- Spain

- /

- Healthcare Services

- /

- BME:CBAV

Top European Dividend Stocks For October 2025

Reviewed by Simply Wall St

As European markets navigate a mixed landscape—buoyed by dovish signals from the U.S. Federal Reserve and tempered by regional economic challenges such as the contraction in eurozone industrial output—investors are increasingly seeking stability through dividend stocks. In this environment, a good dividend stock is typically characterized by consistent payouts and financial resilience, offering potential income even amid fluctuating market conditions.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Zurich Insurance Group (SWX:ZURN) | 4.43% | ★★★★★★ |

| UNIQA Insurance Group (WBAG:UQA) | 4.86% | ★★★★★☆ |

| Scandinavian Tobacco Group (CPSE:STG) | 9.84% | ★★★★★★ |

| Holcim (SWX:HOLN) | 4.70% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 5.18% | ★★★★★★ |

| DKSH Holding (SWX:DKSH) | 4.23% | ★★★★★★ |

| Cembra Money Bank (SWX:CMBN) | 4.72% | ★★★★★★ |

| CaixaBank (BME:CABK) | 6.60% | ★★★★★☆ |

| Bravida Holding (OM:BRAV) | 4.02% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.76% | ★★★★★☆ |

Click here to see the full list of 230 stocks from our Top European Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

Clínica Baviera (BME:CBAV)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Clínica Baviera, S.A. is a medical company that operates a network of ophthalmology clinics across Spain and Europe, with a market cap of €680.43 million.

Operations: Clínica Baviera generates its revenue primarily from its ophthalmology clinics, with a total of €288.92 million.

Dividend Yield: 3.8%

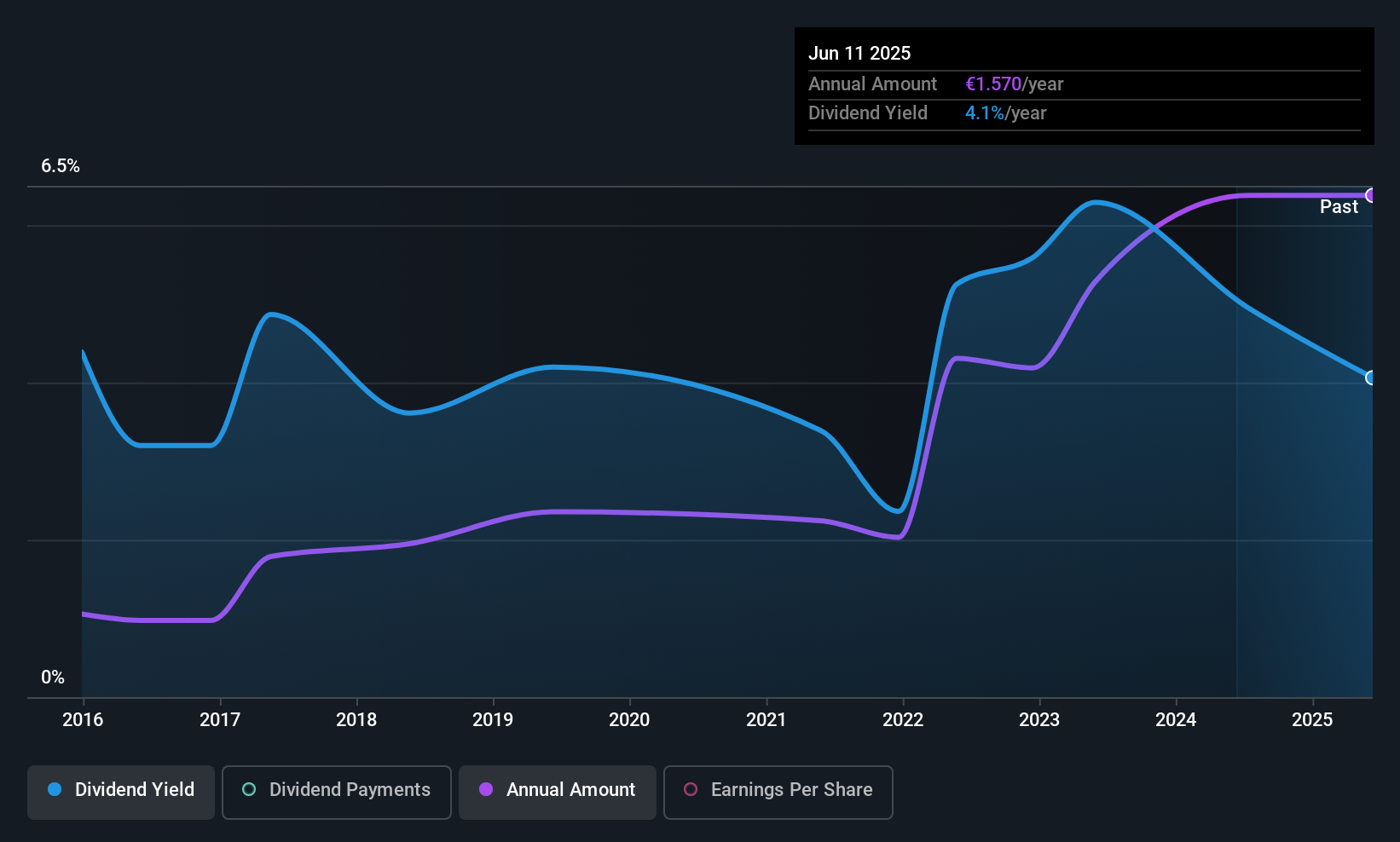

Clínica Baviera's dividend payments are covered by earnings and cash flows, with payout ratios of 62.5% and 61.1%, respectively, indicating sustainability despite a volatile history over the past decade. The recent earnings report showed sales growth to €156.11 million, though net income slightly decreased to €22.32 million compared to the previous year. With a dividend yield of 3.76%, it lags behind top Spanish market payers but offers potential value given its P/E ratio of 17.4x below the market average.

- Click here to discover the nuances of Clínica Baviera with our detailed analytical dividend report.

- Insights from our recent valuation report point to the potential overvaluation of Clínica Baviera shares in the market.

Colruyt Group (ENXTBR:COLR)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Colruyt Group N.V. operates in retail, wholesale, and food service sectors across Belgium, France, and internationally, with a market cap of €3.99 billion.

Operations: Colruyt Group N.V.'s revenue is primarily derived from its Food segment, which generated €10.44 billion, complemented by contributions of €499.60 million from Health & Well-being and Non-food, and €28.80 million from Group Activities, Real Estate, and Energy.

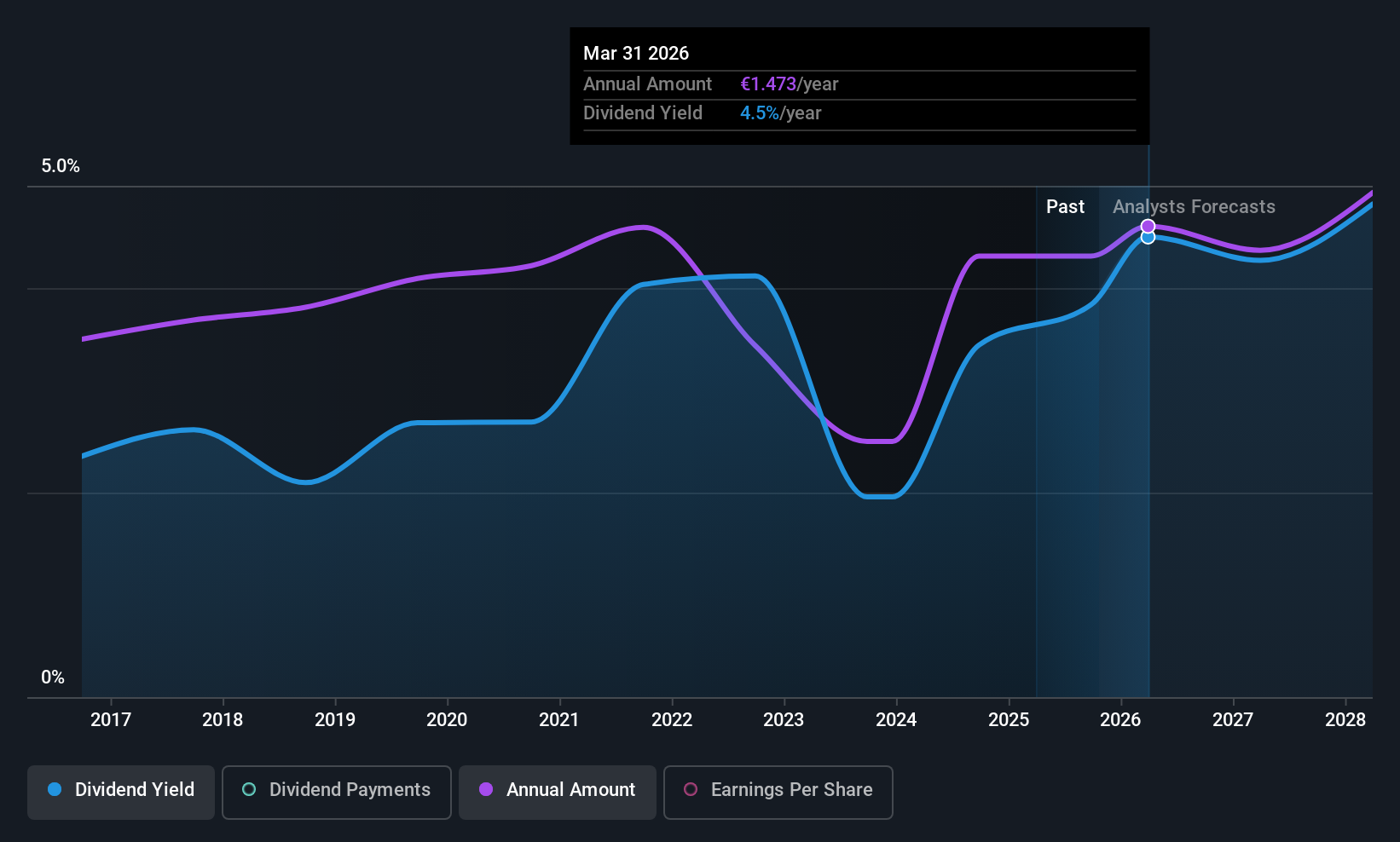

Dividend Yield: 4.2%

Colruyt Group's dividend payments, covered by earnings and cash flows with payout ratios of 50.9% and 64.1%, respectively, suggest sustainability despite a volatile history over the past decade. The recent affirmation of an annual dividend of €0.966 per share highlights its commitment to returning value to shareholders, though its yield remains below Belgium's top tier. Profit margins have declined from last year, but the stock trades significantly below estimated fair value, indicating potential investment appeal amidst reliability concerns.

- Navigate through the intricacies of Colruyt Group with our comprehensive dividend report here.

- The valuation report we've compiled suggests that Colruyt Group's current price could be quite moderate.

Sodexo (ENXTPA:SW)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Sodexo S.A. offers food services and facilities management services globally, with a market cap of €7.98 billion.

Operations: Sodexo S.A. generates its revenue from three main geographical segments: Europe (€8.53 billion), North America (€11.33 billion), and the Rest of the World (€4.31 billion).

Dividend Yield: 4.8%

Sodexo's dividend sustainability is supported by a payout ratio of 57.3% covered by earnings and a cash payout ratio of 58%, yet its dividends have been volatile over the past decade. Trading at a substantial discount to its estimated fair value, it offers potential investment appeal despite yielding below France's top tier. Recent leadership changes, including Thierry Delaporte’s CEO appointment, may influence strategic direction as Sodexo renews significant contracts like with Shell for workplace services.

- Get an in-depth perspective on Sodexo's performance by reading our dividend report here.

- Insights from our recent valuation report point to the potential undervaluation of Sodexo shares in the market.

Taking Advantage

- Take a closer look at our Top European Dividend Stocks list of 230 companies by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BME:CBAV

Clínica Baviera

A medical company, operates a network of ophthalmology clinics in Spain and Europe.

Adequate balance sheet average dividend payer.

Market Insights

Community Narratives