The KBC Group (EBR:KBC) Share Price Is Down 27% So Some Shareholders Are Getting Worried

Investors are understandably disappointed when a stock they own declines in value. But no-one can make money on every call, especially in a declining market. The KBC Group NV (EBR:KBC) is down 27% over three years, but the total shareholder return is -22% once you include the dividend. And that total return actually beats the market decline of 26%. On top of that, the share price is down 5.4% in the last week. But this could be related to the soft market, which is down about 4.1% in the same period.

View our latest analysis for KBC Group

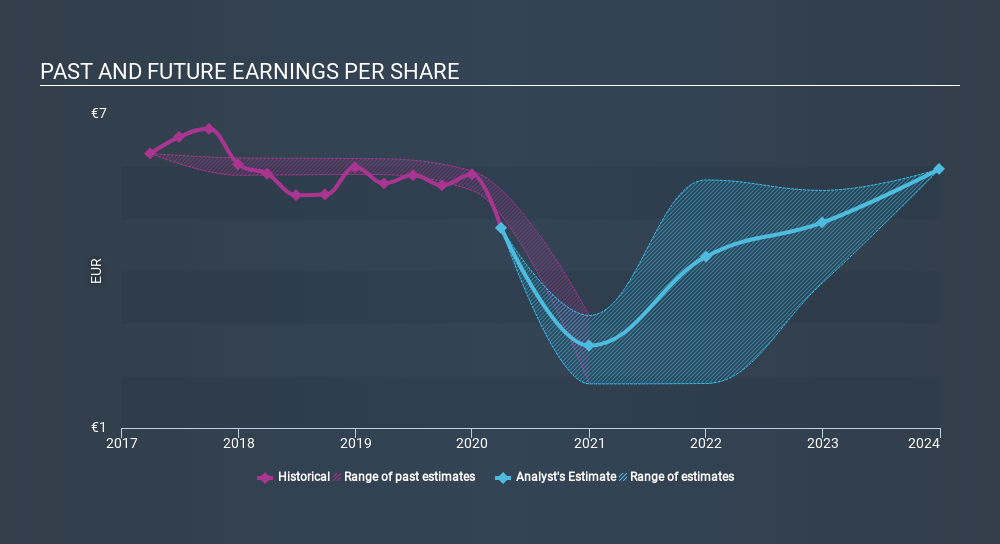

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

KBC Group saw its EPS decline at a compound rate of 8.3% per year, over the last three years. This fall in EPS isn't far from the rate of share price decline, which was 10% per year. So it seems like sentiment towards the stock hasn't changed all that much over time. It seems like the share price is reflecting the declining earnings per share.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

Dive deeper into KBC Group's key metrics by checking this interactive graph of KBC Group's earnings, revenue and cash flow.

What about the Total Shareholder Return (TSR)?

We've already covered KBC Group's share price action, but we should also mention its total shareholder return (TSR). Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. KBC Group's TSR of was a loss of 22% for the 3 years. That wasn't as bad as its share price return, because it has paid dividends.

A Different Perspective

While it's certainly disappointing to see that KBC Group shares lost 14% throughout the year, that wasn't as bad as the market loss of 18%. Given the total loss of 1.2% per year over five years, it seems returns have deteriorated in the last twelve months. While some investors do well specializing in buying companies that are struggling (but nonetheless undervalued), don't forget that Buffett said that 'turnarounds seldom turn'. Is KBC Group cheap compared to other companies? These 3 valuation measures might help you decide.

Of course KBC Group may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on BE exchanges.

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.

About ENXTBR:KBC

KBC Group

Provides banking, insurance, and asset management services primarily for retail, private banking, small and medium sized enterprises, and mid-cap clients in Belgium, Bulgaria, the Czech Republic, Hungary, and Slovakia.

Solid track record with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives