- Belgium

- /

- Medical Equipment

- /

- ENXTBR:BCART

Investors Give Biocartis Group NV (EBR:BCART) Shares A 31% Hiding

Unfortunately for some shareholders, the Biocartis Group NV (EBR:BCART) share price has dived 31% in the last thirty days, prolonging recent pain. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 78% loss during that time.

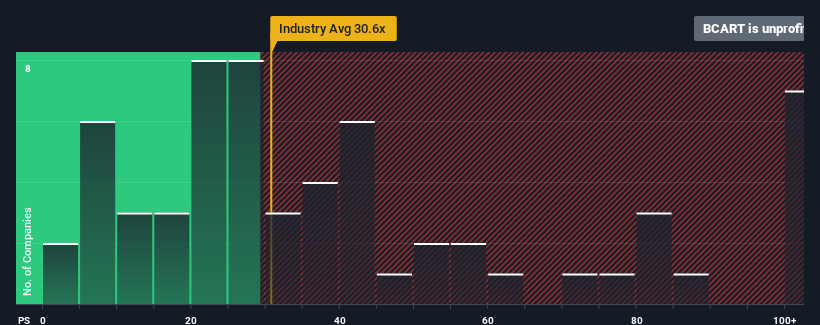

After such a large drop in price, Biocartis Group may be sending very bullish signals at the moment with its price-to-earnings (or "P/E") ratio of -0.6x, since almost half of all companies in Belgium have P/E ratios greater than 12x and even P/E's higher than 29x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so limited.

Biocartis Group has been doing a good job lately as it's been growing earnings at a solid pace. It might be that many expect the respectable earnings performance to degrade substantially, which has repressed the P/E. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

View our latest analysis for Biocartis Group

What Are Growth Metrics Telling Us About The Low P/E?

Biocartis Group's P/E ratio would be typical for a company that's expected to deliver very poor growth or even falling earnings, and importantly, perform much worse than the market.

Taking a look back first, we see that the company managed to grow earnings per share by a handy 13% last year. Still, EPS has barely risen at all in aggregate from three years ago, which is not ideal. So it appears to us that the company has had a mixed result in terms of growing earnings over that time.

Comparing that to the market, which is predicted to shrink 5.1% in the next 12 months, the company's positive momentum based on recent medium-term earnings results is a bright spot for the moment.

In light of this, it's quite peculiar that Biocartis Group's P/E sits below the majority of other companies. It looks like most investors are not convinced at all that the company can maintain its recent positive growth rate in the face of a shrinking broader market.

What We Can Learn From Biocartis Group's P/E?

Shares in Biocartis Group have plummeted and its P/E is now low enough to touch the ground. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Biocartis Group currently trades on a much lower than expected P/E since its recent three-year earnings growth is beating forecasts for a struggling market. There could be some major unobserved threats to earnings preventing the P/E ratio from matching this positive performance. One major risk is whether its earnings trajectory can keep outperforming under these tough market conditions. It appears many are indeed anticipating earnings instability, because this relative performance should normally provide a boost to the share price.

And what about other risks? Every company has them, and we've spotted 6 warning signs for Biocartis Group (of which 5 are a bit unpleasant!) you should know about.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Biocartis Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTBR:BCART

Biocartis Group

A molecular diagnostics company, provides diagnostic solutions enhancing clinical practice for the benefit of patients, clinicians, payers, and healthcare industry with a focus on oncology.

Very low with weak fundamentals.