The Australian market has experienced a downturn, with the ASX200 closing down 0.35% at 8266 points, as investors reacted to underwhelming Chinese stimulus measures and subsequent declines in commodity prices. In this context, identifying promising investment opportunities requires careful consideration of market dynamics and sector performance. While the term "penny stock" may seem outdated, it still signifies smaller or newer companies that can offer substantial value when backed by strong financials. We've identified three such stocks that combine financial robustness with potential for growth, providing investors with an opportunity to uncover hidden value in quality companies.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.76 | A$138.53M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.62 | A$71.5M | ★★★★★★ |

| Helloworld Travel (ASX:HLO) | A$1.88 | A$306.91M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.545 | A$350.38M | ★★★★★☆ |

| MaxiPARTS (ASX:MXI) | A$1.87 | A$103.44M | ★★★★★★ |

| SHAPE Australia (ASX:SHA) | A$2.72 | A$228.01M | ★★★★★★ |

| Navigator Global Investments (ASX:NGI) | A$1.60 | A$813.53M | ★★★★★☆ |

| EZZ Life Science Holdings (ASX:EZZ) | A$2.94 | A$127.05M | ★★★★★★ |

| Perenti (ASX:PRN) | A$1.165 | A$1.08B | ★★★★★★ |

| Big River Industries (ASX:BRI) | A$1.34 | A$114.39M | ★★★★★☆ |

Click here to see the full list of 1,037 stocks from our ASX Penny Stocks screener.

We'll examine a selection from our screener results.

Algorae Pharmaceuticals (ASX:1AI)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Algorae Pharmaceuticals Limited is a pharmaceutical development company focused on the research and development of living cells technologies primarily in New Zealand, with a market cap of approximately A$11.81 million.

Operations: The company's revenue segment is derived entirely from its research and development efforts in living cell technologies, amounting to A$0.13 million.

Market Cap: A$11.81M

Algorae Pharmaceuticals, with a market cap of A$11.81 million, is pre-revenue and focused on living cells technologies. Despite its unprofitability and increased losses over the past five years, the company remains debt-free with sufficient cash runway for more than a year. Its short-term assets significantly exceed liabilities, providing financial stability in the near term. However, both management and board members are relatively inexperienced, potentially impacting strategic direction. The stock has experienced high volatility recently but hasn't diluted shareholder value over the past year. Recent results showed consistent net losses with minimal improvement in loss per share figures.

- Dive into the specifics of Algorae Pharmaceuticals here with our thorough balance sheet health report.

- Explore historical data to track Algorae Pharmaceuticals' performance over time in our past results report.

Lindsay Australia (ASX:LAU)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Lindsay Australia Limited offers integrated transport, logistics, and rural supply services to the food processing, food services, fresh produce, and horticulture sectors in Australia with a market cap of A$269.19 million.

Operations: The company's revenue is derived from several segments, including Transport (A$577.36 million), Rural (A$155.44 million), Hunters (A$87.44 million), and Corporate (A$5.00 million).

Market Cap: A$269.19M

Lindsay Australia Limited, with a market cap of A$269.19 million, shows mixed performance as a penny stock. The company's revenue reached A$804.37 million for the year ending June 2024, marking growth from the previous year; however, net income dropped to A$27.27 million from A$34.52 million. Despite high-quality earnings and well-covered debt by operating cash flow, profit margins have contracted to 3.4% from 5.1%. While trading at good value compared to peers and below analyst price targets, its dividend track record remains unstable with recent decreases noted in payouts per share amidst negative earnings growth over the past year.

- Jump into the full analysis health report here for a deeper understanding of Lindsay Australia.

- Evaluate Lindsay Australia's prospects by accessing our earnings growth report.

Orcoda (ASX:ODA)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Orcoda Limited, with a market cap of A$23.68 million, offers smart technology transport logistics and contracting services across the healthcare, transportation, infrastructure, and resources sectors both in Australia and internationally.

Operations: The company's revenue is primarily derived from its Transport Technology segment, which generated A$8.36 million, and Infrastructure Services segment, contributing A$16.71 million.

Market Cap: A$23.68M

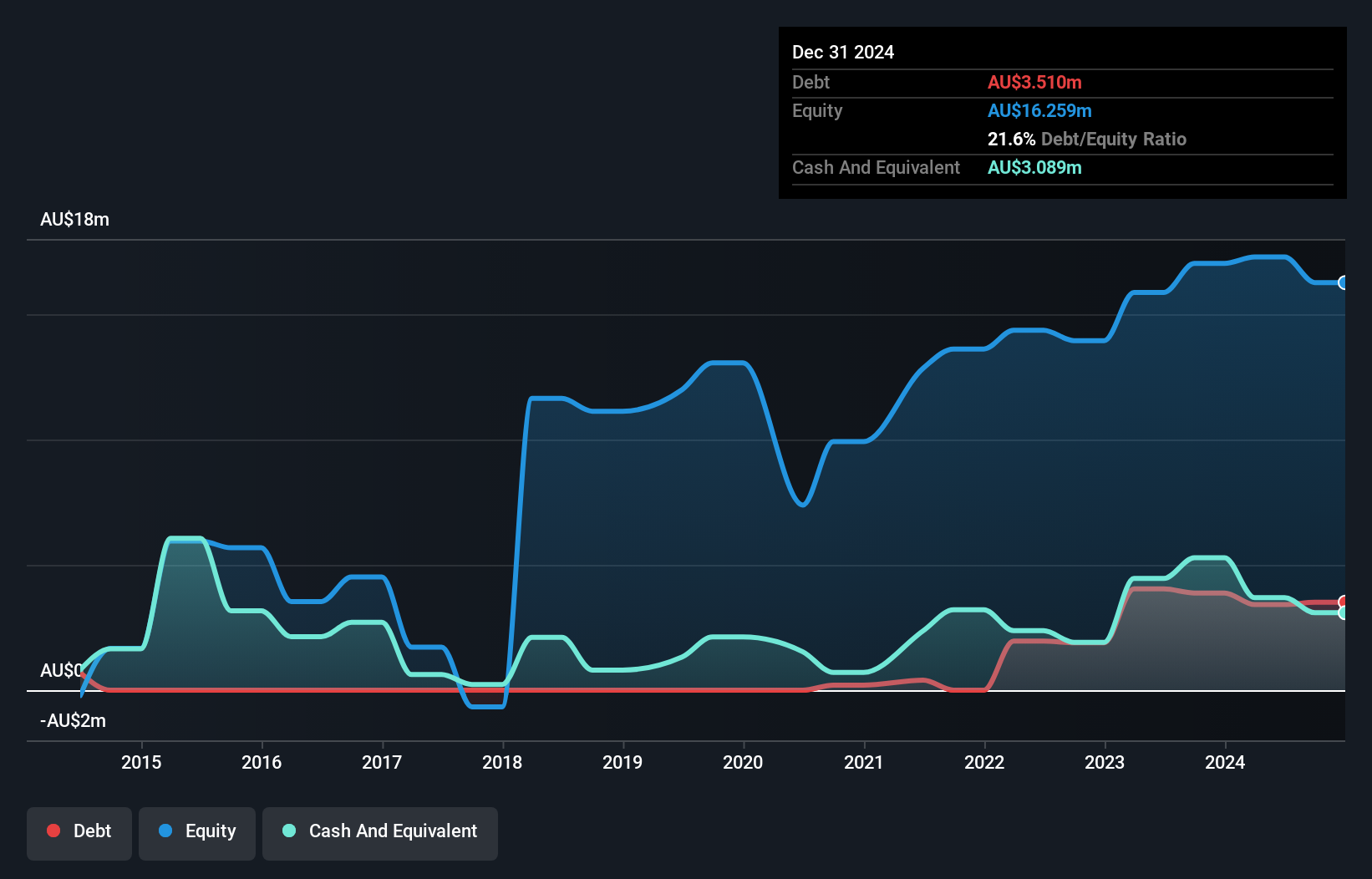

Orcoda Limited, with a market cap of A$23.68 million, demonstrates potential in the penny stock arena through its diverse revenue streams and stable financial footing. The company reported A$25.07 million in sales for the year ending June 2024, an increase from A$19.91 million the previous year, alongside a net income rise to A$0.91 million from A$0.40 million. With a price-to-earnings ratio of 26.2x below industry average and no significant shareholder dilution recently, Orcoda's earnings growth has outpaced industry norms significantly at 128.9%. However, its high share price volatility may concern risk-averse investors despite strong debt coverage by cash flow and experienced management.

- Click here to discover the nuances of Orcoda with our detailed analytical financial health report.

- Gain insights into Orcoda's historical outcomes by reviewing our past performance report.

Summing It All Up

- Explore the 1,037 names from our ASX Penny Stocks screener here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:ODA

Orcoda

Provides smart technology transport logistics and contracting services for the healthcare, transportation, infrastructure, and resources sectors in Australia and internationally.

Mediocre balance sheet and slightly overvalued.

Market Insights

Community Narratives