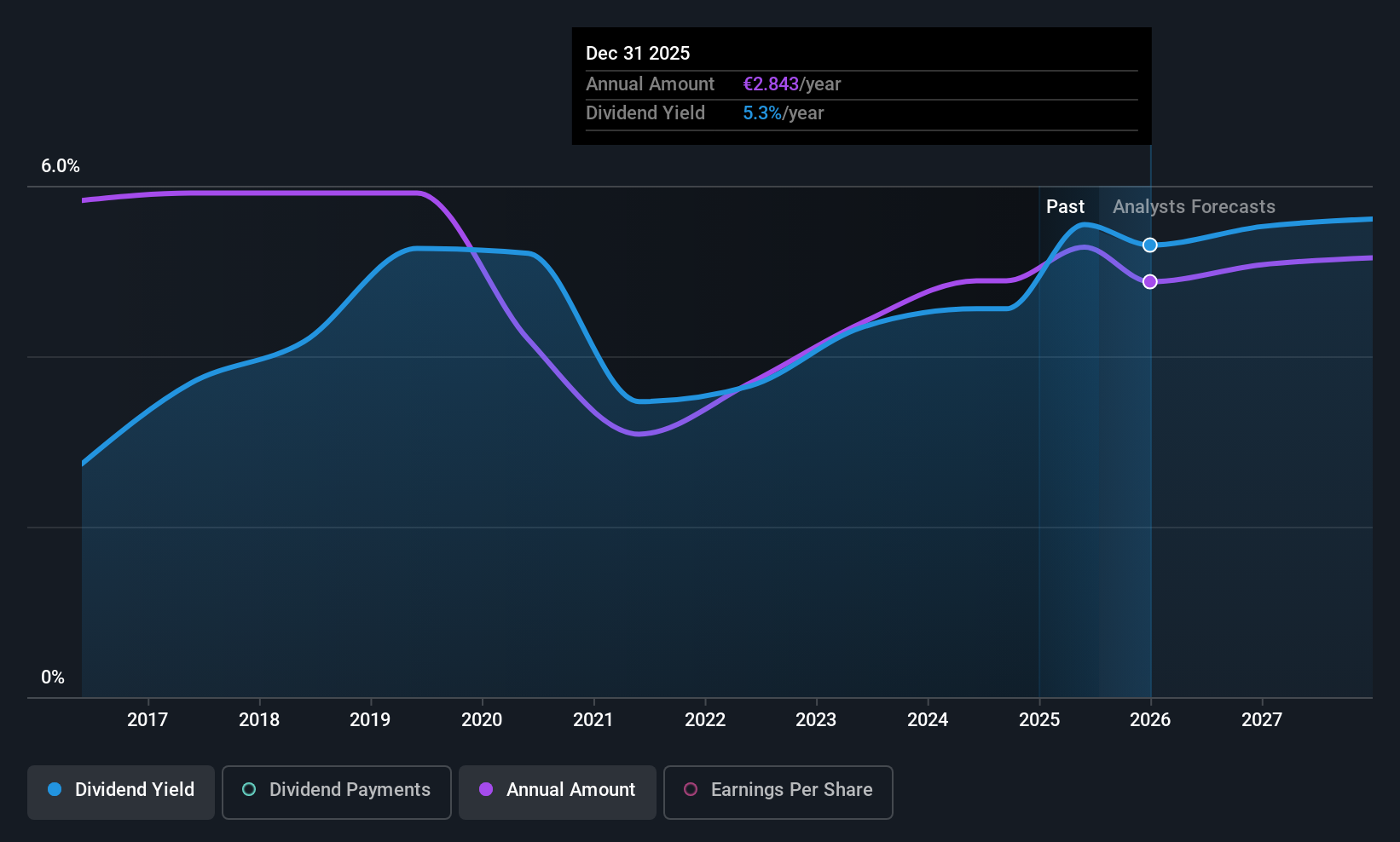

Société BIC (ENXTPA:BB)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Société BIC SA is a global manufacturer and seller of stationery, lighters, shavers, and other products with a market capitalization of approximately €2.20 billion.

Operations: Société BIC SA generates its revenue from several segments, including Flame for Life (€810 million), Blade Excellence (€543 million), and Human Expression (€814 million).

Dividend Yield: 5.7%

Société BIC offers a dividend yield in the top quartile of French payers, with dividends covered by earnings and cash flows at payout ratios of 60.4% and 46.6%, respectively. Despite a history of volatility, recent increases in dividend payments highlight growth potential. The stock trades below estimated fair value, suggesting good relative value compared to peers. Recent executive changes include appointing Rob Versloot as CEO and an 8% dividend increase approved at the General Shareholders Meeting.

- Navigate through the intricacies of Société BIC with our comprehensive dividend report here.

- Our valuation report here indicates Société BIC may be undervalued.

Make It Happen

- Get an in-depth perspective on all 237 Top European Dividend Stocks by using our screener here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:BB

Société BIC

Manufactures and sells stationery, lighter, shaver, and other products worldwide.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives