- Australia

- /

- Gas Utilities

- /

- ASX:APA

APA Group (ASX:APA) Valuation After Brigalow Peaking Power Plant Deal With CS Energy

Reviewed by Simply Wall St

APA Group (ASX:APA) has drawn fresh attention after signing a joint development agreement with CS Energy to lead and own 80% of the proposed 400MW Brigalow Peaking Power Plant in Queensland.

See our latest analysis for APA Group.

The Brigalow announcement lands after a busy stretch for APA, including the sale of its Networks business. It comes with the share price at A$9.29 after a robust year to date share price return of 32.34 percent and a strong 1 year total shareholder return of 40.33 percent, suggesting momentum is building as investors reassess its growth pipeline rather than just its defensive income profile.

If this kind of infrastructure story has you thinking about what else could quietly reshape your portfolio, it might be worth exploring fast growing stocks with high insider ownership.

With the shares trading above consensus targets but a discounted view on intrinsic value and faster growth now in sight, is APA still flying under the radar, or is the market already baking in the next leg of expansion?

Most Popular Narrative: 6.6% Overvalued

Compared to APA Group’s last close at A$9.29, the most popular narrative pegs fair value slightly lower, setting up a tight valuation gap built on ambitious profit upgrades.

The analysts have a consensus price target of A$8.718 for APA Group based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of A$9.3, and the most bearish reporting a price target of just A$7.7.

Curious how modest revenue growth assumptions can still support a punchy valuation upgrade, powered by a dramatic profit margin reset and richer future earnings multiple expectations? The full narrative unpacks the precise growth runway, profitability lift, and discount rate behind that fair value line, but only if you are ready to see how much has to go right.

Result: Fair Value of A$8.72 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, escalating climate regulation or faster renewable adoption could compress gas pipeline demand and margins, forcing APA to reprice growth and capital allocation assumptions.

Find out about the key risks to this APA Group narrative.

Another Lens on Value

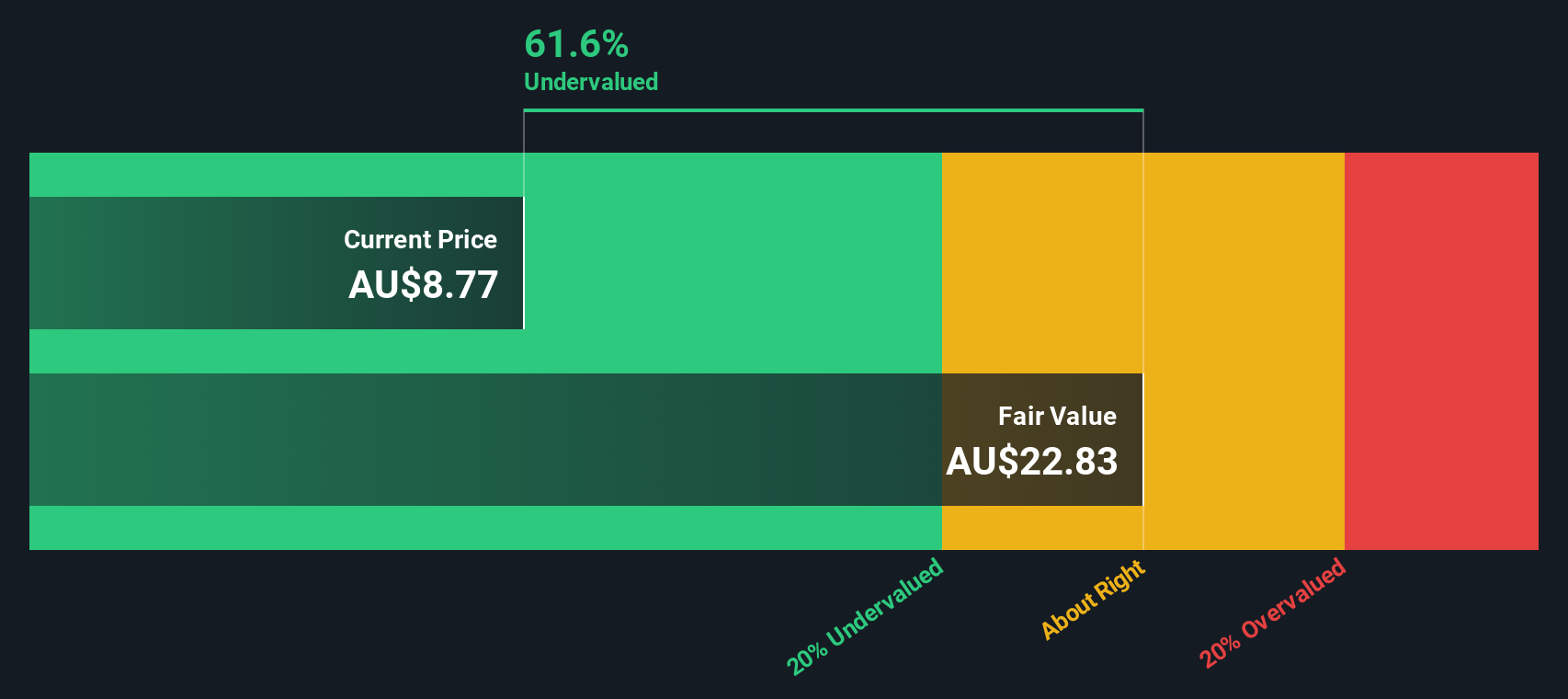

While analysts see APA as modestly overvalued on their fair value narrative, our DCF model presents a different perspective. It suggests the shares trade at a steep 56.9 percent discount to intrinsic value. If that gap is even half right, is the market underpricing a long runway of regulated cash flows?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out APA Group for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 928 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own APA Group Narrative

If you are unconvinced by these views or simply prefer to dive into the numbers yourself, you can build a fresh narrative in minutes, Do it your way.

A great starting point for your APA Group research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Ready for your next investing move?

Do not stop at a single opportunity. Use the Simply Wall Street Screener to spot more targeted ideas before the market prices them into perfection.

- Capture potential mispricings by scanning these 928 undervalued stocks based on cash flows that strong cash flow analysis suggests the market has overlooked.

- Position yourself ahead of the next tech wave by checking out these 25 AI penny stocks shaping breakthroughs in automation and intelligent software.

- Lock in dependable income prospects by evaluating these 14 dividend stocks with yields > 3% that aim to deliver yields above 3 percent with room for growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:APA

Reasonable growth potential average dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026