- Belgium

- /

- Diversified Financial

- /

- ENXTBR:GBLB

Investors Appear Satisfied With Groupe Bruxelles Lambert SA's (EBR:GBLB) Prospects

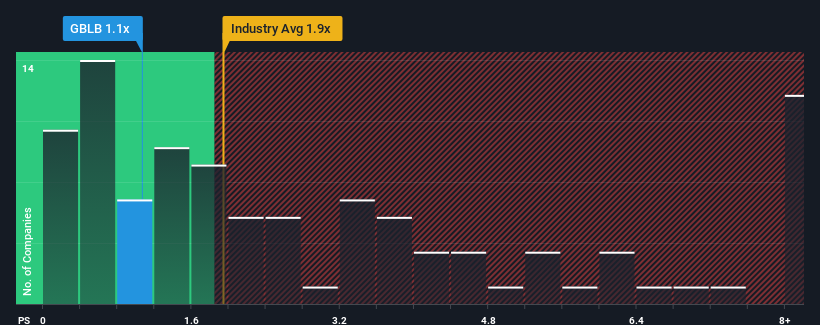

There wouldn't be many who think Groupe Bruxelles Lambert SA's (EBR:GBLB) price-to-sales (or "P/S") ratio of 1.1x is worth a mention when the median P/S for the Diversified Financial industry in Belgium is similar at about 1x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

View our latest analysis for Groupe Bruxelles Lambert

How Groupe Bruxelles Lambert Has Been Performing

With its revenue growth in positive territory compared to the declining revenue of most other companies, Groupe Bruxelles Lambert has been doing quite well of late. Perhaps the market is expecting its current strong performance to taper off in accordance to the rest of the industry, which has kept the P/S contained. Those who are bullish on Groupe Bruxelles Lambert will be hoping that this isn't the case, so that they can pick up the stock at a slightly lower valuation.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Groupe Bruxelles Lambert.Is There Some Revenue Growth Forecasted For Groupe Bruxelles Lambert?

The only time you'd be comfortable seeing a P/S like Groupe Bruxelles Lambert's is when the company's growth is tracking the industry closely.

Taking a look back first, we see that the company managed to grow revenues by a handy 11% last year. The latest three year period has also seen an excellent 50% overall rise in revenue, aided somewhat by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to slump, contracting by 33% during the coming year according to the two analysts following the company. Meanwhile, the industry is forecast to moderate by 33%, which suggests the company won't escape the wider industry forces.

With this in consideration, it's clear to see why Groupe Bruxelles Lambert's P/S stacks up closely with its industry peers. Nonetheless, with revenue going in reverse, it's not guaranteed that the P/S has found a floor yet. Maintaining these prices will be difficult to achieve as the weak outlook is likely to weigh down the shares eventually.

What We Can Learn From Groupe Bruxelles Lambert's P/S?

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As expected, we see that Groupe Bruxelles Lambert maintains its moderate P/S thanks to a revenue outlook that's pretty much level with the wider industry. Right now shareholders are comfortable with the P/S as they are confident future revenue won't throw up any further unpleasant surprises. Although, we are somewhat concerned whether the company can maintain this level of performance under these tough industry conditions. In the meantime, unless the company's prospects change they will continue to support the share price at these levels.

And what about other risks? Every company has them, and we've spotted 1 warning sign for Groupe Bruxelles Lambert you should know about.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTBR:GBLB

Groupe Bruxelles Lambert

Invests in a portfolio of industrial, consumer goods, and business service companies operating in various sectors in Belgium, other European countries, North America, and internationally.

Moderate growth potential low.