As global markets navigate the complexities of tariff uncertainties and shifting economic indicators, investors are keenly observing how these factors influence major indices and sectors. With U.S. stocks experiencing slight declines amid trade tensions and mixed economic data, dividend stocks continue to attract attention for their potential to provide steady income streams in uncertain times. In this environment, a good dividend stock often combines a history of reliable payouts with a strong financial foundation that can weather market volatility.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 5.83% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.54% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.88% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.33% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.55% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.12% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 3.90% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.20% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.84% | ★★★★★★ |

| Archer-Daniels-Midland (NYSE:ADM) | 4.46% | ★★★★★★ |

Click here to see the full list of 1966 stocks from our Top Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

Colruyt Group (ENXTBR:COLR)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Colruyt Group N.V. operates in retail, wholesale, food service, and other activities across Belgium, France, and internationally with a market cap of €4.51 billion.

Operations: Colruyt Group N.V. generates revenue through its operations in retail, wholesale, and food service sectors across Belgium, France, and international markets.

Dividend Yield: 3.7%

Colruyt Group's dividend yield of 3.74% is below the top 25% of Belgian dividend payers. Despite a payout ratio indicating dividends are covered by earnings and cash flows, the company's dividend history has been unreliable and volatile over the past decade. Recent results show a decline in net income to €193.9 million for H1 2024 from €897 million the previous year, affecting profit margins which fell to 3.3%.

- Unlock comprehensive insights into our analysis of Colruyt Group stock in this dividend report.

- Our valuation report here indicates Colruyt Group may be undervalued.

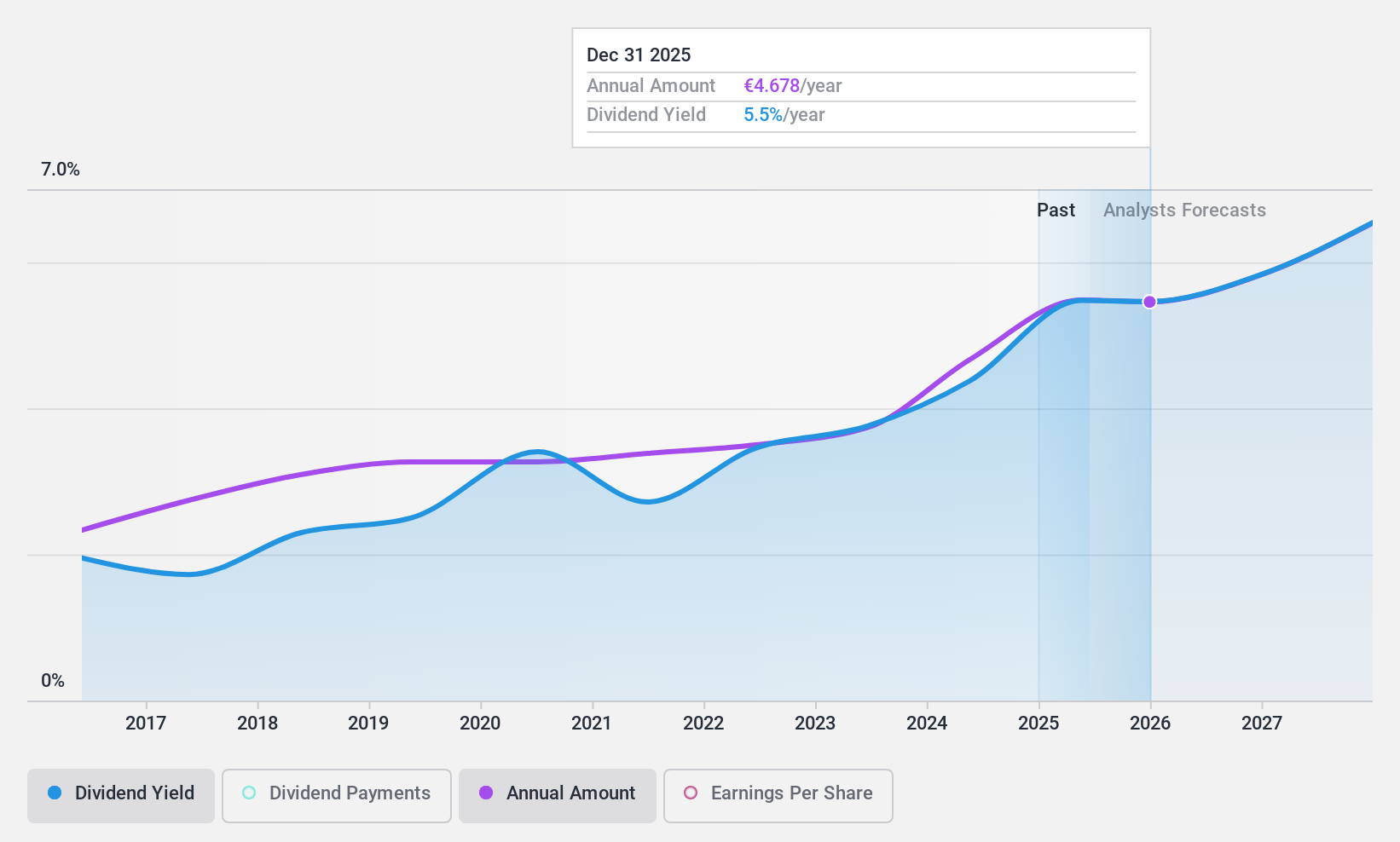

Wendel (ENXTPA:MF)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Wendel is a private equity firm that focuses on equity financing in middle markets and later stages through leveraged buy-outs, transactions, and acquisitions, with a market cap of €4.09 billion.

Operations: Wendel's revenue segments include Bureau Veritas with €5.99 billion, Stahl at €935.20 million, CPI contributing €136 million, and ACAMS providing €93.60 million.

Dividend Yield: 4.1%

Wendel's dividend yield of 4.11% is below the top 25% in France, and while dividends have been stable and growing over the past decade, they are not well covered by earnings due to unprofitability. However, a low cash payout ratio of 14.2% suggests dividends are supported by cash flows. Trading at a discount to fair value with expectations for price appreciation could appeal to investors seeking growth alongside income stability.

- Get an in-depth perspective on Wendel's performance by reading our dividend report here.

- Insights from our recent valuation report point to the potential undervaluation of Wendel shares in the market.

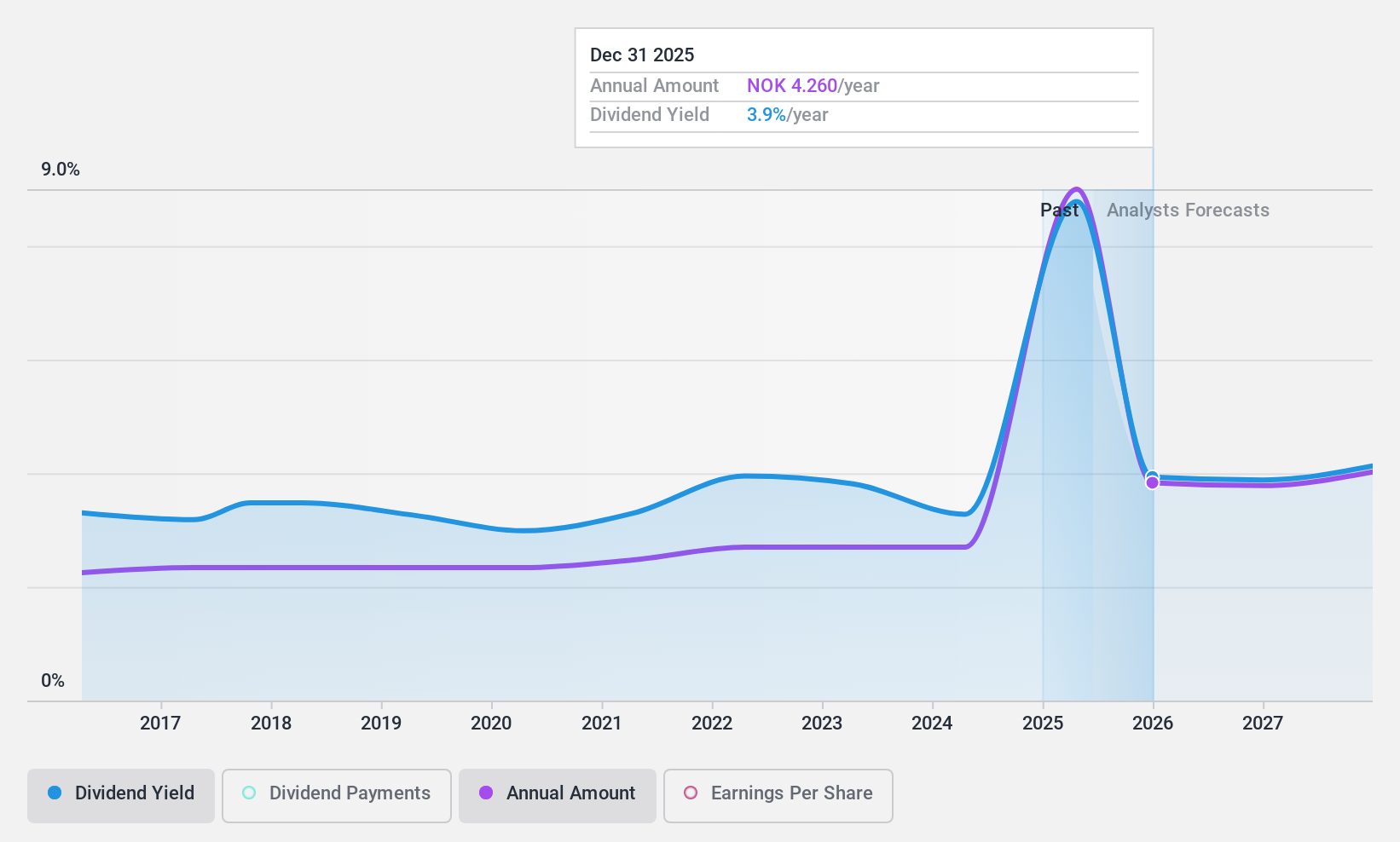

Orkla (OB:ORK)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Orkla ASA operates in branded consumer goods and industrial and financial investment sectors, with a market cap of NOK108.28 billion.

Operations: Orkla ASA's revenue segments include Branded Consumer Goods at NOK53.87 billion and Industrial & Financial Investments at NOK2.45 billion.

Dividend Yield: 9.3%

Orkla's dividend yield of 9.3% ranks in the top 25% of Norwegian payers, but is not well covered by free cash flows due to a high cash payout ratio of 130%, despite being covered by earnings with a 65.9% payout ratio. Dividends have been stable and growing over the past decade, enhancing reliability for income-focused investors. Recent discussions about selling its Indian businesses for $1.4 billion could impact future financial strategies and dividend sustainability.

- Click here to discover the nuances of Orkla with our detailed analytical dividend report.

- The valuation report we've compiled suggests that Orkla's current price could be inflated.

Where To Now?

- Discover the full array of 1966 Top Dividend Stocks right here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:ORK

Orkla

Operates as an industrial investment company within brands and consumer-oriented businesses in Norway, Sweden, Denmark, Finland, Iceland, the Baltics, rest of Europe, and internationally.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives