- Belgium

- /

- Electrical

- /

- ENXTBR:ENRGY

European Growth Stocks With High Insider Stakes

Reviewed by Simply Wall St

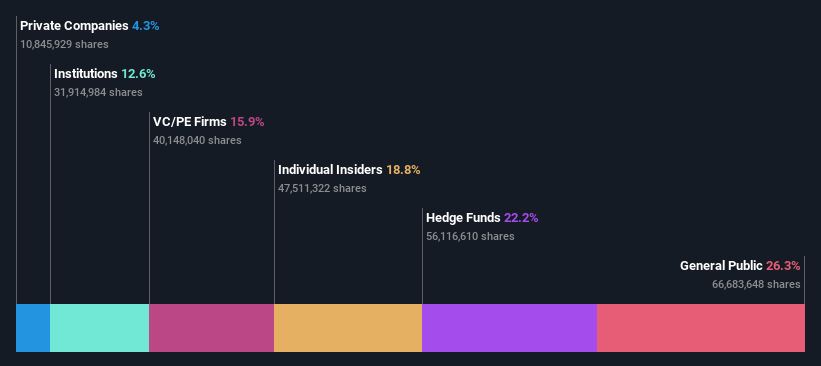

As European markets show resilience with the STOXX Europe 600 Index rising by 2.35%, investors are keenly observing inflation trends and fiscal policies that could shape economic stability in the region. In this context, growth companies with high insider ownership can be particularly appealing, as they often signal strong confidence from those closest to the business and may offer potential for robust performance amid evolving market conditions.

Top 10 Growth Companies With High Insider Ownership In Europe

| Name | Insider Ownership | Earnings Growth |

| Pharma Mar (BME:PHM) | 12% | 41.5% |

| MilDef Group (OM:MILDEF) | 13.7% | 83% |

| MedinCell (ENXTPA:MEDCL) | 12.5% | 96.3% |

| KebNi (OM:KEBNI B) | 36.3% | 61.2% |

| Elliptic Laboratories (OB:ELABS) | 22.5% | 109.1% |

| DNO (OB:DNO) | 13.5% | 97.5% |

| CTT Systems (OM:CTT) | 17.5% | 52% |

| Circus (XTRA:CA1) | 24.1% | 65.8% |

| CD Projekt (WSE:CDR) | 29.7% | 52.1% |

| Bonesupport Holding (OM:BONEX) | 10.4% | 49.7% |

Here we highlight a subset of our preferred stocks from the screener.

Trifork Group (CPSE:TRIFOR)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Trifork Group AG is a company that offers information technology and business services across Switzerland, Denmark, the United Kingdom, the Netherlands, the United States, and other international markets with a market cap of DKK1.64 billion.

Operations: The company's revenue segments consist of Trifork - Run at €66.35 million, Trifork - Build at €144.97 million, and Trifork - Inspire at €6.66 million.

Insider Ownership: 21%

Earnings Growth Forecast: 21.5% p.a.

Trifork Group stands out for its strategic alliances and growth potential, despite recent insider selling. The company has partnered with Loft Dynamics to develop LoftHOME, an innovative pilot training solution, and acquired a stake in Replik A/S to enhance AI-driven legal services. Trifork's revenue is forecasted to grow at 6.8% annually, outpacing the Danish market, while earnings are expected to rise significantly by 21.5% per year. Recent financial guidance indicates solid growth expectations for 2025.

- Click here and access our complete growth analysis report to understand the dynamics of Trifork Group.

- Our valuation report here indicates Trifork Group may be undervalued.

EnergyVision (ENXTBR:ENRGY)

Simply Wall St Growth Rating: ★★★★★☆

Overview: EnergyVision NV is a Belgian company offering solar energy and mobility-as-a-service solutions to both corporate and residential clients, with a market cap of €604.88 million.

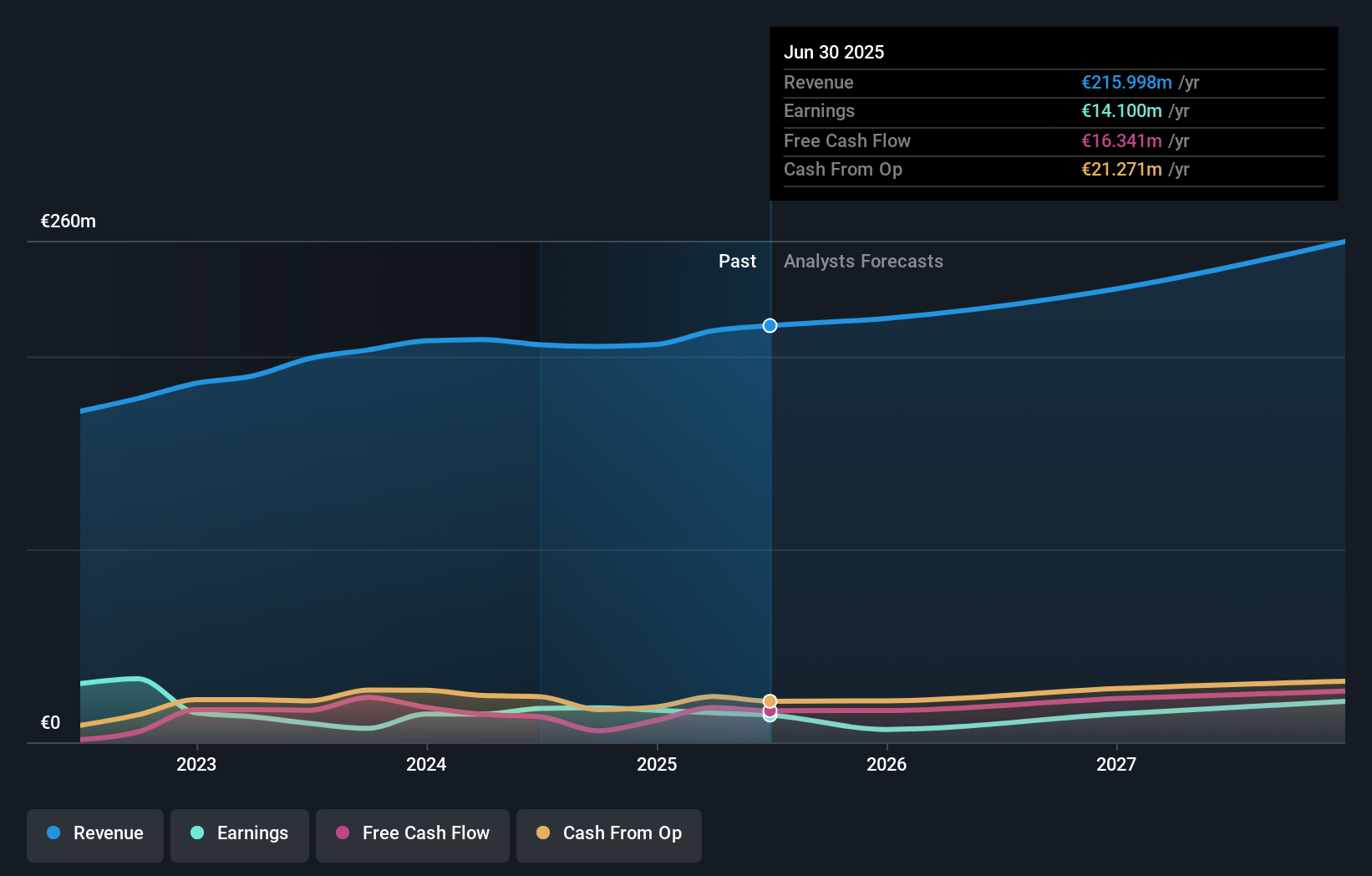

Operations: The company's revenue is primarily derived from EPC Activity (€75.84 million), Non-Asset-Based Energy (€23.49 million), Asset-Based Energy (€16.25 million), and Asset-Based Mobility (€5.07 million).

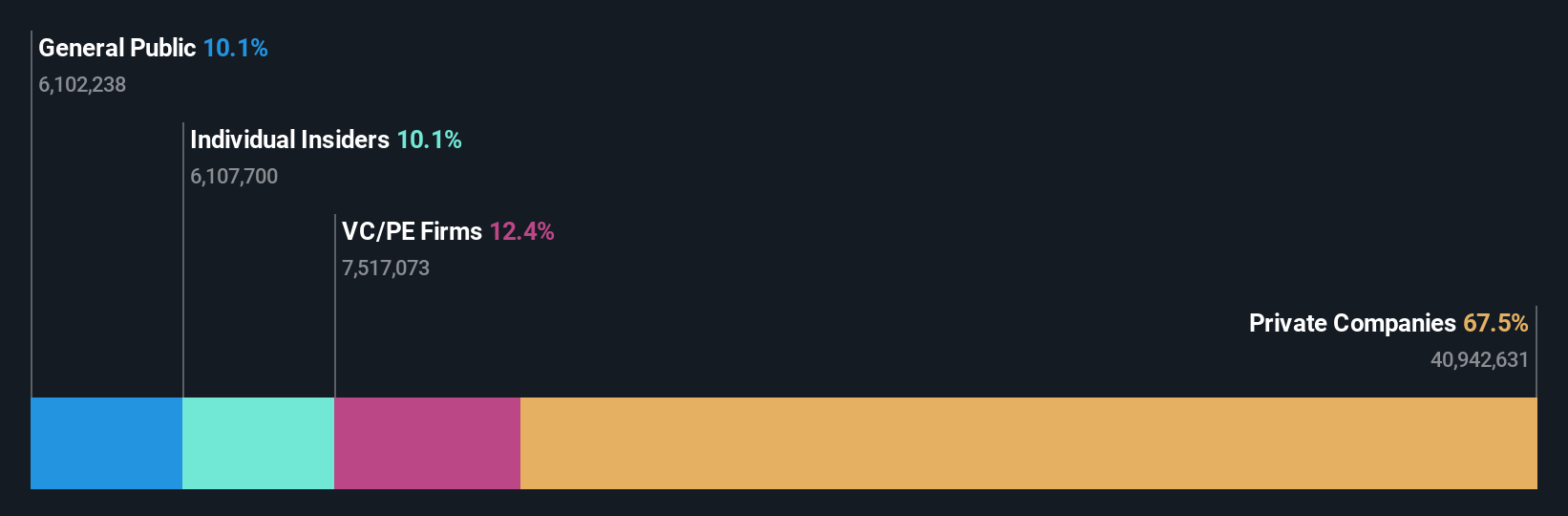

Insider Ownership: 10.1%

Earnings Growth Forecast: 40.7% p.a.

EnergyVision's recent earnings report highlights strong growth, with revenue rising to €62.7 million and net income increasing to €4.45 million for the half year ended June 30, 2025. The company's earnings are projected to grow significantly at 40.7% annually, outpacing the Belgian market's average growth rate. Despite this promising outlook, EnergyVision carries a high level of debt and has no recent insider trading activity reported over the past three months.

- Click to explore a detailed breakdown of our findings in EnergyVision's earnings growth report.

- Our valuation report here indicates EnergyVision may be overvalued.

ITAB Shop Concept (OM:ITAB)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: ITAB Shop Concept AB (publ) is involved in the development, manufacturing, sales, and installation of store concepts for retail chain stores, with a market cap of SEK4.60 billion.

Operations: The company generates revenue of SEK11.13 billion from its Furniture & Fixtures segment.

Insider Ownership: 11.7%

Earnings Growth Forecast: 56.7% p.a.

ITAB Shop Concept is experiencing substantial growth, with earnings forecasted to rise significantly at 56.7% annually, surpassing the Swedish market's average. Despite a recent dip in profit margins and insider selling activity, ITAB's strategic initiatives—such as its large-scale loss prevention solutions in Australia and self-checkout units across Europe—are bolstering revenue prospects. The company's stock trades well below estimated fair value, with analysts anticipating a significant price increase. However, debt coverage remains a concern.

- Navigate through the intricacies of ITAB Shop Concept with our comprehensive analyst estimates report here.

- In light of our recent valuation report, it seems possible that ITAB Shop Concept is trading behind its estimated value.

Next Steps

- Access the full spectrum of 204 Fast Growing European Companies With High Insider Ownership by clicking on this link.

- Contemplating Other Strategies? The end of cancer? These 29 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if EnergyVision might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTBR:ENRGY

EnergyVision

Operates as a B2B and B2C provider of solar energy and mobility-as-a-service solutions for both corporate and residential clients in Belgium.

High growth potential with solid track record.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Moving from "Science Fiction" to "Science Fact" – A Bullish Valuation Case

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026