- Belgium

- /

- Healthcare Services

- /

- ENXTBR:FAGR

Fagron (EBR:FAGR) Has Announced That It Will Be Increasing Its Dividend To €0.175

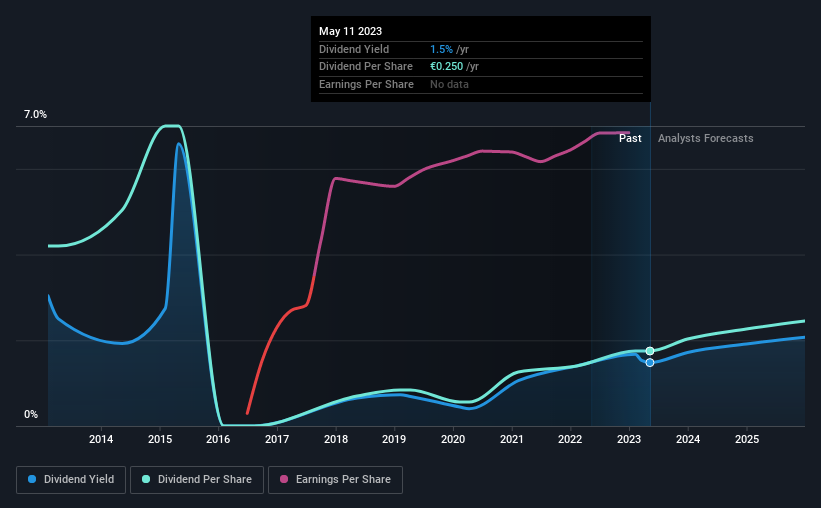

Fagron NV (EBR:FAGR) will increase its dividend from last year's comparable payment on the 17th of May to €0.175. The payment will take the dividend yield to 1.5%, which is in line with the average for the industry.

Check out our latest analysis for Fagron

Fagron's Earnings Easily Cover The Distributions

We like a dividend to be consistent over the long term, so checking whether it is sustainable is important. Before making this announcement, Fagron was easily earning enough to cover the dividend. This means that most of its earnings are being retained to grow the business.

Looking forward, earnings per share is forecast to rise by 43.4% over the next year. If the dividend continues on this path, the payout ratio could be 15% by next year, which we think can be pretty sustainable going forward.

Dividend Volatility

Although the company has a long dividend history, it has been cut at least once in the last 10 years. Since 2013, the dividend has gone from €0.60 total annually to €0.25. Doing the maths, this is a decline of about 8.4% per year. A company that decreases its dividend over time generally isn't what we are looking for.

Fagron Could Grow Its Dividend

Given that dividend payments have been shrinking like a glacier in a warming world, we need to check if there are some bright spots on the horizon. Fagron has impressed us by growing EPS at 8.0% per year over the past five years. Fagron definitely has the potential to grow its dividend in the future with earnings on an uptrend and a low payout ratio.

In Summary

Overall, it's great to see the dividend being raised and that it is still in a sustainable range. The payout ratio looks good, but unfortunately the company's dividend track record isn't stellar. The dividend looks okay, but there have been some issues in the past, so we would be a little bit cautious.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. As an example, we've identified 1 warning sign for Fagron that you should be aware of before investing. Is Fagron not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTBR:FAGR

Fagron

A pharmaceutical compounding company, delivers personalized pharmaceutical care to hospitals, pharmacies, clinics, patients, and worldwide.

Very undervalued with proven track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)