Is It Too Late To Consider KBC Ancora After Its 52% Share Price Surge?

Reviewed by Bailey Pemberton

- Wondering if KBC Ancora is still a smart buy after its big run up, or if you are turning up late to the party? This breakdown will help you decide whether the current price really makes sense.

- The share price has climbed an impressive 51.9% over the last year and 169.6% over five years, even after a recent 2.1% slip over the past week and a 2.9% gain in the last month.

- Much of this move has been driven by shifting sentiment toward European financials and holding companies that give leveraged exposure to KBC Group, alongside ongoing debates about discount to net asset value and capital allocation. For KBC Ancora specifically, investors have been reacting to changes in the broader rate environment and evolving expectations around dividends. All of these factors feed directly into how the market thinks about its long term value.

- Right now, KBC Ancora scores just 2 out of 6 on our valuation checks, which means it only screens as undervalued on a couple of metrics. In what follows we will walk through those traditional valuation lenses and then finish with a more holistic way to think about what the stock might really be worth.

KBC Ancora scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: KBC Ancora Excess Returns Analysis

The Excess Returns model looks at how much profit a company can earn above the return that investors demand on its equity, and then projects how long those super normal returns can persist.

For KBC Ancora, the analysis starts with a Book Value of €45.82 per share and a Stable EPS estimate of €4.77 per share, based on the median return on equity from the past 5 years. That historical performance translates into an Average Return on Equity of 10.51%, compared with a Cost of Equity of €2.79 per share. The difference between what the business earns and what investors require is the Excess Return, estimated at €1.97 per share.

