As European markets navigate a complex economic landscape, marked by mixed performances across major indices like the STOXX Europe 600 and policy decisions from central banks, investors are keenly observing the potential impact of these developments on small-cap stocks. With interest rates holding steady in key regions and industrial output showing resilience despite uncertainties, this environment presents intriguing opportunities for those seeking to explore lesser-known equities. In such a dynamic market, identifying promising stocks often involves looking for companies with strong fundamentals that can thrive amidst shifting economic conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| La Forestière Equatoriale | NA | -65.30% | 37.55% | ★★★★★★ |

| Evergent Investments | 3.82% | 10.46% | 23.17% | ★★★★★☆ |

| Zespól Elektrocieplowni Wroclawskich KOGENERACJA | 13.23% | 20.22% | 17.99% | ★★★★★☆ |

| ABG Sundal Collier Holding | 46.02% | -6.02% | -15.62% | ★★★★☆☆ |

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 394.25% | 3.36% | 6.34% | ★★★★☆☆ |

| Practic | NA | 4.86% | 6.64% | ★★★★☆☆ |

| Darwin | 3.03% | 84.88% | 5.63% | ★★★★☆☆ |

| Inversiones Doalca SOCIMI | 15.57% | 6.53% | 7.16% | ★★★★☆☆ |

| Alantra Partners | 11.48% | -5.76% | -30.16% | ★★★★☆☆ |

| MCH Group | 124.09% | 12.40% | 43.58% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Faes Farma (BME:FAE)

Simply Wall St Value Rating: ★★★★★☆

Overview: Faes Farma, S.A. is a global company engaged in the research, development, production, and marketing of pharmaceutical and healthcare products as well as raw materials, with a market capitalization of approximately €1.31 billion.

Operations: Faes Farma generates revenue primarily from its Pharmaceutical Specialties and Healthcare segment, which accounts for €478.50 million, followed by the Nutrition and Animal Health segment at €63.94 million.

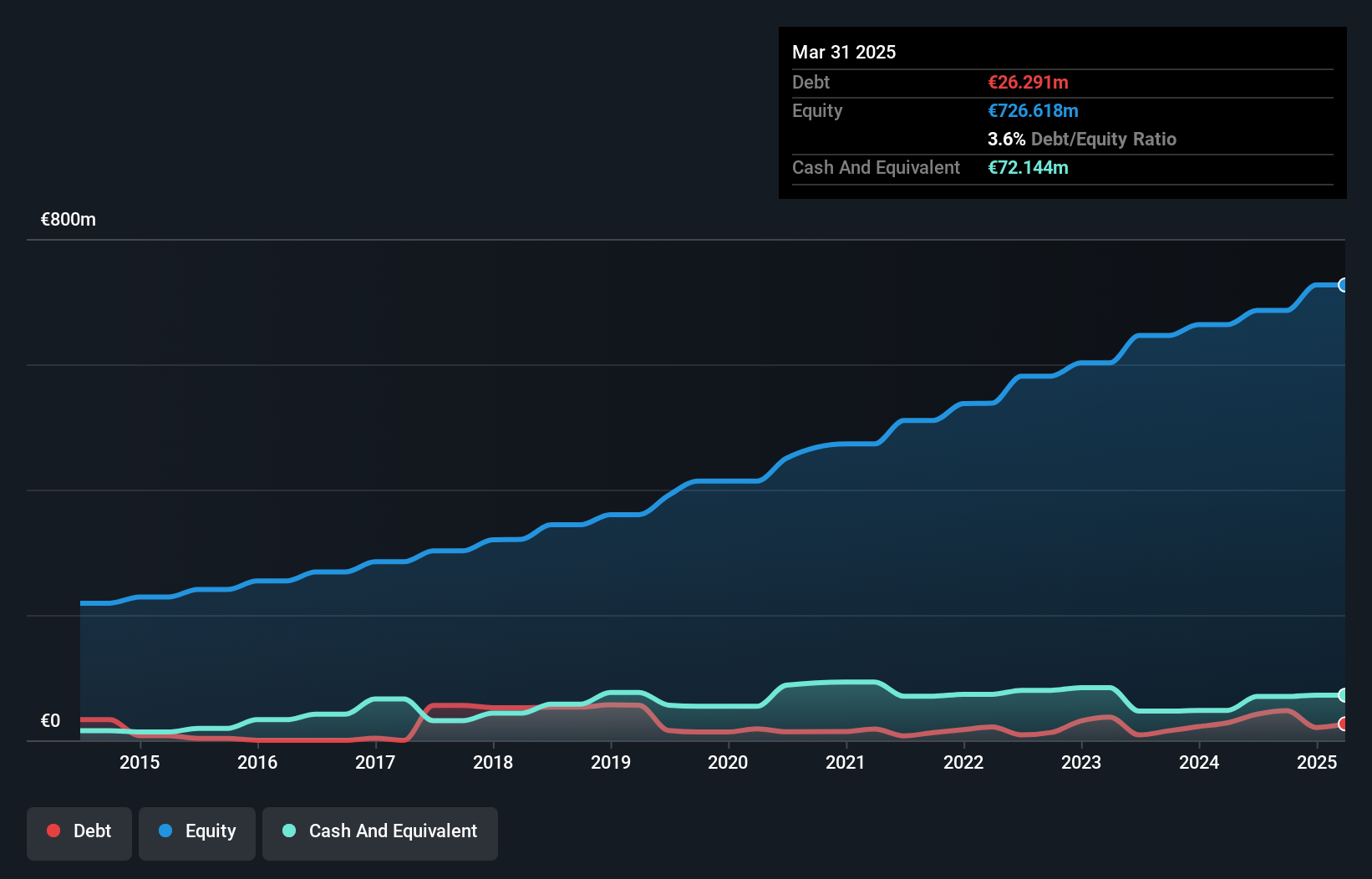

Faes Farma, a notable player in the European pharmaceutical scene, has shown resilient financial health. With cash exceeding total debt and interest payments covered 345.9 times by EBIT, it stands on solid ground. The company's debt to equity ratio increased from 3% to 10.7% over five years, indicating strategic leveraging perhaps for growth initiatives. Despite earnings not outpacing the industry's 20.7%, they have consistently grown at 8% annually over five years and are projected to continue at a similar pace of 8%. Recent sales reached €296 million, up from €261 million last year, though net income dipped slightly to €52 million from €58 million.

- Take a closer look at Faes Farma's potential here in our health report.

Review our historical performance report to gain insights into Faes Farma's's past performance.

Nueva Expresión Textil (BME:NXT)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Nueva Expresión Textil, S.A. is involved in the manufacturing and selling of fabrics and garments, with a market cap of €291.44 million.

Operations: Nueva Expresión Textil generates revenue primarily from the sale of fabrics and garments. The company has a market capitalization of €291.44 million.

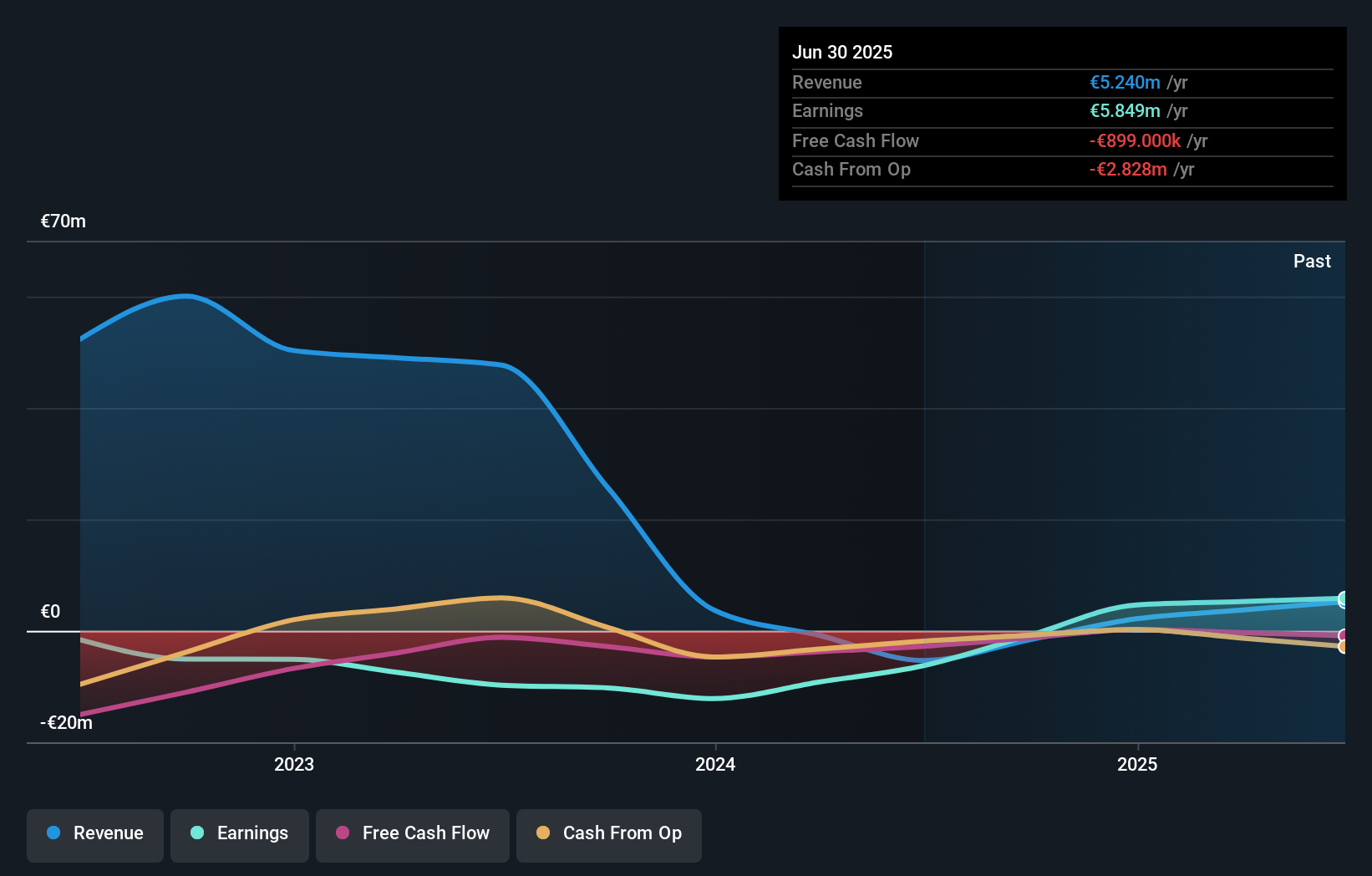

Nueva Expresión Textil has shown promising growth with sales reaching €17.21 million for the first half of 2025, up from €14.13 million the previous year. Net income also saw a significant rise to €1.27 million compared to just €0.075 million last year, reflecting its improved profitability status this year. Despite shareholder dilution over the past year, NXT maintains a satisfactory net debt to equity ratio of 24%, indicating sound financial management. However, high volatility in its share price and lack of free cash flow positivity might concern some investors despite its robust earnings performance and industry outpacing growth rate.

- Delve into the full analysis health report here for a deeper understanding of Nueva Expresión Textil.

Learn about Nueva Expresión Textil's historical performance.

Exmar (ENXTBR:EXM)

Simply Wall St Value Rating: ★★★★★★

Overview: Exmar NV provides shipping and floating infrastructure solutions globally, with a market capitalization of €825.38 million.

Operations: Exmar NV generates revenue primarily from its Shipping and Infrastructure segments, contributing $141.51 million and $145.34 million respectively. Supporting Services add an additional $90.12 million to the revenue stream.

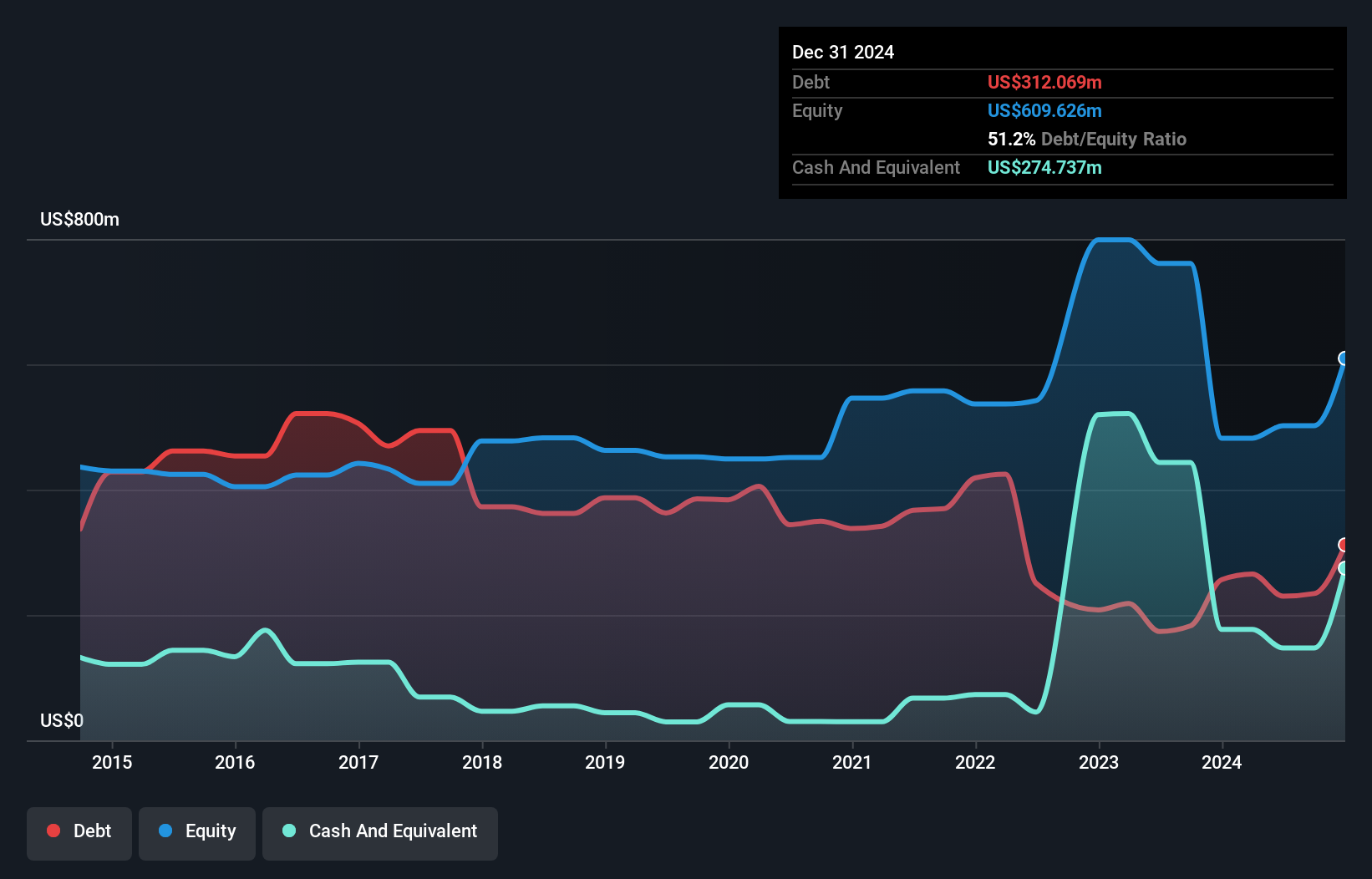

Exmar, a niche player in the oil and gas sector, has demonstrated robust financial management with its debt to equity ratio decreasing from 76.2% to 44.5% over five years. The company reported a net income of US$44 million for the first half of 2025, despite sales dropping to US$122 million from US$194 million the previous year. Earnings growth outpaced industry trends at 29.4%, supported by an EBIT interest coverage of 7.3x, indicating strong operational performance amidst market volatility. Exmar's valuation appears attractive as it trades at nearly 78% below estimated fair value, though shareholders faced significant dilution recently due to one-off gains impacting earnings quality.

- Unlock comprehensive insights into our analysis of Exmar stock in this health report.

Understand Exmar's track record by examining our Past report.

Key Takeaways

- Access the full spectrum of 335 European Undiscovered Gems With Strong Fundamentals by clicking on this link.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BME:FAE

Faes Farma

Researches, develops, produces, and markets pharmaceutical products, healthcare products, and raw materials internationally.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives