- Australia

- /

- Transportation

- /

- ASX:CL8

Here's Why Shareholders May Want To Be Cautious With Increasing Carly Holdings Limited's (ASX:CL8) CEO Pay Packet

Key Insights

- Carly Holdings' Annual General Meeting to take place on 30th of November

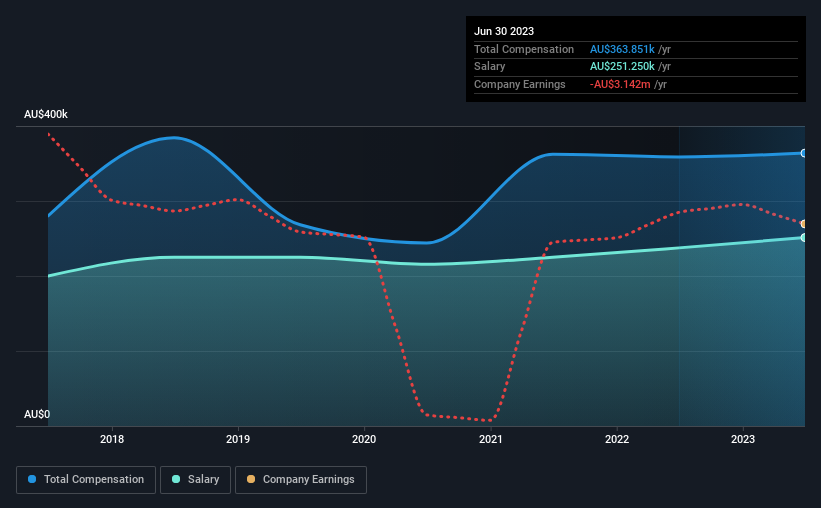

- CEO Chris Noone's total compensation includes salary of AU$251.3k

- Total compensation is 251% above industry average

- Over the past three years, Carly Holdings' EPS grew by 70% and over the past three years, the total loss to shareholders 91%

Shareholders of Carly Holdings Limited (ASX:CL8) will have been dismayed by the negative share price return over the last three years. Despite positive EPS growth in the past few years, the share price hasn't tracked the fundamental performance of the company. Shareholders may want to question the board on the future direction of the company at the upcoming AGM on 30th of November. They could also try to influence management and firm direction through voting on resolutions such as executive remuneration and other company matters. We discuss below why we think shareholders should be cautious of approving a raise for the CEO at the moment.

View our latest analysis for Carly Holdings

How Does Total Compensation For Chris Noone Compare With Other Companies In The Industry?

Our data indicates that Carly Holdings Limited has a market capitalization of AU$4.6m, and total annual CEO compensation was reported as AU$364k for the year to June 2023. This means that the compensation hasn't changed much from last year. Notably, the salary which is AU$251.3k, represents most of the total compensation being paid.

For comparison, other companies in the Australian Transportation industry with market capitalizations below AU$304m, reported a median total CEO compensation of AU$104k. Accordingly, our analysis reveals that Carly Holdings Limited pays Chris Noone north of the industry median.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | AU$251k | AU$238k | 69% |

| Other | AU$113k | AU$121k | 31% |

| Total Compensation | AU$364k | AU$359k | 100% |

Talking in terms of the industry, salary represented approximately 64% of total compensation out of all the companies we analyzed, while other remuneration made up 36% of the pie. Carly Holdings is largely mirroring the industry average when it comes to the share a salary enjoys in overall compensation. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

Carly Holdings Limited's Growth

Carly Holdings Limited has seen its earnings per share (EPS) increase by 70% a year over the past three years. In the last year, its revenue is up 68%.

Overall this is a positive result for shareholders, showing that the company has improved in recent years. It's great to see that revenue growth is strong, too. These metrics suggest the business is growing strongly. Historical performance can sometimes be a good indicator on what's coming up next but if you want to peer into the company's future you might be interested in this free visualization of analyst forecasts.

Has Carly Holdings Limited Been A Good Investment?

The return of -91% over three years would not have pleased Carly Holdings Limited shareholders. So shareholders would probably want the company to be less generous with CEO compensation.

To Conclude...

The fact that shareholders are sitting on a loss on the value of their shares in the past few years is certainly disconcerting. The stock's movement is disjointed with the company's earnings growth, which ideally should move in the same direction. If there are some unknown variables that are influencing the stock's price, surely shareholders would have some concerns. These concerns should be addressed at the upcoming AGM, where shareholders can question the board and evaluate if their judgement and decision making is still in line with their expectations.

It is always advisable to analyse CEO pay, along with performing a thorough analysis of the company's key performance areas. In our study, we found 4 warning signs for Carly Holdings you should be aware of, and 1 of them doesn't sit too well with us.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:CL8

Carly Holdings

An online technology company, engages in the provision of car subscription and rental services for individuals and businesses in Australia and New Zealand.

Medium-low and fair value.

Market Insights

Community Narratives