- Belgium

- /

- Oil and Gas

- /

- ENXTBR:EXM

3 Undiscovered European Gems with Strong Fundamentals

Reviewed by Simply Wall St

Amidst a backdrop of fluctuating economic indicators and geopolitical tensions, European markets have shown resilience, with the pan-European STOXX Europe 600 Index rising by 1.15% due to optimism around potential trade deals. As investors navigate these complex conditions, identifying stocks with strong fundamentals becomes crucial for capitalizing on opportunities in this dynamic environment.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| AB Traction | NA | 5.39% | 5.24% | ★★★★★★ |

| Martifer SGPS | 102.88% | -0.23% | 7.16% | ★★★★★★ |

| Linc | NA | 101.28% | 29.81% | ★★★★★★ |

| Flügger group | 30.11% | 1.55% | -30.01% | ★★★★★☆ |

| Grenobloise d'Electronique et d'Automatismes Société Anonyme | 0.01% | 7.01% | -1.81% | ★★★★★☆ |

| Alantra Partners | 3.79% | -3.99% | -23.83% | ★★★★★☆ |

| Dekpol | 63.20% | 11.06% | 13.37% | ★★★★★☆ |

| Deutsche Balaton | 5.64% | -7.61% | -16.14% | ★★★★★☆ |

| Practic | 5.21% | 4.49% | 7.23% | ★★★★☆☆ |

| Inversiones Doalca SOCIMI | 15.57% | 6.53% | 7.16% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Grupo Empresarial San José (BME:GSJ)

Simply Wall St Value Rating: ★★★★★★

Overview: Grupo Empresarial San José, S.A., along with its subsidiaries, operates primarily in the construction industry both in Spain and internationally, with a market capitalization of approximately €407.06 million.

Operations: San José generates revenue primarily from its construction segment, which accounts for €1.44 billion, followed by concessions and services at €81.40 million, and energy at €10.68 million. The real estate and urban development segment contributes €7.21 million to the overall revenue stream.

Grupo Empresarial San José, a notable name in construction, has shown impressive earnings growth of 49.7% over the past year, outpacing the industry average of 4.9%. Its price-to-earnings ratio stands at 12.2x, which is favorable compared to the broader Spanish market's 18.6x. The company reported first-quarter sales of €366.68 million and net income of €10.57 million, both slightly up from last year's figures. With a debt-to-equity ratio reduced to 45.8% over five years and more cash than total debt, GSJ seems well-positioned financially despite forecasts suggesting an earnings decline ahead.

- Take a closer look at Grupo Empresarial San José's potential here in our health report.

Gain insights into Grupo Empresarial San José's past trends and performance with our Past report.

Exmar (ENXTBR:EXM)

Simply Wall St Value Rating: ★★★★★☆

Overview: Exmar NV provides shipping and floating infrastructure solutions globally, with a market capitalization of €687.08 million.

Operations: Exmar NV generates revenue primarily from its Infrastructure and Shipping segments, contributing $212.16 million and $142.83 million, respectively. The Supporting Services segment adds $90.18 million to the total revenue stream.

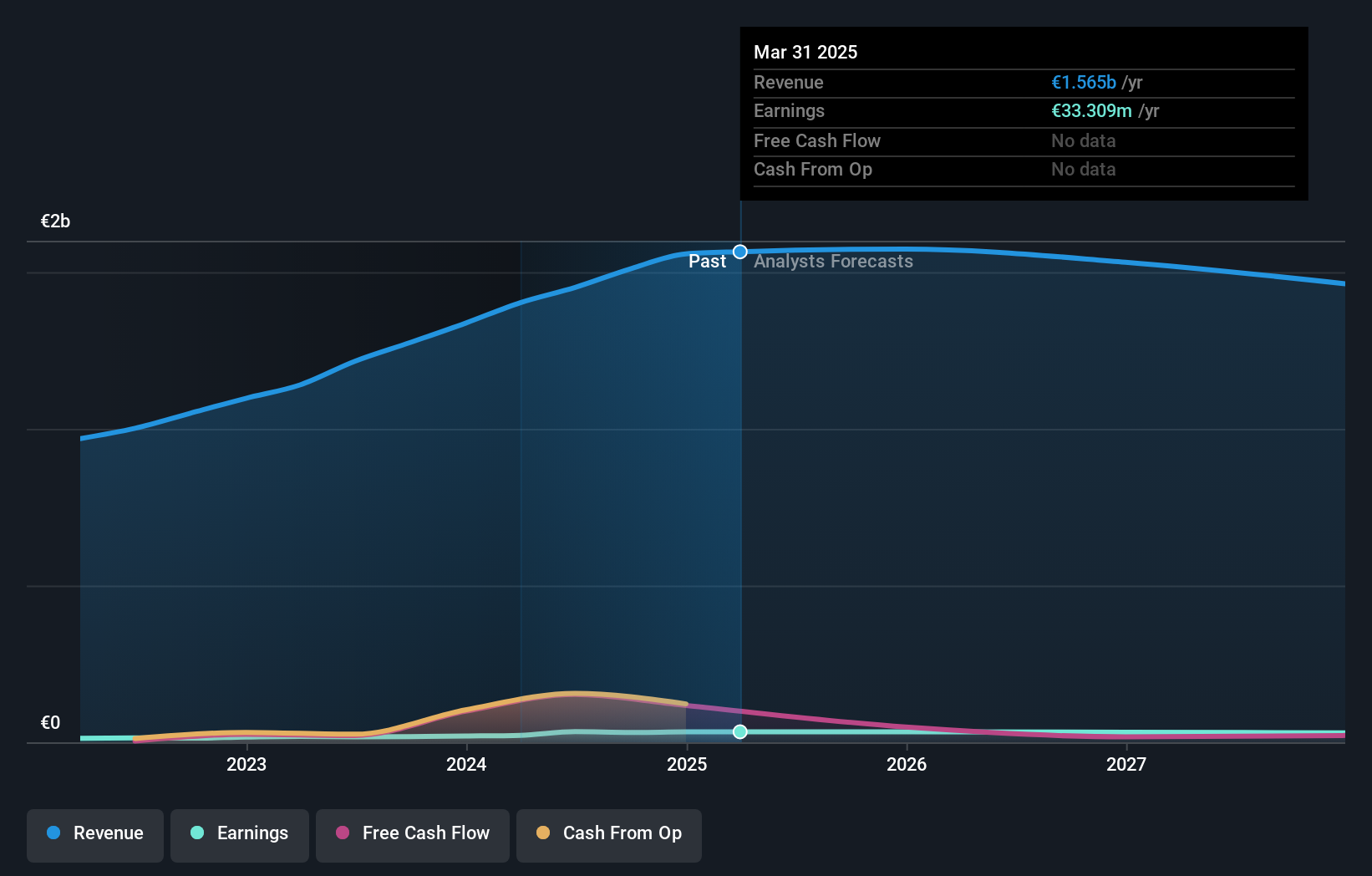

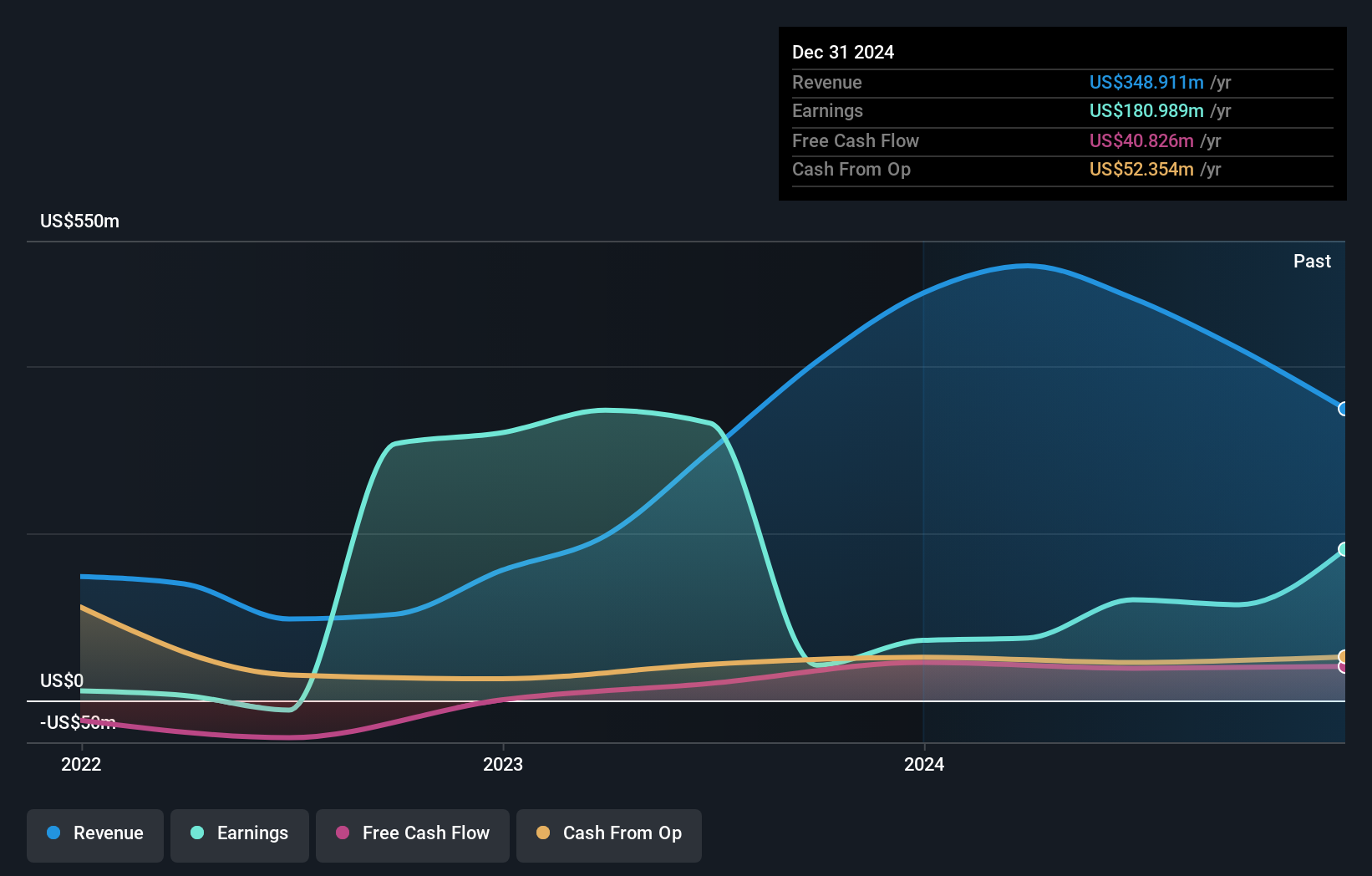

Exmar is making waves with a 151.5% earnings growth over the past year, outpacing the Oil and Gas industry’s -20.8%. Trading at 29.7% below its estimated fair value, it presents an intriguing opportunity for investors seeking undervalued stocks. The company boasts a net debt to equity ratio of 6.1%, which seems satisfactory compared to industry standards, and its interest payments are well covered by EBIT at seven times coverage. Additionally, Exmar has reduced its debt to equity ratio from 85.5% to 51.2% over five years, highlighting effective financial management in recent times.

- Click to explore a detailed breakdown of our findings in Exmar's health report.

Gain insights into Exmar's historical performance by reviewing our past performance report.

Caisse Régionale de Crédit Agricole Mutuel du Languedoc Société coopérative (ENXTPA:CRLA)

Simply Wall St Value Rating: ★★★★★★

Overview: Caisse Régionale de Crédit Agricole Mutuel du Languedoc Société coopérative offers a range of banking products and services to diverse client groups in France, with a market cap of approximately €1.23 billion.

Operations: The company's revenue primarily comes from its Retail Banking operations in France, generating €456.43 million, while Non-Business Activities contribute €106.65 million.

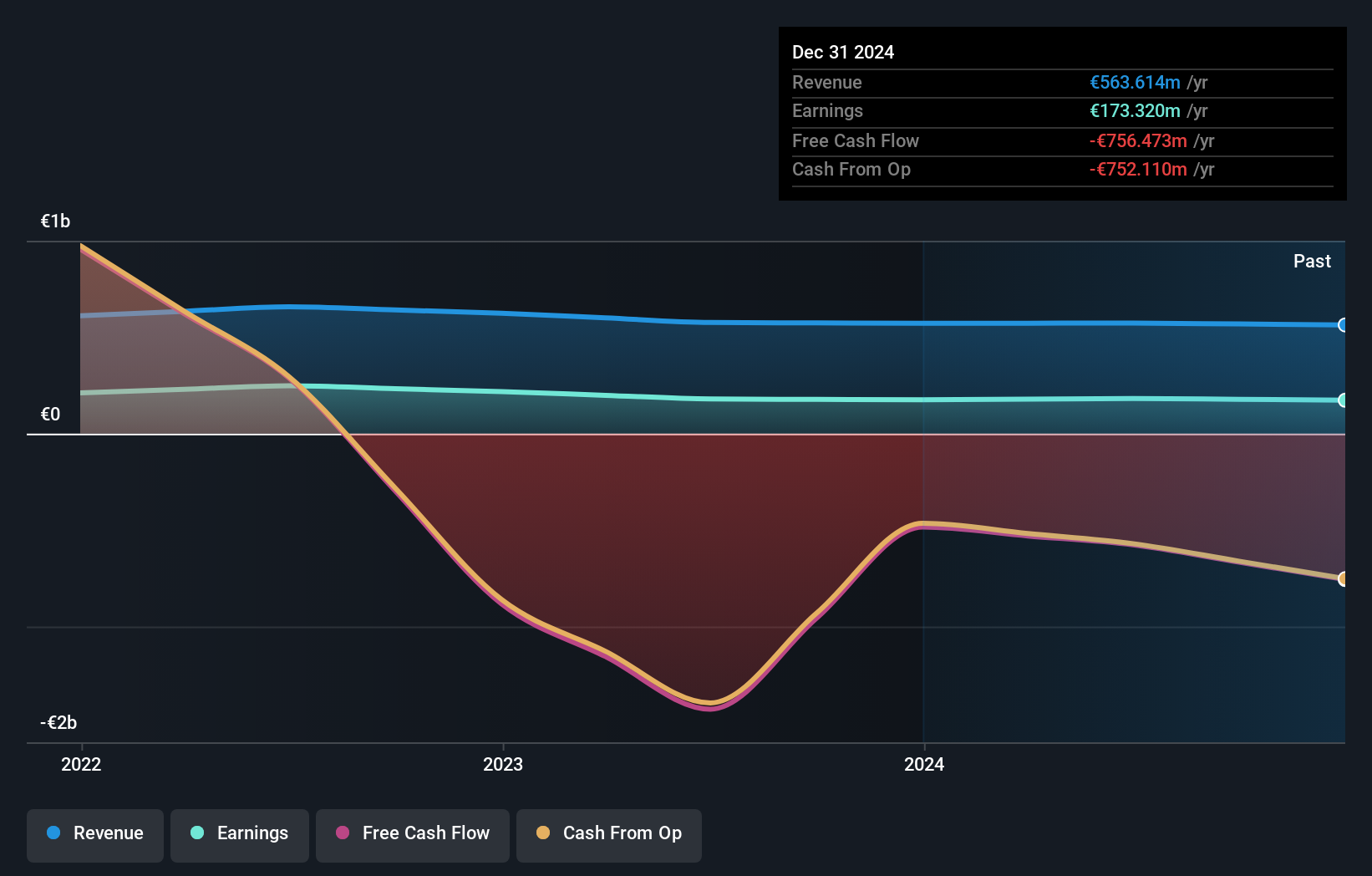

CRLA, with total assets of €36.1B and equity of €5.5B, operates in a niche market with robust low-risk funding sources, as 95% of its liabilities are customer deposits. While earnings growth was negative at -1.3% against an industry average of 3.2%, the bank's allowance for bad loans is a healthy 137%, covering its non-performing loan ratio of 1.4%. Trading at approximately 30% below estimated fair value, CRLA seems undervalued yet faces challenges in free cash flow generation and earnings momentum relative to peers, indicating potential areas for improvement or strategic shifts moving forward.

Summing It All Up

- Gain an insight into the universe of 319 European Undiscovered Gems With Strong Fundamentals by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Exmar might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTBR:EXM

Exmar

Engages in the provision of shipping and floating infrastructure solutions worldwide.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives