Qantas (ASX:QAN): Exploring Valuation Perspectives After Recent Share Price Drift

Reviewed by Kshitija Bhandaru

See our latest analysis for Qantas Airways.

Although Qantas shares have slipped slightly this week, the stock’s momentum has generally stabilized in 2024, with a year-to-date share price return near flat. Looking longer term, total shareholder returns over five years remain positive, suggesting that investors see potential for value creation even as sentiment rises and falls in the short run.

If you’re weighing up your next move in the market, now is a good opportunity to broaden your search and discover fast growing stocks with high insider ownership

With Qantas trading below analyst price targets and showing strong results over one and five years, investors are beginning to ask if the market is overlooking value or if future growth is already fully priced in.

Most Popular Narrative: 14.9% Undervalued

Compared to its recent close at A$10.81, the most widely followed narrative estimates Qantas's fair value at A$12.70. This suggests meaningful upside that has caught the attention of investors amid shifting price trends.

"Fleet renewal is expected to accelerate, with 18 new aircraft this year and 21 next year, unlocking EBIT benefits and driving future growth through operational efficiencies and increased capacity. This will likely have a positive impact on net margins and earnings as new aircraft improve cost structures."

Want to know what’s fueling this bullish price target? The narrative builds a case using bold assumptions about future revenue, earnings expansion, and a profit multiple above industry norms. Curious about which optimistic forecasts drive their estimated fair value? See the full breakdown of projections and scenarios that make up this view.

Result: Fair Value of $12.70 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing fleet renewal costs and potential delivery delays could erode expected margin gains. These factors act as key risks to the current bullish outlook.

Find out about the key risks to this Qantas Airways narrative.

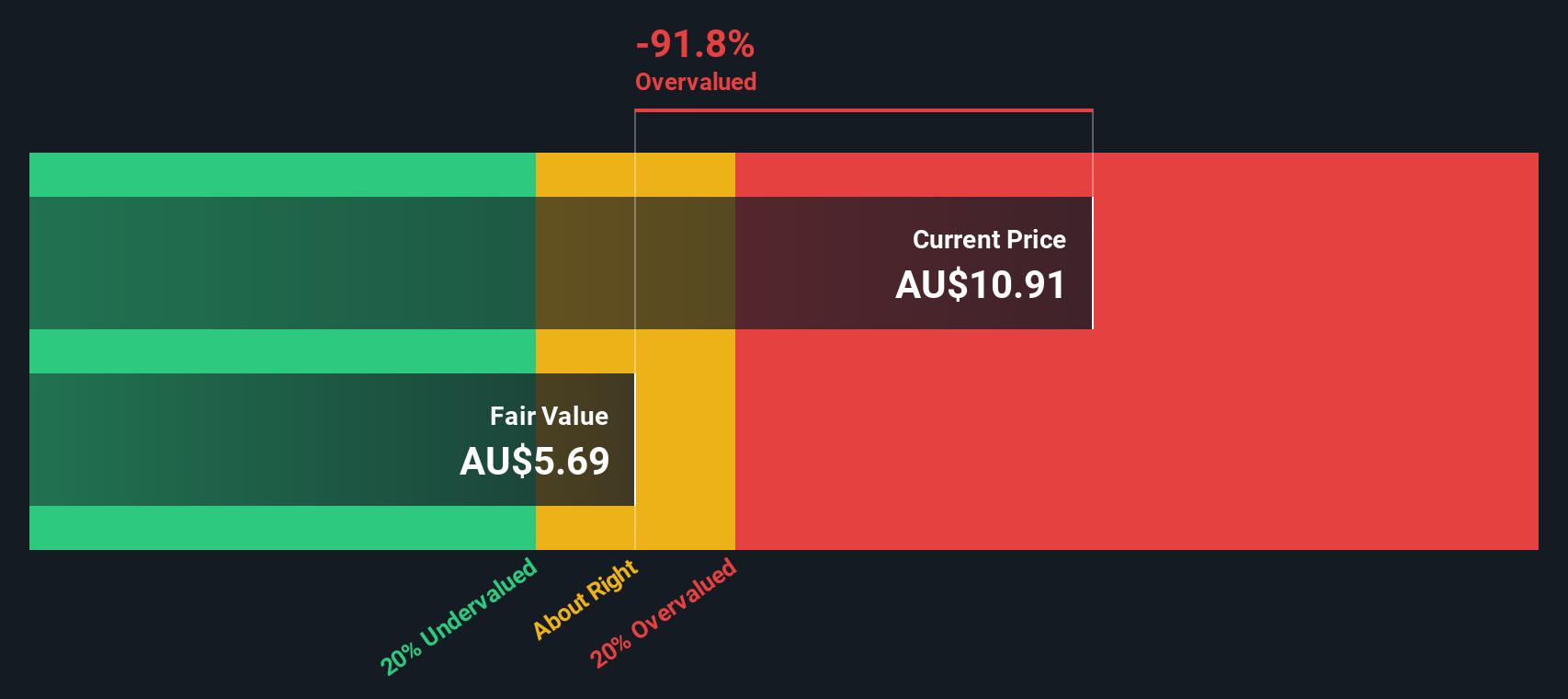

Another View: Discounted Cash Flow Perspective

Looking through the lens of the SWS DCF model provides a different reading. Our DCF valuation is much lower than the current share price, suggesting Qantas could be overvalued if you rely on more conservative cash flow forecasts and discount rates. Are these projections too cautious, or is the market pricing in blue-sky optimism?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Qantas Airways for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Qantas Airways Narrative

If you see things differently or want to dig into the numbers yourself, you can quickly create your own perspective and narrative in just a few minutes. Do it your way.

A great starting point for your Qantas Airways research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don't limit your opportunities. Power up your investing strategy by tapping into handpicked stocks across today’s most exciting trends before others spot them.

- Uncover steady income potential with high-yield picks by checking out these 19 dividend stocks with yields > 3% offering yields above 3% for your portfolio.

- Catalyze your returns with disruptive trends and cutting-edge companies among these 25 AI penny stocks making waves in artificial intelligence.

- Benefit from market inefficiencies and growth by targeting these 886 undervalued stocks based on cash flows that the market may be missing right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Qantas Airways might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:QAN

Qantas Airways

Provides air transportation services in Australia and internationally.

Good value with slight risk.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026