- Australia

- /

- Electric Utilities

- /

- ASX:LPE

If EPS Growth Is Important To You, Locality Planning Energy Holdings (ASX:LPE) Presents An Opportunity

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

In contrast to all that, many investors prefer to focus on companies like Locality Planning Energy Holdings (ASX:LPE), which has not only revenues, but also profits. While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

See our latest analysis for Locality Planning Energy Holdings

How Fast Is Locality Planning Energy Holdings Growing Its Earnings Per Share?

In the last three years Locality Planning Energy Holdings' earnings per share took off; so much so that it's a bit disingenuous to use these figures to try and deduce long term estimates. So it would be better to isolate the growth rate over the last year for our analysis. Outstandingly, Locality Planning Energy Holdings' EPS shot from AU$0.015 to AU$0.034, over the last year. It's not often a company can achieve year-on-year growth of 130%. Shareholders will be hopeful that this is a sign of the company reaching an inflection point.

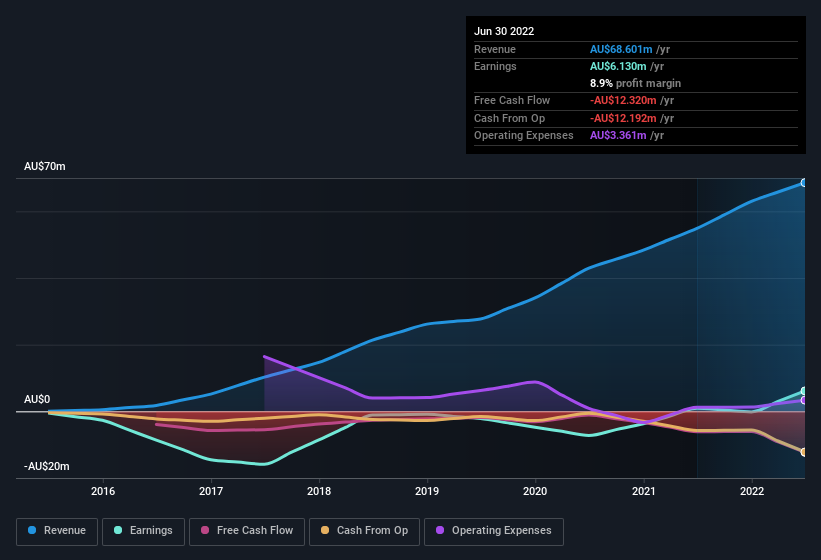

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. Locality Planning Energy Holdings shareholders can take confidence from the fact that EBIT margins are up from 4.5% to 13%, and revenue is growing. Ticking those two boxes is a good sign of growth, in our book.

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

Locality Planning Energy Holdings isn't a huge company, given its market capitalisation of AU$9.3m. That makes it extra important to check on its balance sheet strength.

Are Locality Planning Energy Holdings Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. Because often, the purchase of stock is a sign that the buyer views it as undervalued. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

It's good to see Locality Planning Energy Holdings insiders walking the walk, by spending AU$827k on shares in just twelve months. And when you consider that there was no insider selling, you can understand why shareholders might believe that there are brighter days ahead. We also note that it was the company insider, Simons Brooklyn, who made the biggest single acquisition, paying AU$169k for shares at about AU$0.059 each.

On top of the insider buying, we can also see that Locality Planning Energy Holdings insiders own a large chunk of the company. Owning 36% of the company, insiders have plenty riding on the performance of the the share price. Those who are comforted by solid insider ownership like this should be happy, as it implies that those running the business are genuinely motivated to create shareholder value. Valued at only AU$9.3m Locality Planning Energy Holdings is really small for a listed company. So despite a large proportional holding, insiders only have AU$3.3m worth of stock. That might not be a huge sum but it should be enough to keep insiders motivated!

Is Locality Planning Energy Holdings Worth Keeping An Eye On?

Locality Planning Energy Holdings' earnings have taken off in quite an impressive fashion. What's more, insiders own a significant stake in the company and have been buying more shares. This quick rundown suggests that the business may be of good quality, and also at an inflection point, so maybe Locality Planning Energy Holdings deserves timely attention. Even so, be aware that Locality Planning Energy Holdings is showing 5 warning signs in our investment analysis , and 3 of those are significant...

The good news is that Locality Planning Energy Holdings is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:LPE

Locality Planning Energy Holdings

Provides energy solutions throughout Queensland and Northern New South Wales.

Flawless balance sheet and good value.

Market Insights

Community Narratives