It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Kelsian Group (ASX:KLS). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

See our latest analysis for Kelsian Group

How Fast Is Kelsian Group Growing Its Earnings Per Share?

Even modest earnings per share growth (EPS) can create meaningful value, when it is sustained reliably from year to year. So EPS growth can certainly encourage an investor to take note of a stock. Kelsian Group's EPS skyrocketed from AU$0.12 to AU$0.17, in just one year; a result that's bound to bring a smile to shareholders. That's a impressive gain of 35%.

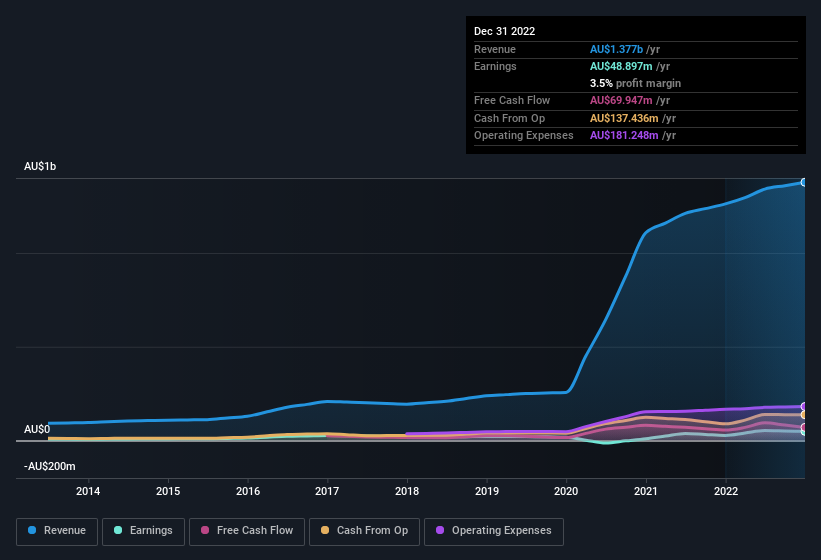

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. EBIT margins for Kelsian Group remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 9.1% to AU$1.4b. That's encouraging news for the company!

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

While we live in the present moment, there's little doubt that the future matters most in the investment decision process. So why not check this interactive chart depicting future EPS estimates, for Kelsian Group?

Are Kelsian Group Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

Although we did see some insider selling (worth AU$5.0m) this was overshadowed by a mountain of buying, totalling AU$11m in just one year. We find this encouraging because it suggests they are optimistic about Kelsian Group'sfuture. It is also worth noting that it was Non-Executive Director Neil Smith who made the biggest single purchase, worth AU$4.0m, paying AU$5.55 per share.

Along with the insider buying, another encouraging sign for Kelsian Group is that insiders, as a group, have a considerable shareholding. We note that their impressive stake in the company is worth AU$389m. That equates to 20% of the company, making insiders powerful and aligned with other shareholders. So there is opportunity here to invest in a company whose management have tangible incentives to deliver.

While insiders are apparently happy to hold and accumulate shares, that is just part of the big picture. The cherry on top is that the CEO, Clinton Feuerherdt is paid comparatively modestly to CEOs at similar sized companies. Our analysis has discovered that the median total compensation for the CEOs of companies like Kelsian Group with market caps between AU$1.5b and AU$4.9b is about AU$2.5m.

Kelsian Group's CEO took home a total compensation package worth AU$2.1m in the year leading up to June 2022. That seems pretty reasonable, especially given it's below the median for similar sized companies. While the level of CEO compensation shouldn't be the biggest factor in how the company is viewed, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. It can also be a sign of good governance, more generally.

Does Kelsian Group Deserve A Spot On Your Watchlist?

If you believe that share price follows earnings per share you should definitely be delving further into Kelsian Group's strong EPS growth. Furthermore, company insiders have been adding to their significant stake in the company. These things considered, this is one stock worth watching. You should always think about risks though. Case in point, we've spotted 3 warning signs for Kelsian Group you should be aware of.

The good news is that Kelsian Group is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Kelsian Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:KLS

Second-rate dividend payer with low risk.

Similar Companies

Market Insights

Community Narratives