As European markets continue to show resilience, with the STOXX Europe 600 Index climbing 2.35% and major single-country indexes like Germany's DAX and the UK's FTSE 100 also posting gains, investors are increasingly interested in small-cap stocks that may offer unique opportunities amid subdued inflation rates and recent economic developments. In this environment, identifying stocks with strong fundamentals and growth potential can be particularly rewarding for those looking to uncover hidden gems within Europe's dynamic market landscape.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Dekpol | 61.42% | 9.03% | 14.54% | ★★★★★★ |

| Evergent Investments | 3.63% | 11.51% | 22.05% | ★★★★★☆ |

| KABE Group AB (publ.) | 3.82% | 3.46% | 5.42% | ★★★★★☆ |

| Inversiones Doalca SOCIMI | 13.10% | 6.72% | 3.11% | ★★★★★☆ |

| Dn Agrar Group | NA | 29.02% | 36.03% | ★★★★★☆ |

| Envirotainer | 43.54% | 8.03% | -34.33% | ★★★★★☆ |

| VNV Global | 15.38% | -18.33% | -18.19% | ★★★★★☆ |

| Procimmo Group | 141.47% | 6.84% | 6.01% | ★★★★☆☆ |

| Practic | NA | 4.86% | 6.64% | ★★★★☆☆ |

| Alantra Partners | 11.36% | -6.39% | -33.69% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Spadel (ENXTBR:SPA)

Simply Wall St Value Rating: ★★★★★★

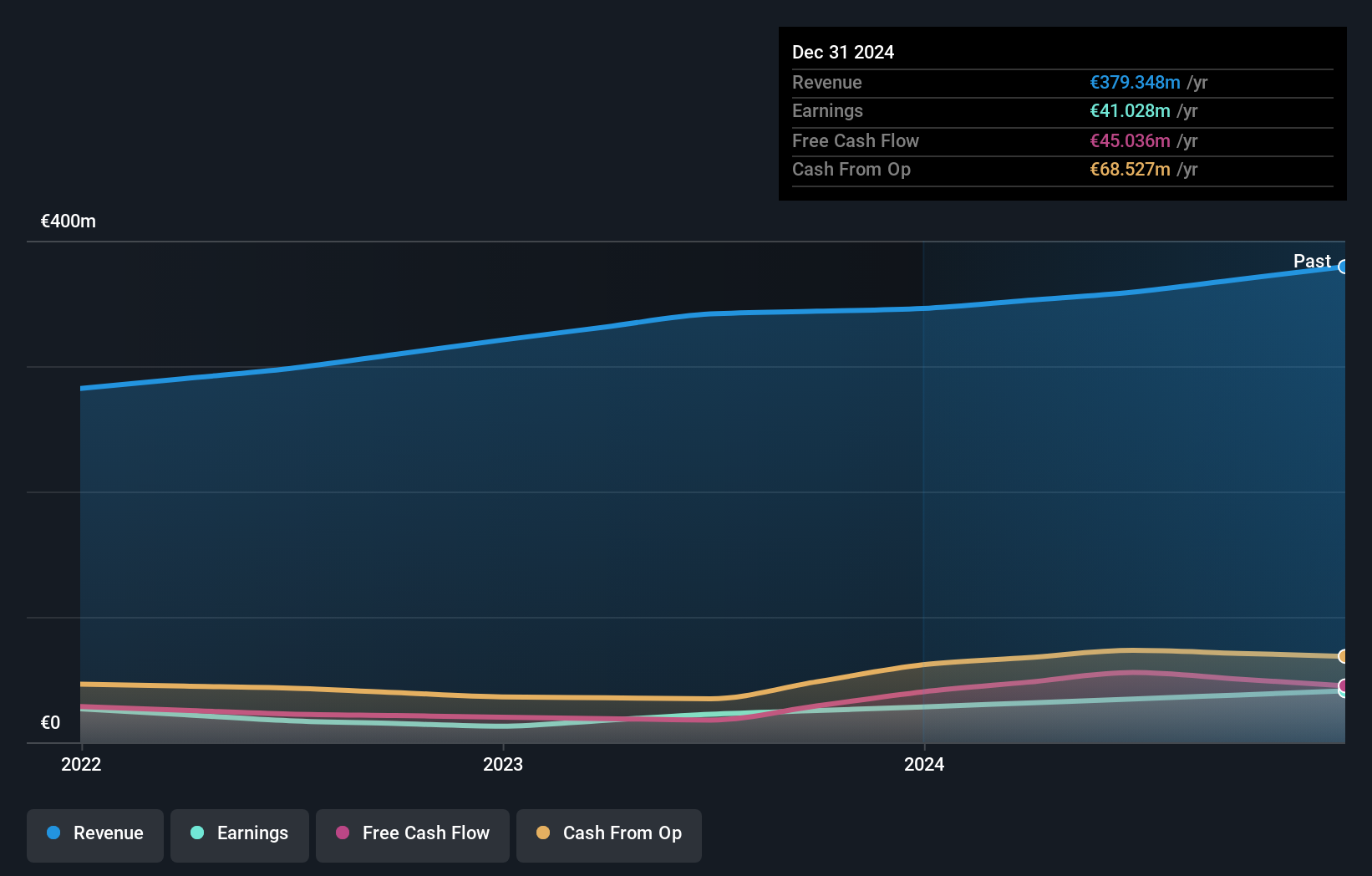

Overview: Spadel SA is a Belgian company that specializes in the production and marketing of natural mineral water, with a market capitalization of €1 billion.

Operations: Spadel's revenue is primarily derived from its non-alcoholic beverages segment, amounting to €399.96 million. The company has a market capitalization of approximately €1 billion.

Spadel shines as a promising small player in Europe, boasting an impressive 26.6% earnings growth over the past year, outpacing the Beverage industry's -6.6%. This debt-free company has successfully reduced its debt from a 14.7% debt-to-equity ratio five years ago to zero today, enhancing financial stability and flexibility. With high-quality earnings and positive free cash flow, Spadel seems well-positioned for sustainable operations. Levered free cash flow reached €50.34 million at the end of September 2024, indicating robust financial health despite capital expenditures of €19.51 million during the same period—an encouraging sign for future prospects in a competitive market.

Caisse Régionale de Crédit Agricole Mutuel du Languedoc Société coopérative (ENXTPA:CRLA)

Simply Wall St Value Rating: ★★★★★★

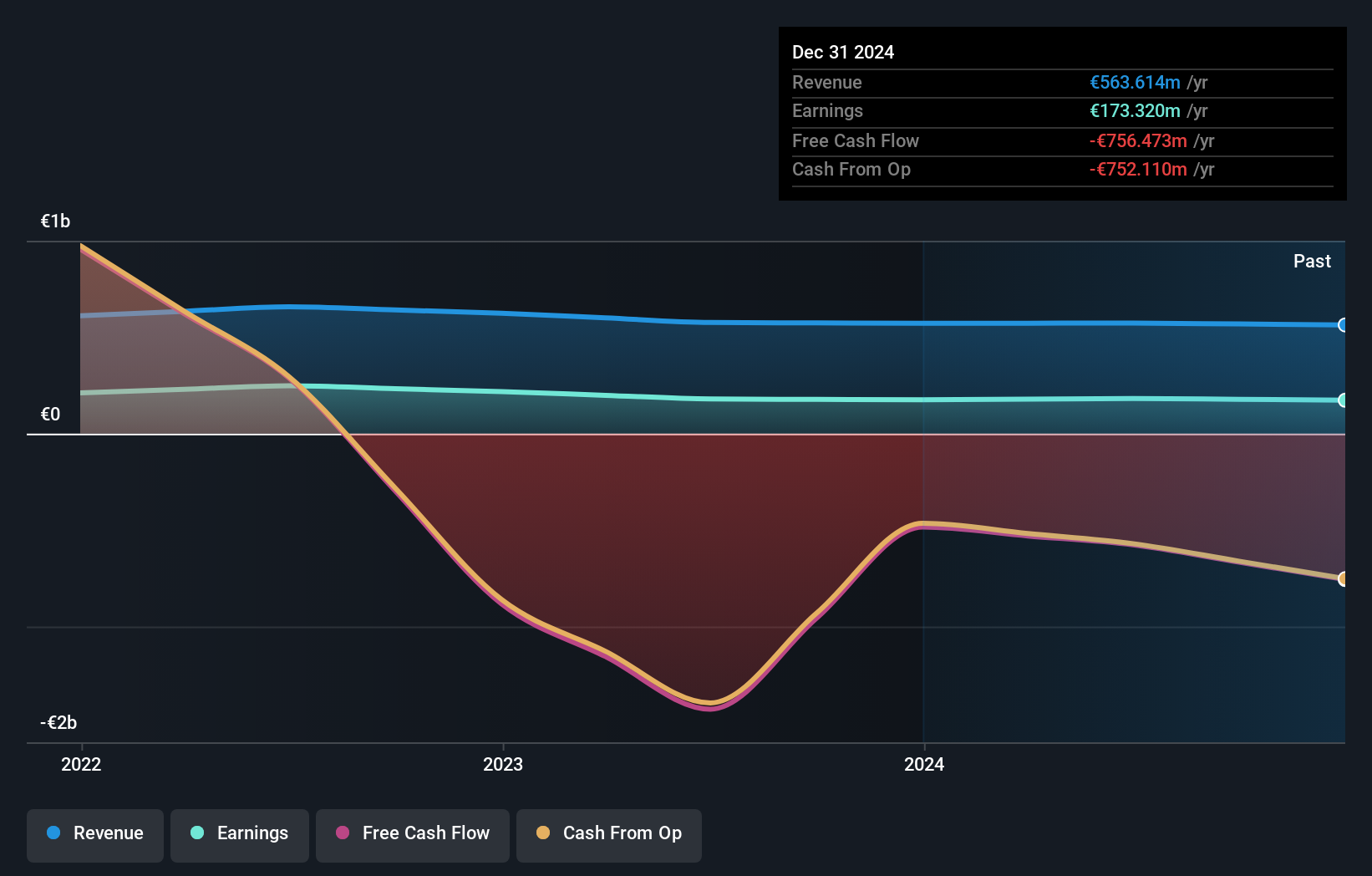

Overview: Caisse Régionale de Crédit Agricole Mutuel du Languedoc Société coopérative offers a range of banking products and services to diverse clients in France, including individuals, businesses, and local authorities, with a market cap of €1.53 billion.

Operations: The cooperative generates revenue through its diverse banking products and services offered to various client segments in France. Its financial performance is reflected in a market cap of €1.53 billion, indicating its significant presence in the regional banking sector.

CRLA, with assets totaling €35.9B and equity at €5.7B, stands out for its robust financial health in the banking sector. Total deposits of €28.6B and loans of €28.8B reflect a balanced approach to growth, supported by primarily low-risk customer deposits making up 95% of liabilities. The bank has a sufficient allowance for bad loans at 136%, ensuring resilience against potential defaults while maintaining an appropriate level of non-performing loans at 1.5%. With earnings growth surpassing the industry average and a price-to-earnings ratio of 8.3x below the French market's average, CRLA appears undervalued yet promising within its niche market segment.

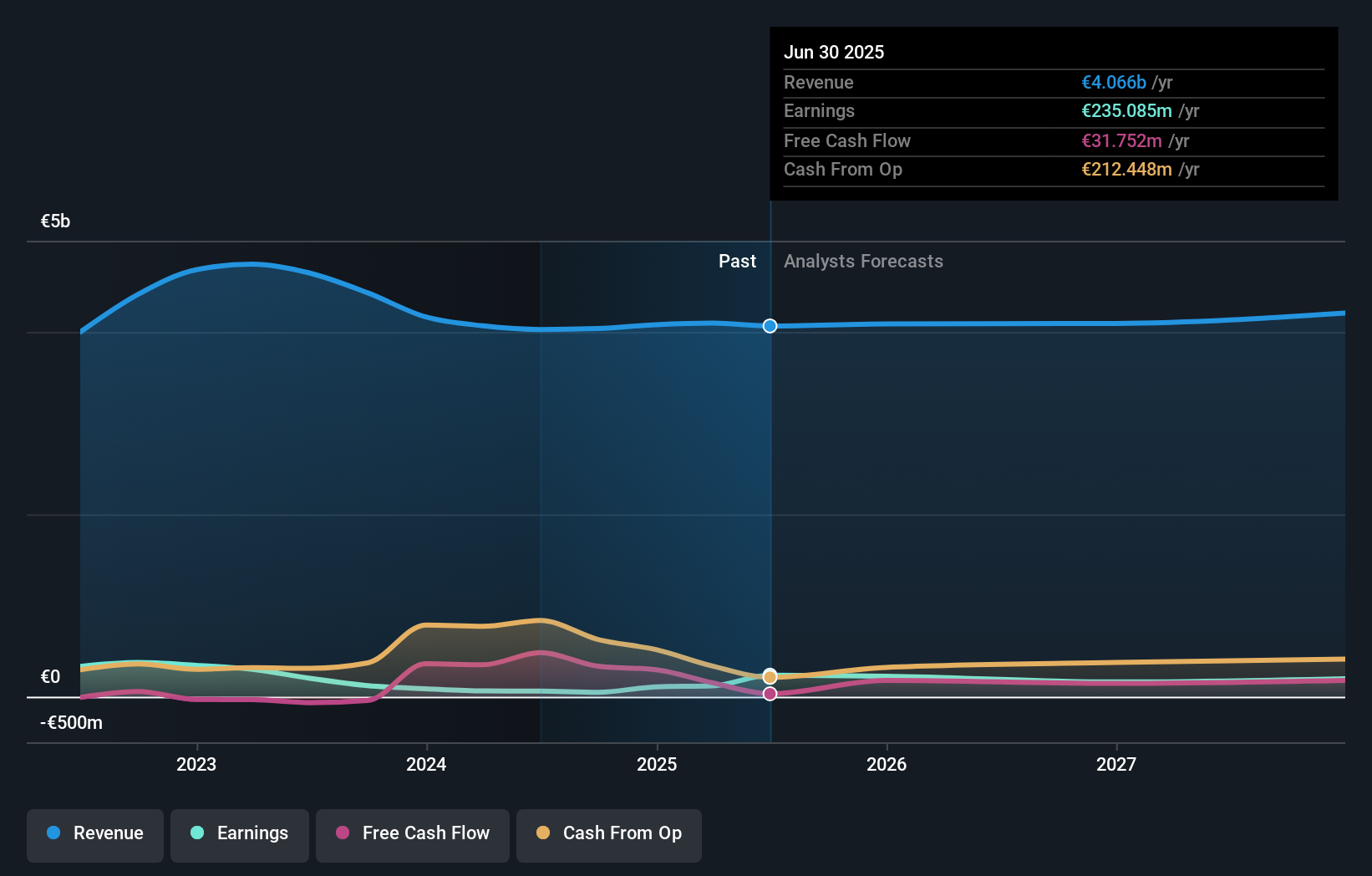

Mayr-Melnhof Karton (WBAG:MMK)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Mayr-Melnhof Karton AG is a company that produces and distributes cartonboard and folding cartons across Germany, Austria, and other international markets, with a market capitalization of approximately €1.65 billion.

Operations: Mayr-Melnhof Karton generates revenue primarily from its MM Board & Paper segment (€1.96 billion) and MM Food & Premium Packaging segment (€1.62 billion), with additional contributions from MM Pharma & Healthcare Packaging (€614.79 million).

Mayr-Melnhof Karton, a notable player in the packaging industry, has seen substantial earnings growth of 362.9% over the past year, outperforming its sector's -18.7%. However, the company faces challenges with a high net debt to equity ratio of 49.9%, which is above typical levels. Despite this, interest payments are well covered by EBIT at an impressive 8x coverage. Recent results show third-quarter sales at €949.56 million compared to €1 billion previously and net income at €1.95 million down from €14 million last year, indicating pressure on margins amidst industry overcapacity and fluctuating raw material costs.

Turning Ideas Into Actions

- Unlock our comprehensive list of 313 European Undiscovered Gems With Strong Fundamentals by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About WBAG:MMK

Mayr-Melnhof Karton

Manufactures and sells cartonboard and folding cartons in Germany, Austria, and internationally.

Undervalued with proven track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026