As global markets navigate a landscape of mixed economic signals and shifting monetary policies, small-cap stocks have faced particular challenges, with the Russell 2000 Index underperforming relative to larger indices. Amidst this backdrop, discerning investors are on the lookout for promising opportunities within these smaller companies that may offer unique growth potential despite broader market volatility. A good stock in this context often exhibits strong fundamentals and resilience against economic headwinds, making it a compelling consideration for those seeking undiscovered gems in the small-cap arena.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Sugar Terminals | NA | 3.14% | 3.53% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Citra Tubindo | NA | 11.06% | 31.01% | ★★★★★★ |

| Prima Andalan Mandiri | 0.94% | 20.24% | 15.28% | ★★★★★★ |

| Cardig Aero Services | NA | 6.60% | 69.79% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| CTCI Advanced Systems | 30.56% | 24.10% | 29.97% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Chongqing Machinery & Electric | 27.77% | 8.82% | 11.12% | ★★★★☆☆ |

| Bank MNC Internasional | 18.72% | 4.80% | 43.63% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Spadel (ENXTBR:SPA)

Simply Wall St Value Rating: ★★★★★★

Overview: Spadel SA is a company that specializes in the production and marketing of natural mineral water in Belgium, with a market capitalization of €784.42 million.

Operations: Spadel's revenue primarily comes from its non-alcoholic beverages segment, generating €359.03 million.

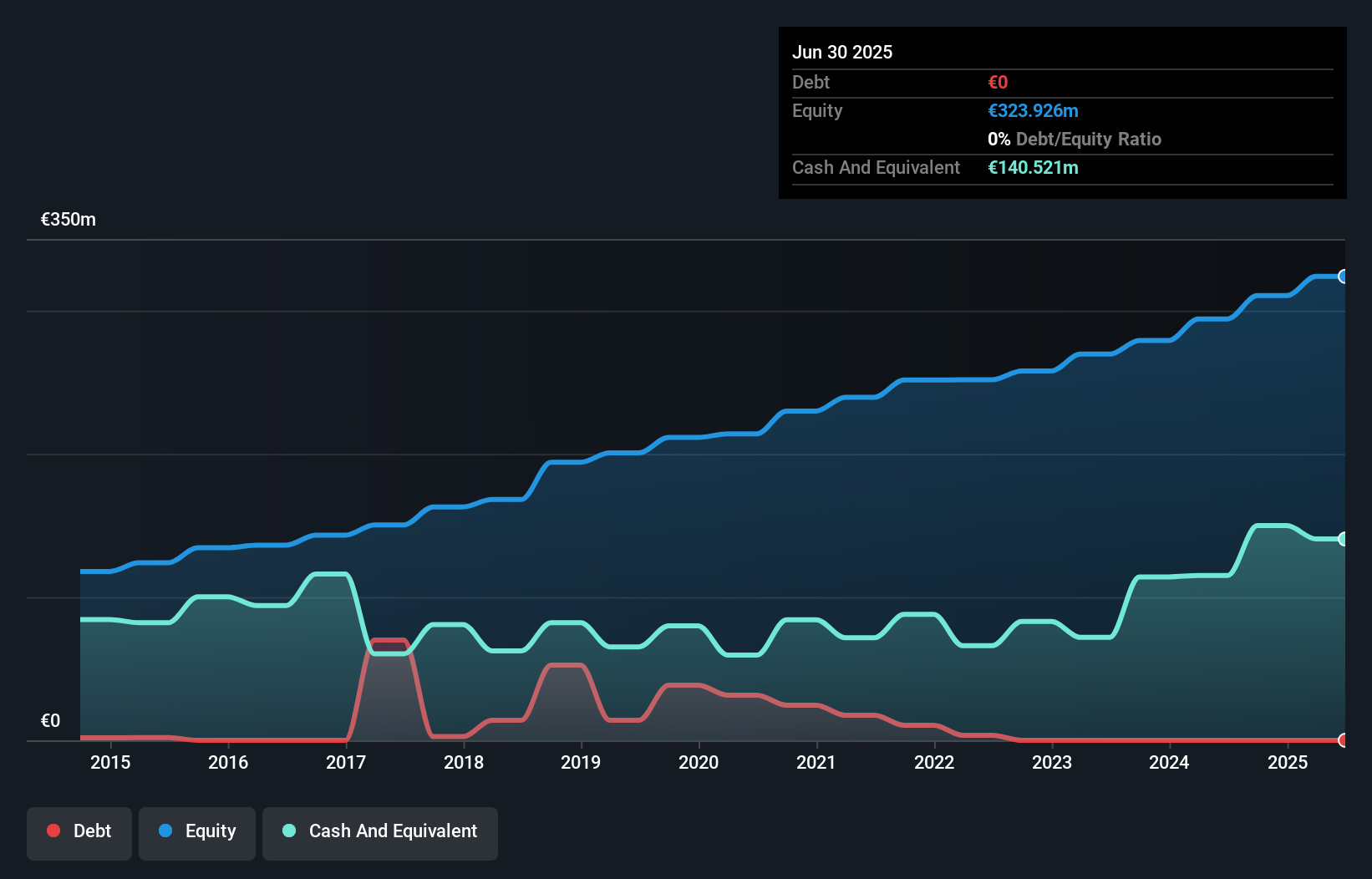

Spadel, a nimble player in the beverage industry, has caught attention with its robust performance despite challenges. The company is debt-free now, a significant improvement from five years ago when it had a 7% debt to equity ratio. Trading at 74.3% below estimated fair value suggests potential undervaluation in the market. Over the past year, Spadel's earnings surged by 54%, outpacing the broader beverage sector's -0.3%. Despite earnings declining by an average of 5.1% annually over five years, its high-quality earnings and positive free cash flow indicate resilience and operational strength within this competitive landscape.

- Take a closer look at Spadel's potential here in our health report.

Explore historical data to track Spadel's performance over time in our Past section.

Placoplatre (ENXTPA:MLPLC)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Placoplatre SA specializes in manufacturing and supplying insulation solutions for both professionals and individuals, with a market capitalization of approximately €652.84 million.

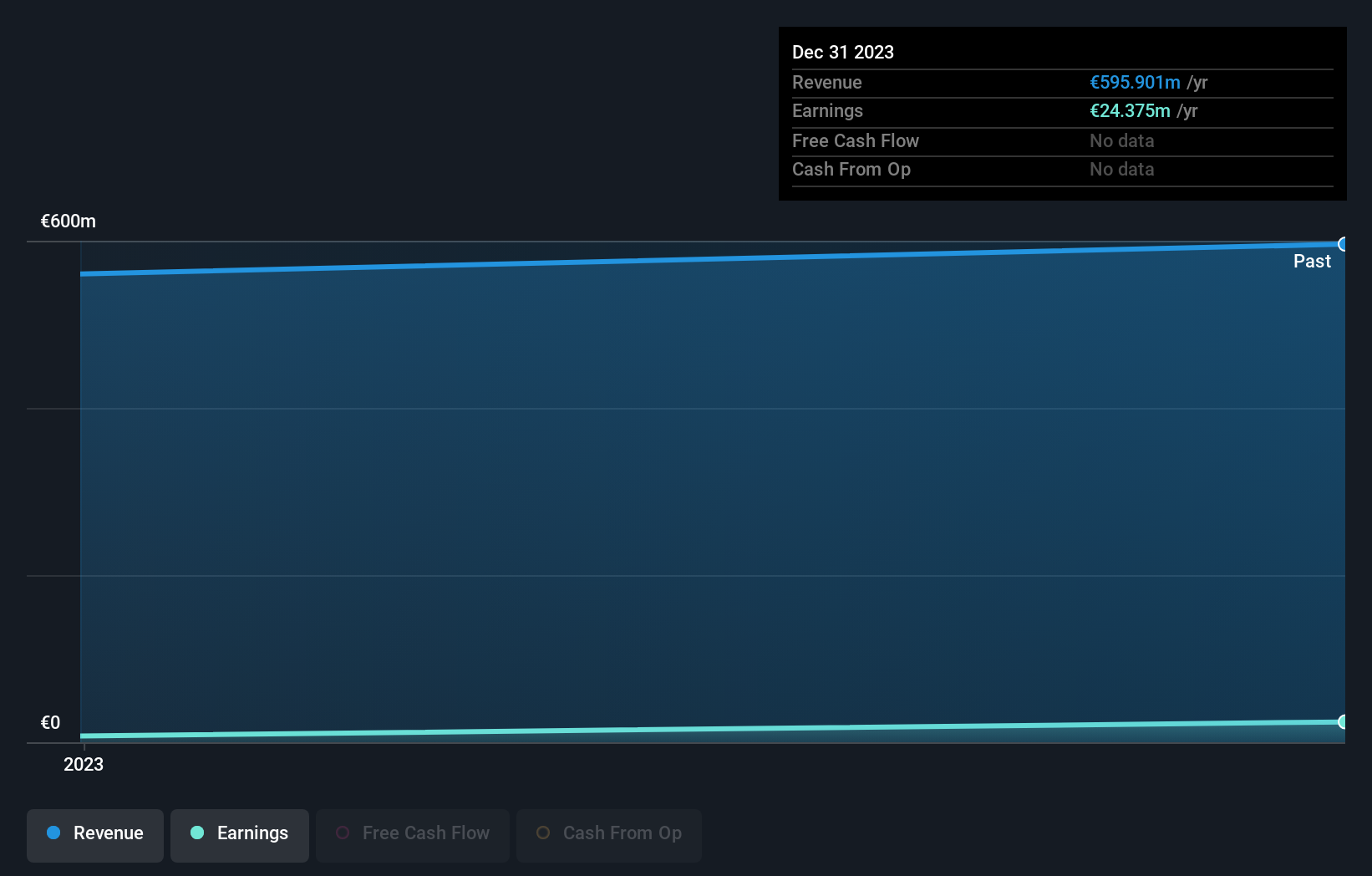

Operations: Placoplatre SA generates revenue primarily from its construction materials segment, totaling €595.90 million. The company's market capitalization is approximately €652.84 million.

Placoplatre, a promising small player in the building industry, has shown remarkable earnings growth of 227% over the past year, far outpacing the industry's -8%. This impressive performance is supported by high-quality earnings and a satisfactory net debt to equity ratio of 15%, indicating sound financial management. The company also comfortably covers its interest payments, which suggests strong operational efficiency. While data on free cash flow remains unavailable, these financial metrics highlight Placoplatre's potential as an investment opportunity within its sector. Looking ahead, such robust growth could position it well for future expansion and value creation.

- Click here and access our complete health analysis report to understand the dynamics of Placoplatre.

Evaluate Placoplatre's historical performance by accessing our past performance report.

S.A.S. Dragon Holdings (SEHK:1184)

Simply Wall St Value Rating: ★★★★★☆

Overview: S.A.S. Dragon Holdings Limited is an investment holding company that distributes electronic components and semiconductor products across various regions, including Hong Kong, Mainland China, Taiwan, the United States, Vietnam, Singapore, Macao, and internationally; it has a market cap of approximately HK$2.58 billion.

Operations: The company generates revenue primarily from the distribution of electronic components and semiconductor products, amounting to approximately HK$26.73 billion.

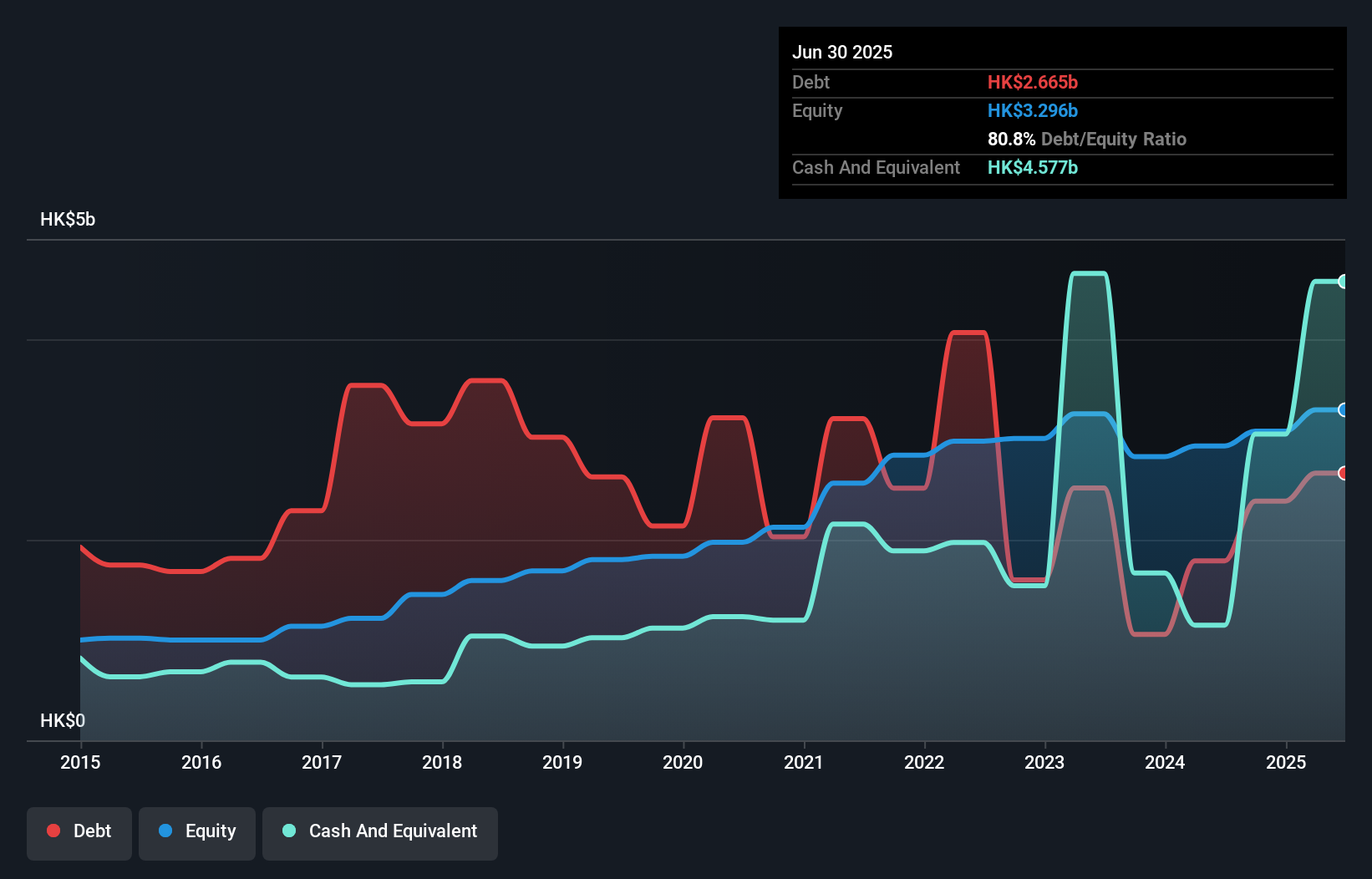

S.A.S. Dragon Holdings, a nimble player in the electronics sector, has demonstrated impressive earnings growth of 24.7% over the past year, outpacing the industry's 11.7%. Trading at 37.9% below its estimated fair value suggests potential undervaluation in the market's eyes. The company shows financial prudence with an interest coverage ratio of 23.9 times EBIT and a net debt to equity ratio standing at a satisfactory 21.9%, down from 145.7% five years ago, indicating effective debt management over time despite not being free cash flow positive currently.

- Dive into the specifics of S.A.S. Dragon Holdings here with our thorough health report.

Assess S.A.S. Dragon Holdings' past performance with our detailed historical performance reports.

Summing It All Up

- Click through to start exploring the rest of the 597 Undiscovered Gems With Strong Fundamentals now.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:MLPLC

Placoplatre

Manufactures and supplies insulation solutions for professionals and individuals.

Not a dividend payer with minimal risk.

Market Insights

Community Narratives