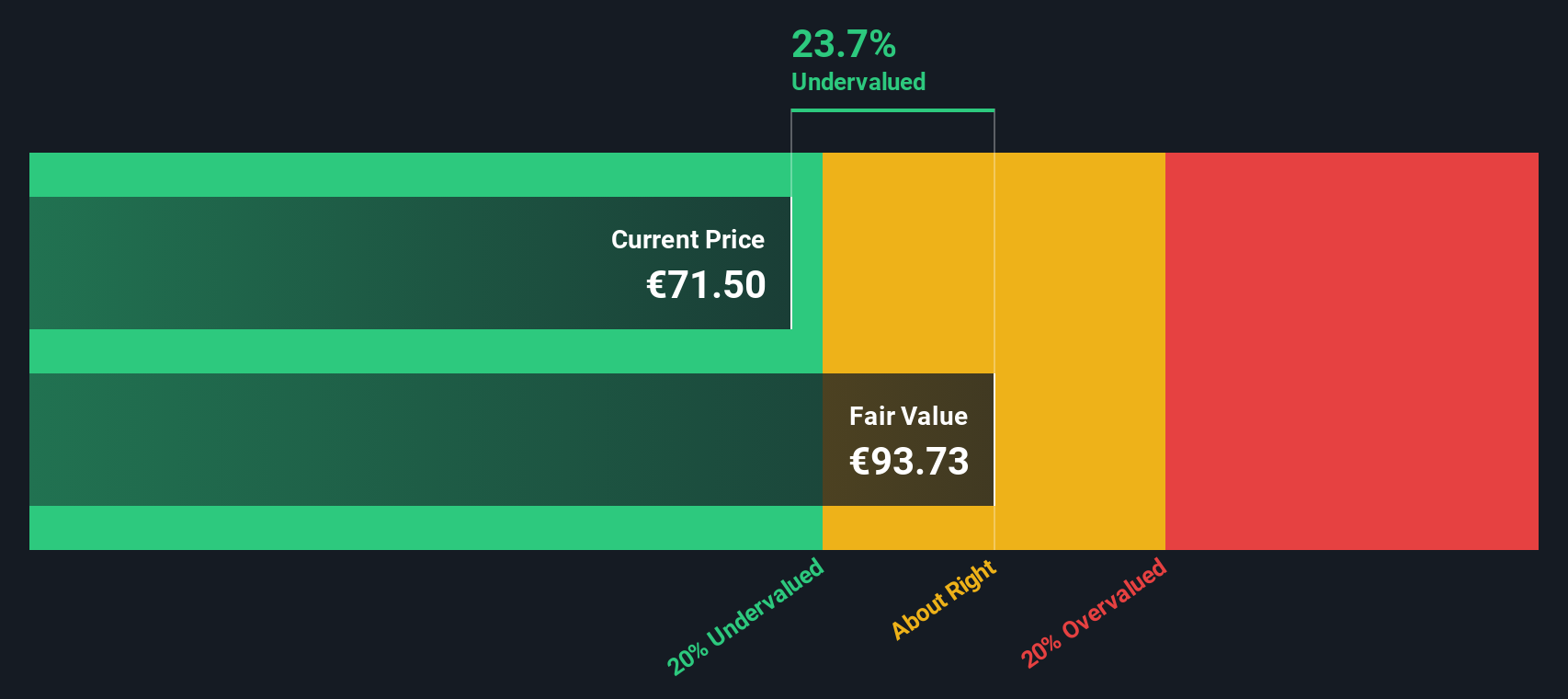

Using a Stable Book Value of €45.35 per share, the model capitalises those excess returns to arrive at an intrinsic value of about €93.73 per share. Against the current market price, this implies the stock is roughly 25.1% undervalued. This suggests investors are not fully pricing in its ability to keep generating attractive returns on equity.

Result: UNDERVALUED

Our Excess Returns analysis suggests KBC Ancora is undervalued by 25.1%. Track this in your watchlist or portfolio, or discover 925 more undervalued stocks based on cash flows.

Approach 2: KBC Ancora Price vs Earnings

For consistently profitable companies, the price to earnings (PE) ratio is a useful way to gauge how much investors are paying for each euro of current earnings. It captures both what the business is earning today and what the market expects those earnings to do over time, which makes it especially relevant for financials like KBC Ancora.

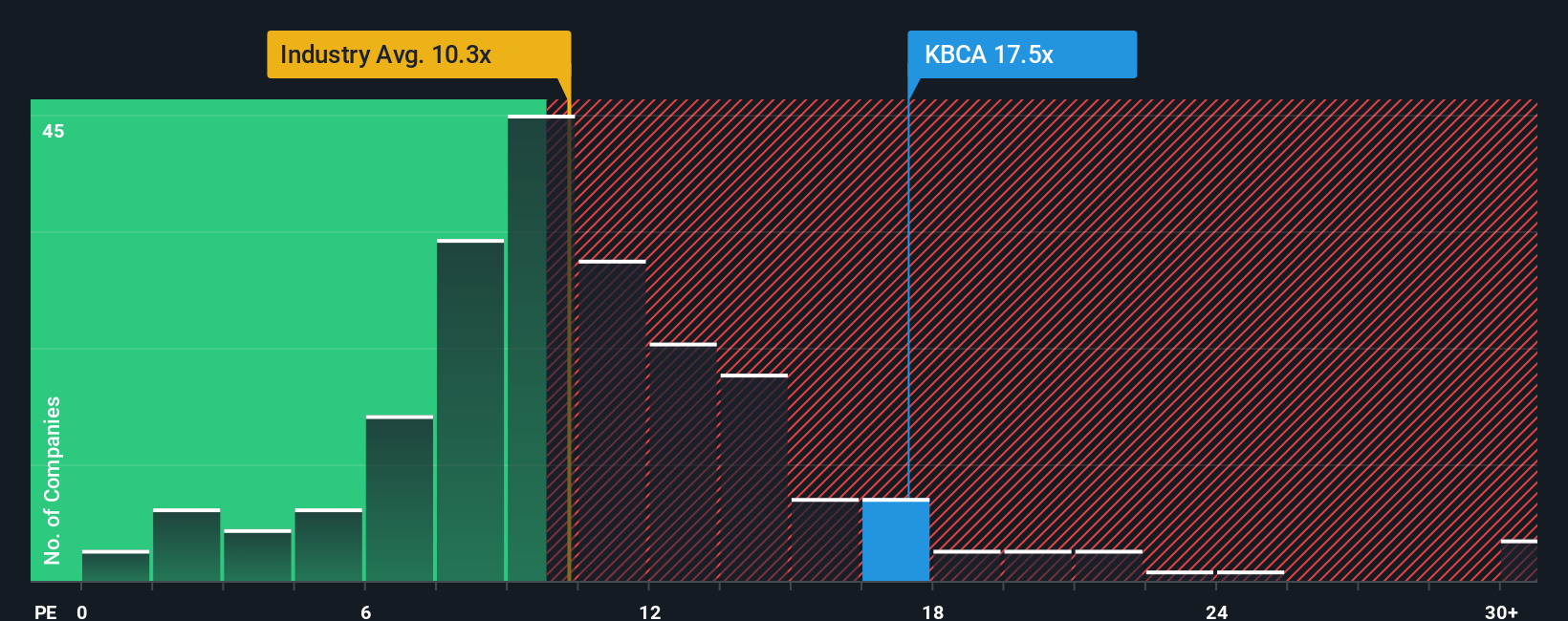

In practice, higher expected earnings growth and lower perceived risk usually justify a higher, or more generous, PE multiple, while slower growth or higher uncertainty call for a lower one. KBC Ancora currently trades on a PE of 17.14x, which is well above both the European banks industry average of about 10.51x and the peer group average of roughly 9.95x. This suggests investors are already pricing in a premium for its earnings profile.

Simply Wall St’s Fair Ratio framework estimates what PE multiple a stock should trade on, given its growth outlook, profitability, industry, market cap and specific risks. This makes it more tailored than a simple comparison with peers or the sector, which can overlook important differences in quality or risk. For KBC Ancora, the Fair Ratio comes out at 13.57x, notably below the current 17.14x. This points to a market valuation that is running ahead of fundamentals.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1441 companies where insiders are betting big on explosive growth.

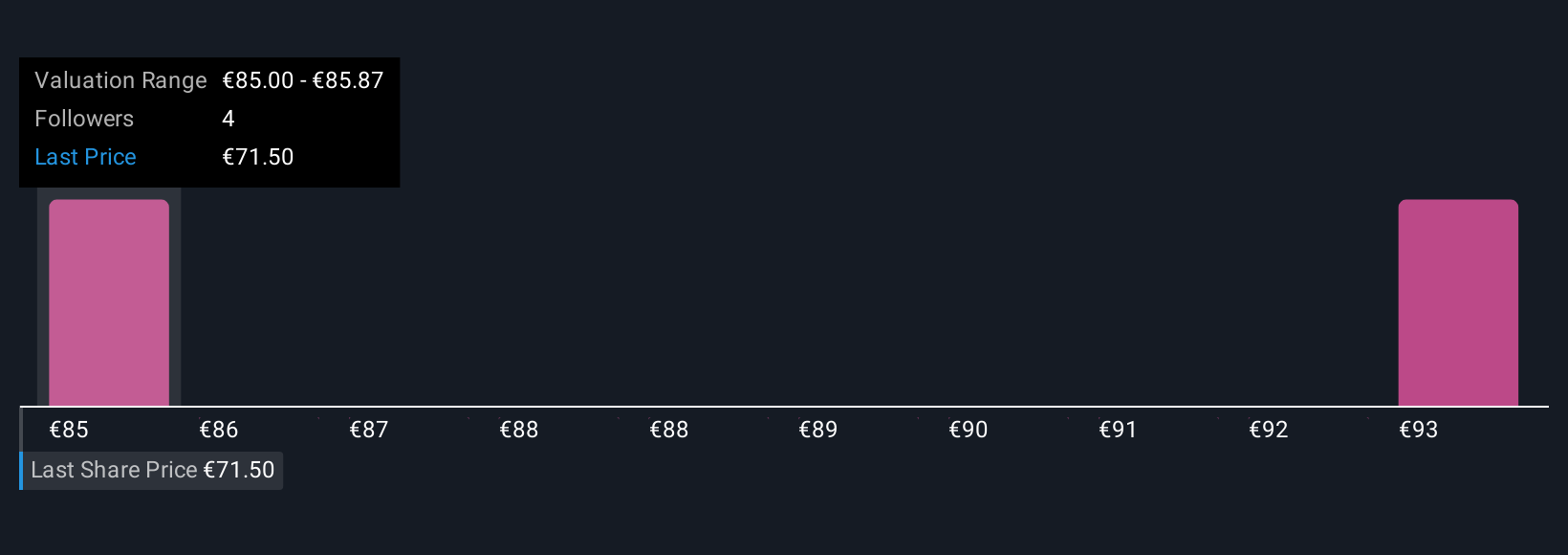

Upgrade Your Decision Making: Choose your KBC Ancora Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives, a simple framework that lets you attach a clear story to your numbers by linking your view of a company's future revenue, earnings and margins to a specific fair value estimate. A Narrative is your own investment storyline, where you spell out what you think will drive KBC Ancora's business, translate that view into a financial forecast, and then into a fair value that you can compare directly with today's share price. On Simply Wall St's Community page, used by millions of investors, Narratives are easy to create, browse and adapt, helping you see whether your assumptions suggest KBC Ancora is a buy, a hold or a sell as its price moves. Because Narratives update dynamically when new information like earnings, dividends or regulatory news appears, they stay relevant instead of going stale. For example, one KBC Ancora Narrative might assume very strong dividend growth and a higher fair value, while another might build in slower growth and a lower fair value, leading to very different decisions about whether to buy or trim the position.

Do you think there's more to the story for KBC Ancora? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if KBC Ancora might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTBR:KBCA

KBC Ancora

Engages in the maintenance and management of its participating interest in KBC Group SA.

Second-rate dividend payer and slightly overvalued.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026