How the Recent 5.1% Dip Impacts the Valuation Story for ageas in 2025

Reviewed by Simply Wall St

If your finger is hovering over the buy or sell button for ageas, you are not alone. With insurance stocks in the spotlight and ageas itself reporting 33.5% growth over the past year, every investor is trying to determine whether this is simply a lucky streak or something more sustainable. Year to date, ageas has gained an impressive 25.4%, and over the last five years, the stock has more than doubled. However, the past month's dip of 5.1% shows that a smooth ride is never guaranteed.

Some of these larger moves can be traced to changing attitudes in the European insurance sector. Investors appear to be reassessing their appetite for risk, especially as interest rates and macroeconomic factors shift across the continent. Despite a short-term pullback, recent sentiment around ageas suggests investors are beginning to weigh the long-term potential more significantly again.

This is where things get interesting for value-seekers. When you analyze ageas with our valuation checklist for undervalued companies, it scores a 4 out of 6, suggesting it appears attractive on more than half of the key metrics we track.

But how does ageas actually compare across the various valuation methods investors use? Is there a more insightful way to review the numbers than simply ticking boxes? Let’s explore the main approaches before introducing a framework that examines the data beyond the usual surface-level analysis.

ageas delivered 33.5% returns over the last year. See how this stacks up to the rest of the Insurance industry.Approach 1: ageas Excess Returns Analysis

The Excess Returns model evaluates a company based on how much profit it generates above the required return on its equity. This method sheds light on whether management is creating true value for shareholders beyond just the cost of capital. For ageas, recent analysis shows the company is generating healthy excess profits relative to its book value.

Looking at the details, ageas has a Book Value of €42.27 per share and is expected to sustain an EPS of €8.07 per share, as projected by a consensus of eight analysts. Its Cost of Equity stands at €3.49 per share, and it delivers an Excess Return of €4.58 per share. Over the long run, average Return on Equity is expected to remain strong at 15.22%. Analysts estimate the Stable Book Value will rise to €52.98 per share. These figures highlight a solid track record of generating returns above what investors typically require for the risk, further supported by consistent performance and future growth expectations.

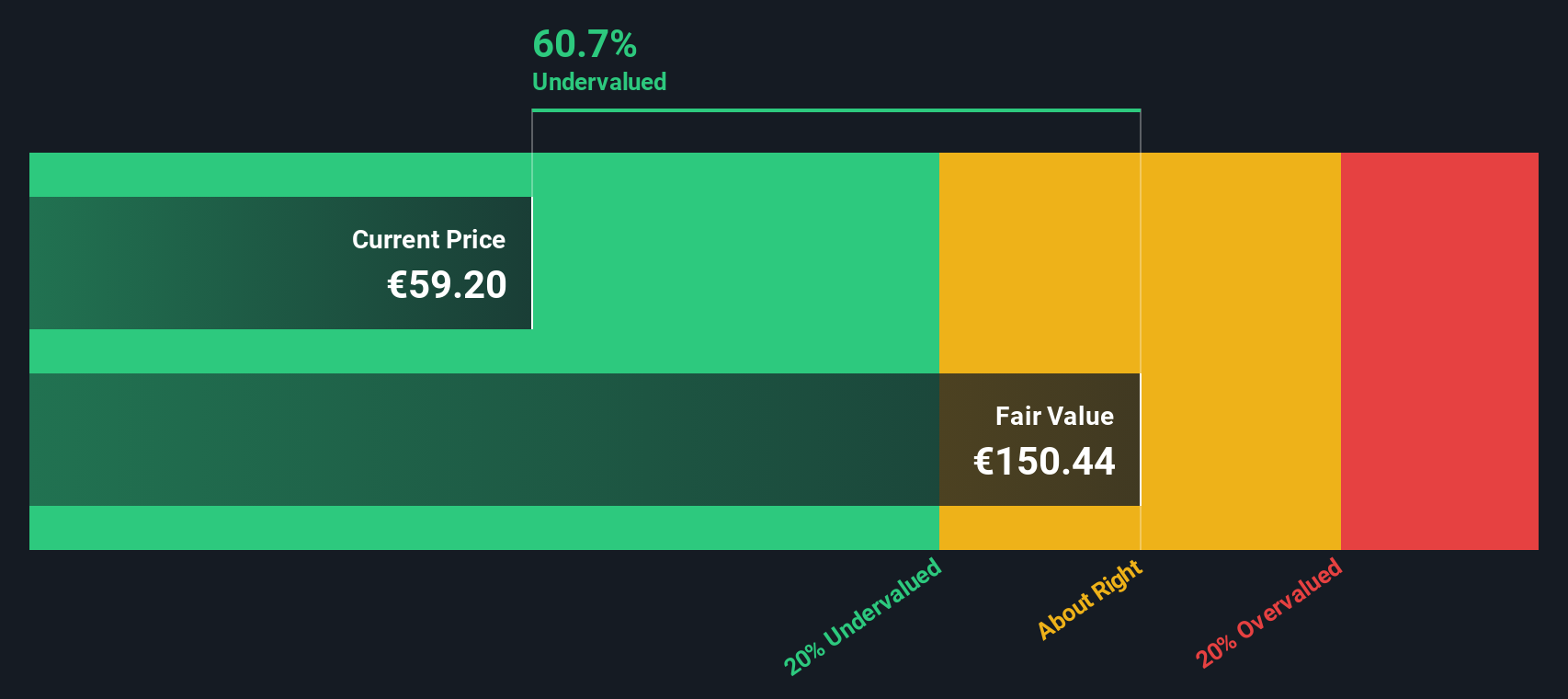

Based on the Excess Returns methodology, this model implies that ageas is currently 60.6% undervalued compared to its intrinsic value.

Result: UNDERVALUED

Head to the Valuation section of our Company Report for more details on how we arrive at this Fair Value for ageas.

Approach 2: ageas Price vs Earnings

For profitable companies like ageas, the Price-to-Earnings (PE) ratio is a useful valuation metric because it directly links a company's share price to its earnings, making it easier for investors to assess whether a stock looks reasonably priced. A "normal" or "fair" PE ratio for any business is influenced by how quickly its profits are expected to grow and the level of risk investors associate with those earnings. Higher growth opportunities and lower risk often justify a higher PE ratio, while lower growth or higher risks pull it down.

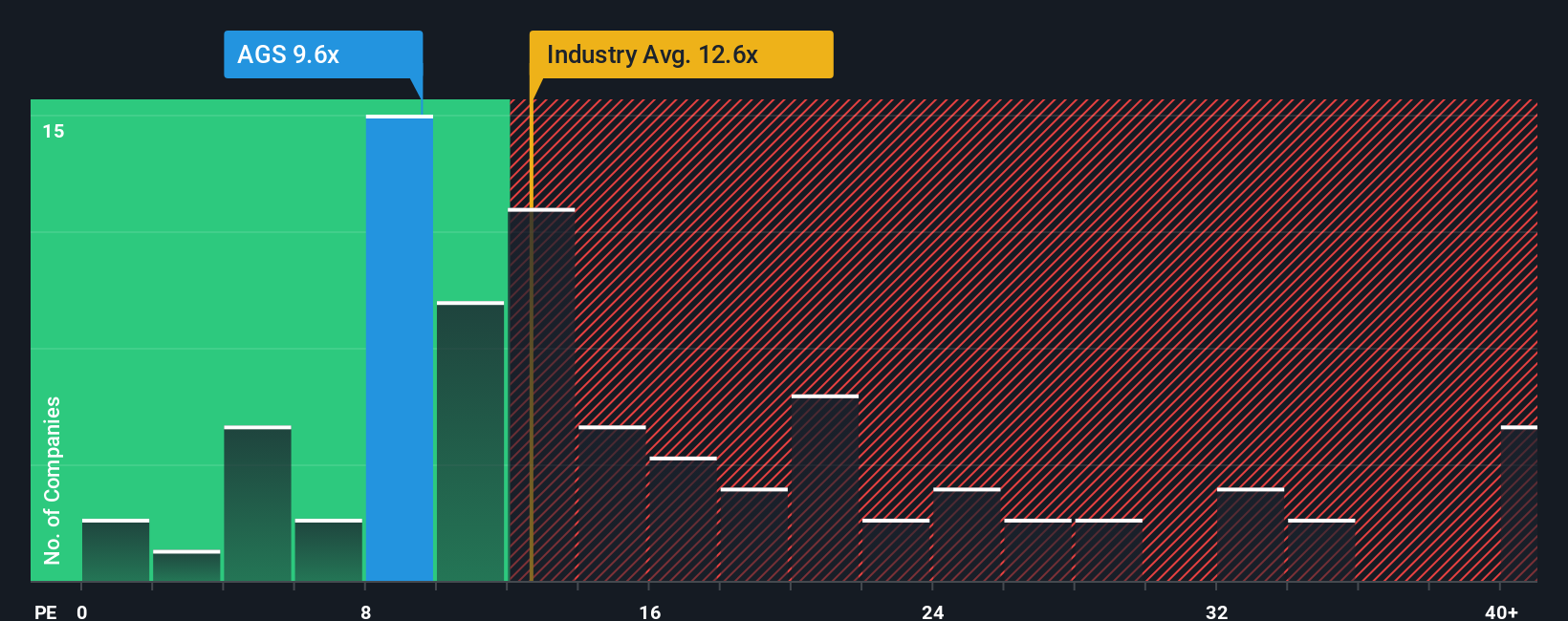

At present, ageas is trading at a PE ratio of 9.79x. This sits below both the insurance industry average of 12.21x and the peer group average of 15.63x. On the surface, this suggests ageas is cheaper than its competitors when measured purely on headline earnings. However, straightforward comparisons to industry averages can overlook a company's specific strengths, growth outlook, or risk profile.

That is why Simply Wall St’s proprietary “Fair Ratio” takes things further by factoring in more than just profits and peer benchmarks. The Fair Ratio considers elements such as projected earnings growth, profit margins, the company’s market cap, its specific sector, and business risks to identify a valuation multiple more tailored to ageas. By using this framework instead of just broad industry numbers, investors get a sharper, more relevant sense of whether the shares offer value today. When comparing ageas's actual PE ratio to the Fair Ratio, the numbers are closely aligned, which indicates the stock is trading at an appropriate level for its characteristics and outlook.

Result: ABOUT RIGHT

Upgrade Your Decision Making: Choose your ageas Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is simply the story you tell about a company, your perspective on its future, supported by your own assumptions about fair value, revenue growth, earnings, and margins. Narratives connect what you believe about ageas’s prospects to a clear financial forecast and then calculate a fair value based on those inputs.

On Simply Wall St’s Community page, Narratives are used by millions of investors to easily explore, build, and update these stories for any stock, making investment analysis more accessible to everyone. Narratives empower you to decide not just what ageas is worth, but why and whether it's time to act by comparing your Fair Value estimate with the current share price. They also update automatically when new information like earnings releases or news arrives, giving you real-time context for your decisions.

For example, some investors' Narratives for ageas see a fair value as high as €69 per share, thanks to optimistic growth forecasts, while others are more cautious, estimating as low as €38 based on conservative profit margins or sector risks.

Do you think there's more to the story for ageas? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTBR:AGS

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives