- Belgium

- /

- Construction

- /

- ENXTBR:CFEB

Compagnie d'Entreprises CFE's (EBR:CFEB) earnings trajectory could turn positive as the stock rallies 12% this past week

While not a mind-blowing move, it is good to see that the Compagnie d'Entreprises CFE SA (EBR:CFEB) share price has gained 29% in the last three months. But will that heal all the wounds inflicted over 5 years of declines? Unlikely. In fact, the share price has tumbled down a mountain to land 83% lower after that period. It's true that the recent bounce could signal the company is turning over a new leaf, but we are not so sure. The important question is if the business itself justifies a higher share price in the long term. While a drop like that is definitely a body blow, money isn't as important as health and happiness.

The recent uptick of 12% could be a positive sign of things to come, so let's take a look at historical fundamentals.

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

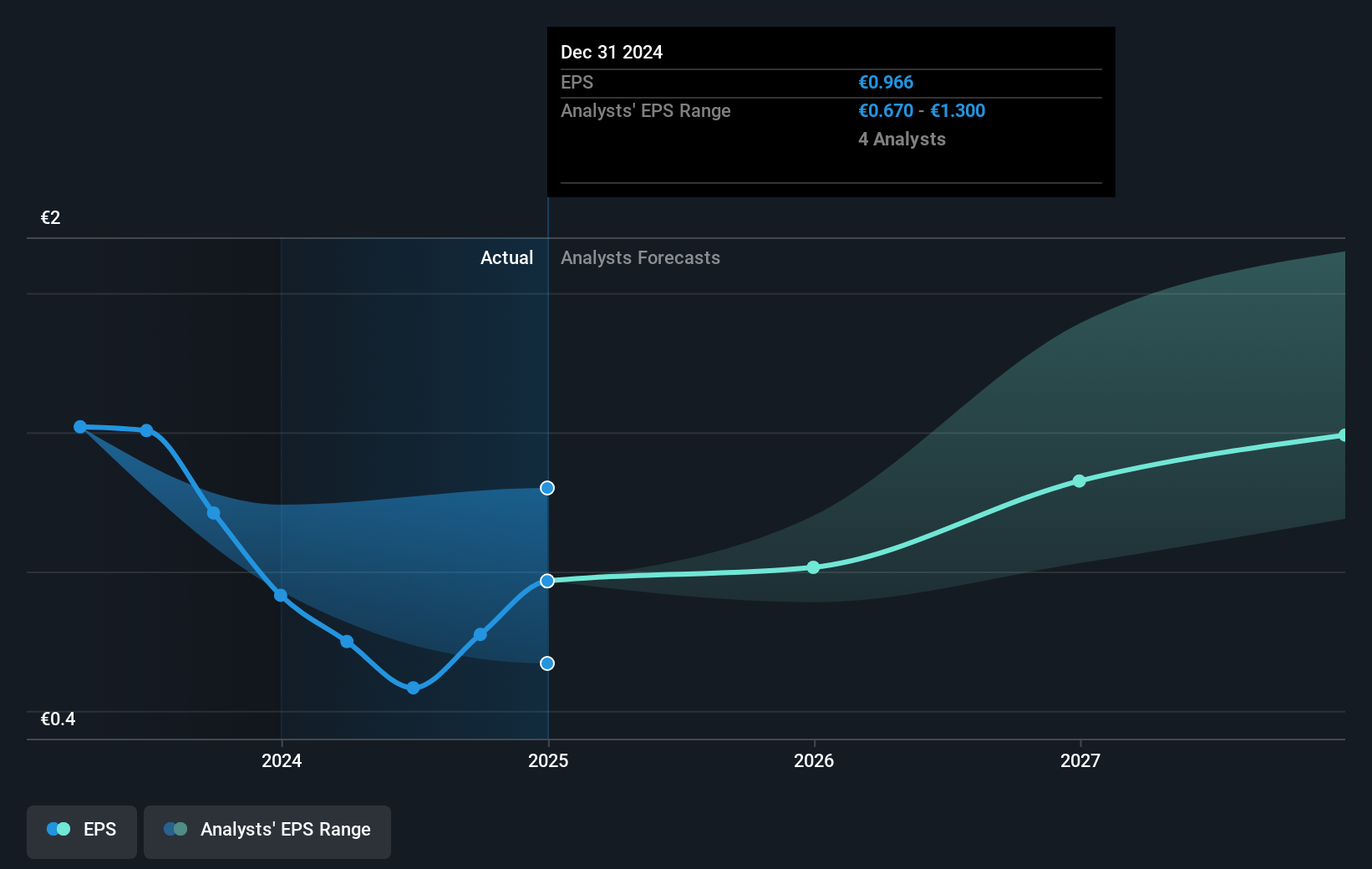

During the five years over which the share price declined, Compagnie d'Entreprises CFE's earnings per share (EPS) dropped by 29% each year. In this case, the EPS change is really very close to the share price drop of 30% a year. That suggests that the market sentiment around the company hasn't changed much over that time. Rather, the share price change has reflected changes in earnings per share.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

This free interactive report on Compagnie d'Entreprises CFE's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

A Different Perspective

It's nice to see that Compagnie d'Entreprises CFE shareholders have received a total shareholder return of 38% over the last year. Of course, that includes the dividend. That certainly beats the loss of about 13% per year over the last half decade. The long term loss makes us cautious, but the short term TSR gain certainly hints at a brighter future. It's always interesting to track share price performance over the longer term. But to understand Compagnie d'Entreprises CFE better, we need to consider many other factors. To that end, you should be aware of the 1 warning sign we've spotted with Compagnie d'Entreprises CFE .

Of course Compagnie d'Entreprises CFE may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Belgian exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTBR:CFEB

Compagnie d'Entreprises CFE

Engages in the real estate, multitechnics, construction and renovation, and sustainable investment businesses in Belgium, Poland, Luxembourg, and internationally.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives