Recticel (EBR:RECT) Full Year 2024 Results

Key Financial Results

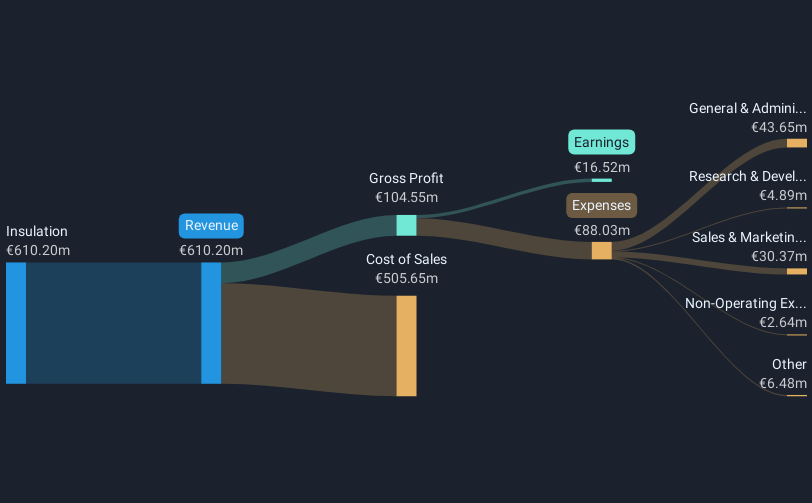

- Revenue: €610.2m (up 15% from FY 2023).

- Net income: €16.5m (up from €8.84m loss in FY 2023).

- Profit margin: 2.7% (up from net loss in FY 2023).

- EPS: €0.29 (up from €0.16 loss in FY 2023).

All figures shown in the chart above are for the trailing 12 month (TTM) period

Recticel Revenues and Earnings Beat Expectations

Revenue exceeded analyst estimates by 1.3%. Earnings per share (EPS) also surpassed analyst estimates by 3.2%.

In the last 12 months, the only revenue segment was Insulation contributing €610.2m. Notably, cost of sales worth €505.6m amounted to 83% of total revenue thereby underscoring the impact on earnings. The largest operating expense was General & Administrative costs, amounting to €43.6m (50% of total expenses). Explore how RECT's revenue and expenses shape its earnings.

Looking ahead, revenue is forecast to grow 7.9% p.a. on average during the next 3 years, compared to a 5.0% growth forecast for the Building industry in Europe.

Performance of the market in Belgium.

The company's shares are up 4.3% from a week ago.

Risk Analysis

We don't want to rain on the parade too much, but we did also find 2 warning signs for Recticel (1 is concerning!) that you need to be mindful of.

If you're looking to trade Recticel, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTBR:RECT

Recticel

An insulation company, offers thermal and thermo-acoustic solutions in Belgium, France, the Netherlands, Germany, Slovenia, other European Union countries, the United Kingdom, the United States, and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives