- Australia

- /

- Transportation

- /

- ASX:LAU

What Lindsay Australia (ASX:LAU)'s Insider Buying and Strong EPS Growth Mean for Shareholders

Reviewed by Sasha Jovanovic

- In recent months, Lindsay Australia Limited has seen significant insider buying and delivered a very large total shareholder return over the past five years, underpinned by a compound earnings per share growth of 22% per year.

- This activity stands out given recent share price declines, highlighting notable confidence from company insiders and a strong track record of steady dividends and resilient long-term operations in agriculture logistics.

- We will assess how this combination of insider accumulation and sustained earnings growth informs Lindsay Australia's current investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Lindsay Australia Investment Narrative Recap

Being a shareholder in Lindsay Australia means believing in the company’s ability to drive growth and maintain reliability within the competitive agriculture logistics sector despite margin pressure and short-term earnings volatility. Recent news of insider buying and a prolonged stretch of earnings growth supports ongoing confidence in management, though falling share prices and softer profit margins suggest the biggest risk right now remains pressure on net margins from persistent cost increases and competitive pricing. The recent developments do not materially affect this immediate earnings risk, but strengthen the view that internal stakeholders see value in the long-term outlook.

The most relevant recent announcement is the full-year earnings result showing sales growth to A$849.78 million, while net income declined to A$17.39 million. While revenue increased, reduced margins and earnings reaffirm that the key catalyst for the company will be successfully translating network expansion, acquisitions, and technology investments into sustainable margin improvement, especially amid challenging operating conditions.

Yet, with margin pressure showing up in the latest results, investors should also be aware of...

Read the full narrative on Lindsay Australia (it's free!)

Lindsay Australia's narrative projects A$1.1 billion revenue and A$35.6 million earnings by 2028. This requires 10.0% yearly revenue growth and a A$18.2 million earnings increase from A$17.4 million today.

Uncover how Lindsay Australia's forecasts yield a A$0.94 fair value, a 48% upside to its current price.

Exploring Other Perspectives

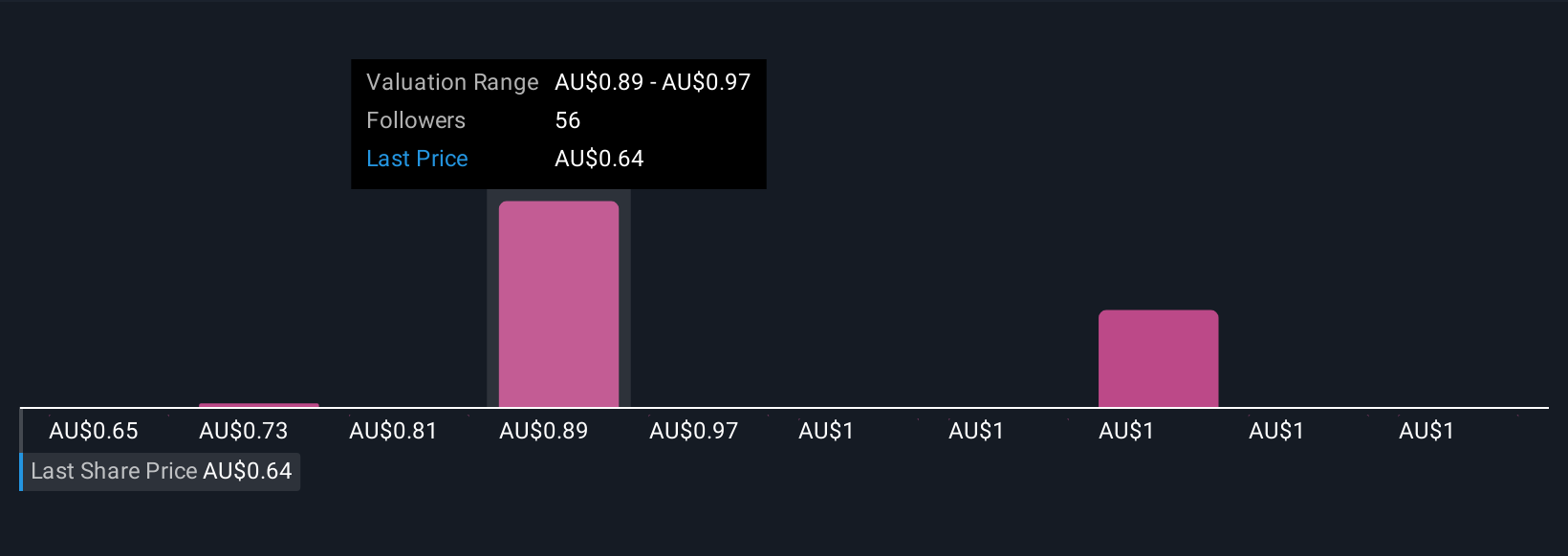

Fourteen opinions from the Simply Wall St Community value Lindsay Australia between A$0.65 and A$2.44 per share. With margin pressure presently a key concern, these contrasting views highlight just how differently market participants assess the company’s future profitability and resilience.

Explore 14 other fair value estimates on Lindsay Australia - why the stock might be worth over 3x more than the current price!

Build Your Own Lindsay Australia Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Lindsay Australia research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Lindsay Australia research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Lindsay Australia's overall financial health at a glance.

Searching For A Fresh Perspective?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:LAU

Lindsay Australia

Provides integrated transport, logistics, and rural supply services to the food processing, food services, fresh produce, and horticulture sectors in Australia.

Undervalued established dividend payer.

Market Insights

Community Narratives