- Australia

- /

- Capital Markets

- /

- ASX:FID

3 ASX Dividend Stocks Offering Up To 6.3% Yield

Reviewed by Simply Wall St

The Australian market has shown resilience with a steady performance over the last week and an impressive 11% rise over the past year, coupled with expectations of a 13% annual earnings growth. In this context, dividend stocks can be particularly appealing for investors looking for stable income streams in a growing market.

Top 10 Dividend Stocks In Australia

| Name | Dividend Yield | Dividend Rating |

| Nick Scali (ASX:NCK) | 5.27% | ★★★★★☆ |

| Collins Foods (ASX:CKF) | 3.14% | ★★★★★☆ |

| Centuria Capital Group (ASX:CNI) | 7.56% | ★★★★★☆ |

| Eagers Automotive (ASX:APE) | 7.28% | ★★★★★☆ |

| Fiducian Group (ASX:FID) | 4.04% | ★★★★★☆ |

| Fortescue (ASX:FMG) | 9.07% | ★★★★★☆ |

| Charter Hall Group (ASX:CHC) | 3.97% | ★★★★★☆ |

| Premier Investments (ASX:PMV) | 4.58% | ★★★★★☆ |

| Diversified United Investment (ASX:DUI) | 3.16% | ★★★★★☆ |

| Macquarie Group (ASX:MQG) | 3.13% | ★★★★☆☆ |

Click here to see the full list of 27 stocks from our Top ASX Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Fiducian Group (ASX:FID)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Fiducian Group Ltd operates in Australia, offering financial services through its subsidiaries, with a market capitalization of approximately A$236.08 million.

Operations: Fiducian Group Ltd generates revenue from four primary segments: Funds Management (A$20.49 million), Corporate Services (A$12.06 million), Financial Planning (A$28.95 million), and Platform Administration (A$15.38 million).

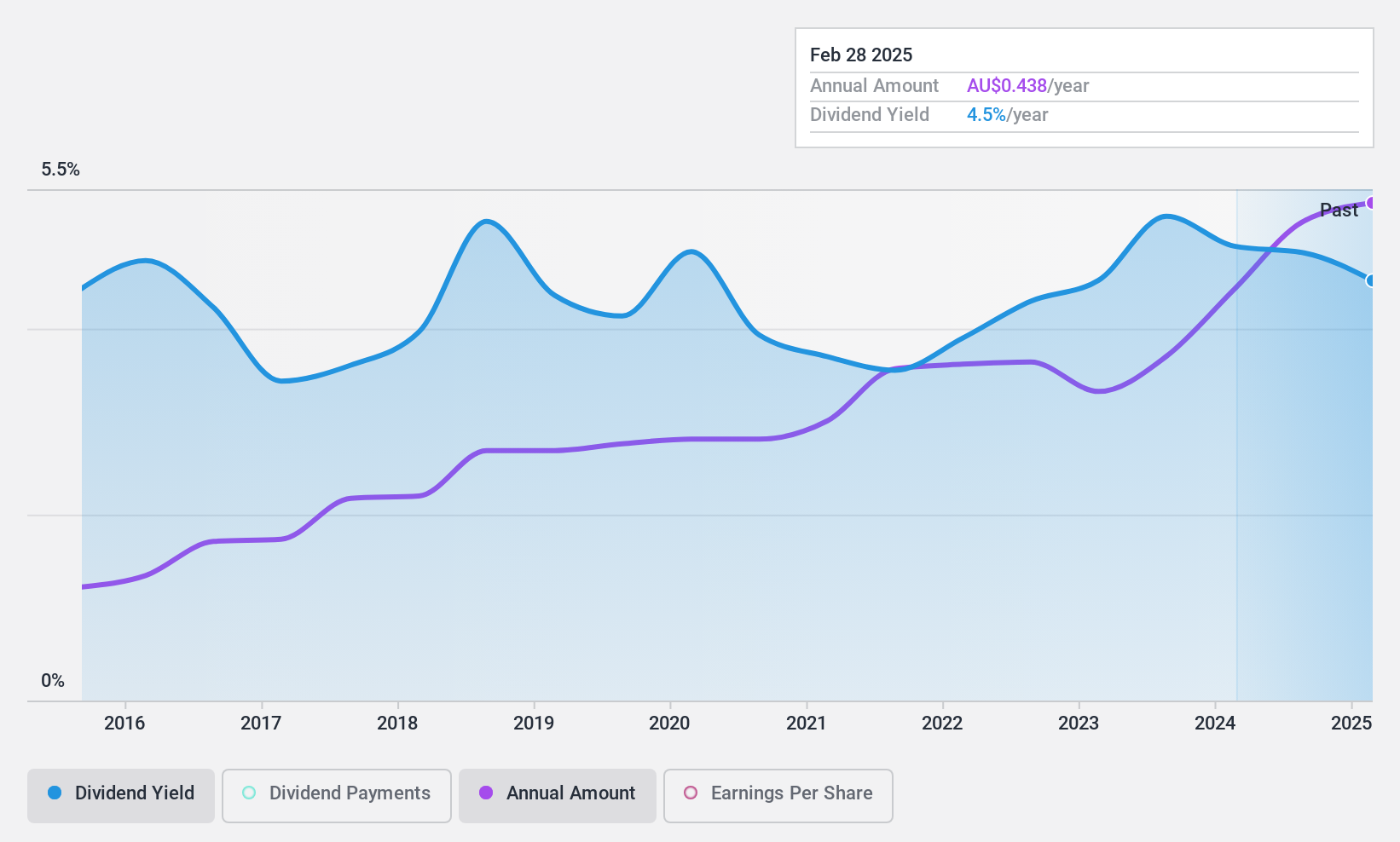

Dividend Yield: 4%

Fiducian Group has demonstrated a consistent dividend history, with stable payments over the past decade and an increase in dividends per share. The dividend yield stands at 4.04%, lower than the top Australian dividend payers. Despite this, the dividends are well-covered by earnings with a payout ratio of 83.7% and by cash flows with a cash payout ratio of 60.5%. Additionally, Fiducian is currently trading at 9.1% below its estimated fair value, suggesting potential undervaluation.

- Unlock comprehensive insights into our analysis of Fiducian Group stock in this dividend report.

- In light of our recent valuation report, it seems possible that Fiducian Group is trading behind its estimated value.

JB Hi-Fi (ASX:JBH)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: JB Hi-Fi Limited operates a retail business specializing in home consumer products, with a market capitalization of approximately A$6.89 billion.

Operations: JB Hi-Fi Limited generates revenue through three primary segments: JB Hi-Fi Australia with A$6.57 billion, The Good Guys at A$2.66 billion, and JB Hi-Fi New Zealand contributing A$0.28 billion.

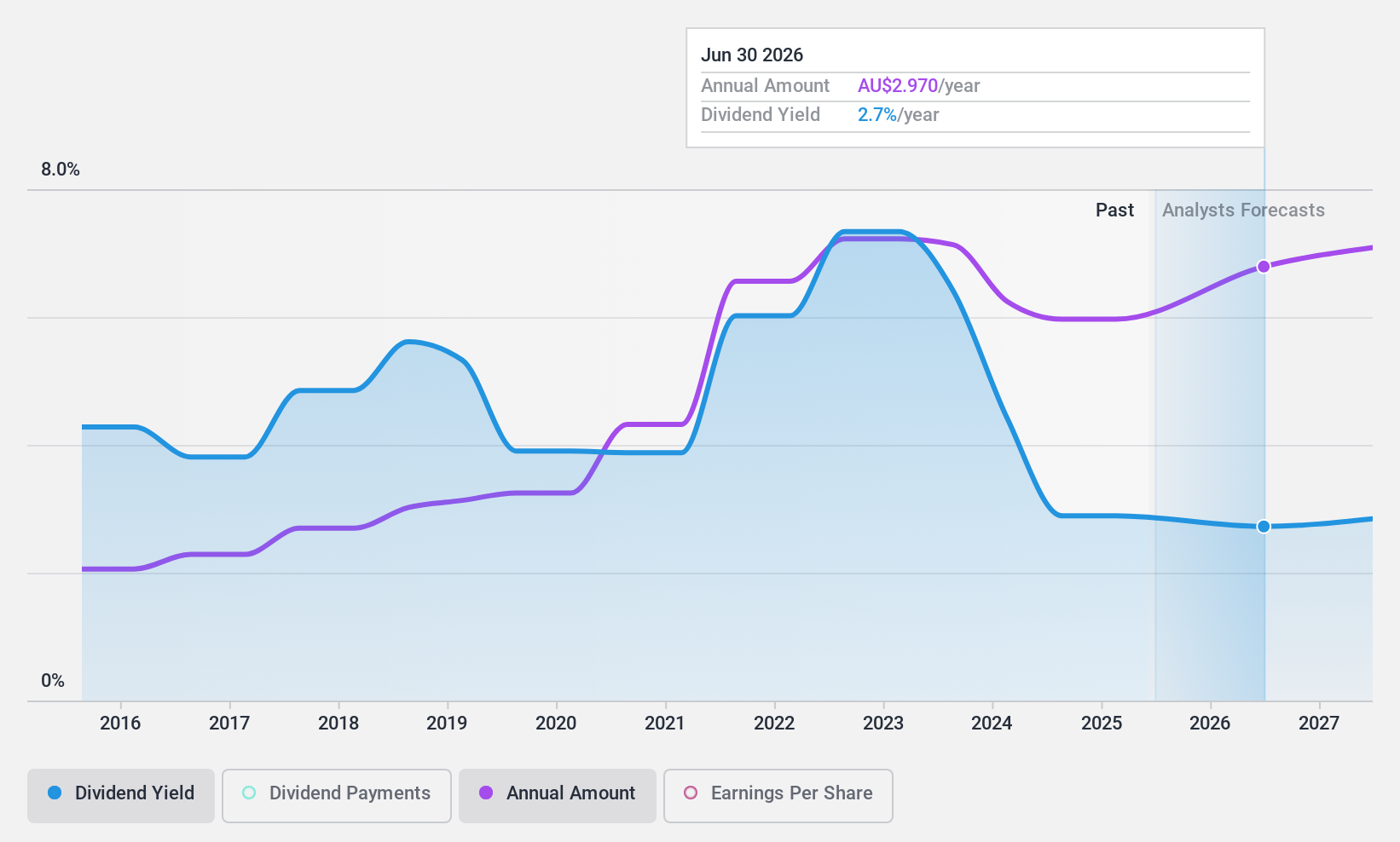

Dividend Yield: 4.3%

JB Hi-Fi has shown a mixed performance in dividend reliability over the past decade, with significant fluctuations in annual payments. Recent sales data indicates slight growth challenges across its various segments, particularly with The Good Guys experiencing notable declines. However, JB Hi-Fi maintains a reasonable payout ratio at 65% and a cash payout ratio of 46.7%, ensuring dividends are well-supported by earnings and cash flows despite forecasted earnings declines of 1.4% annually over the next three years. Trading at 6.1% below estimated fair value suggests potential undervaluation relative to its market position.

- Click here and access our complete dividend analysis report to understand the dynamics of JB Hi-Fi.

- The analysis detailed in our JB Hi-Fi valuation report hints at an inflated share price compared to its estimated value.

Lindsay Australia (ASX:LAU)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Lindsay Australia Limited operates in Australia, offering integrated transport, logistics, and rural supply services primarily to sectors such as food processing, food services, fresh produce, and horticulture, with a market capitalization of A$293.68 million.

Operations: Lindsay Australia Limited generates revenue primarily through its rural and transport services, totaling A$158.73 million and A$571.38 million respectively.

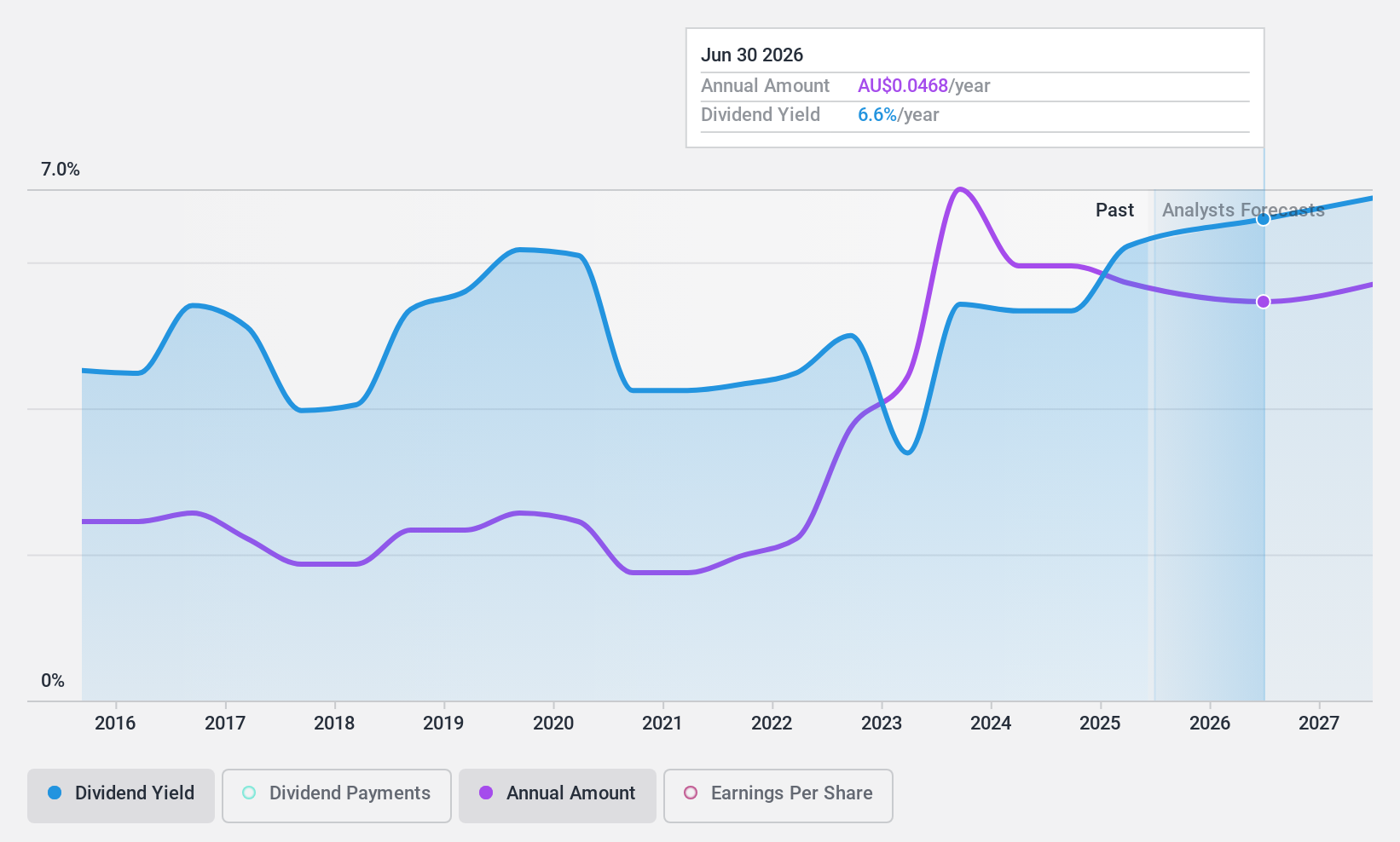

Dividend Yield: 6.4%

Lindsay Australia offers a dividend yield of 6.38%, slightly below the top quartile in its market. Despite this, dividends are well-supported by a payout ratio of 43.7% and cash flows, with a cash payout ratio at 38.9%. The company has increased dividends over the past decade but has also experienced volatility and unreliability in its dividend payments during this period. Recent earnings growth was strong at 50.3% last year, with future earnings expected to grow by 9% annually.

- Take a closer look at Lindsay Australia's potential here in our dividend report.

- According our valuation report, there's an indication that Lindsay Australia's share price might be on the cheaper side.

Taking Advantage

- Unlock our comprehensive list of 27 Top ASX Dividend Stocks by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:FID

Fiducian Group

Through its subsidiaries, provides financial services in Australia.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives