The Bull Case For TPG Telecom (ASX:TPG) Could Change Following Triple Zero Outages And Capital Raise

Reviewed by Sasha Jovanovic

- In recent months, TPG Telecom has faced intense regulatory scrutiny and a Senate inquiry in Australia after multiple Triple Zero (000) emergency call failures involving outdated Samsung devices on its network, with the company working with authorities to investigate possible links to customer deaths and urging tens of thousands of affected users to update their software or replace handsets.

- At the same time, TPG completed a retail reinvestment plan that raised A$73.40 million to repay bank borrowings and strengthen its balance sheet, even as questions about network resilience and public safety place its operational risk management under the spotlight.

- We’ll now examine how the Triple Zero failures and resulting regulatory scrutiny could reshape TPG Telecom’s investment narrative and risk profile.

Find companies with promising cash flow potential yet trading below their fair value.

TPG Telecom Investment Narrative Recap

To own TPG Telecom, you need to believe that its expanded mobile and 5G footprint, digital brands and cost-out program can translate into sustainable profitability, despite current losses. The Triple Zero failures put operational resilience and regulatory risk at the centre of the story in the near term, raising questions about reputation, potential compliance costs and any impact on customer churn or network investment priorities.

The recent completion of TPG’s A$73.40 million retail reinvestment plan is especially relevant here, because it modestly reduces bank borrowings and supports balance sheet flexibility at a time when regulators, politicians and customers are focused on network reliability and public safety. That extra financial headroom could matter if TPG needs to accelerate network upgrades, address any mandated changes or manage short term pressure on earnings while the Triple Zero investigation runs its course.

But investors should be aware that if regulatory scrutiny around emergency call reliability leads to higher compliance costs or constraints on network operations, it could...

Read the full narrative on TPG Telecom (it's free!)

TPG Telecom's narrative projects A$5.3 billion revenue and A$247.4 million earnings by 2028. This implies a 1.6% yearly revenue decline and an A$329.4 million earnings increase from A$-82.0 million today.

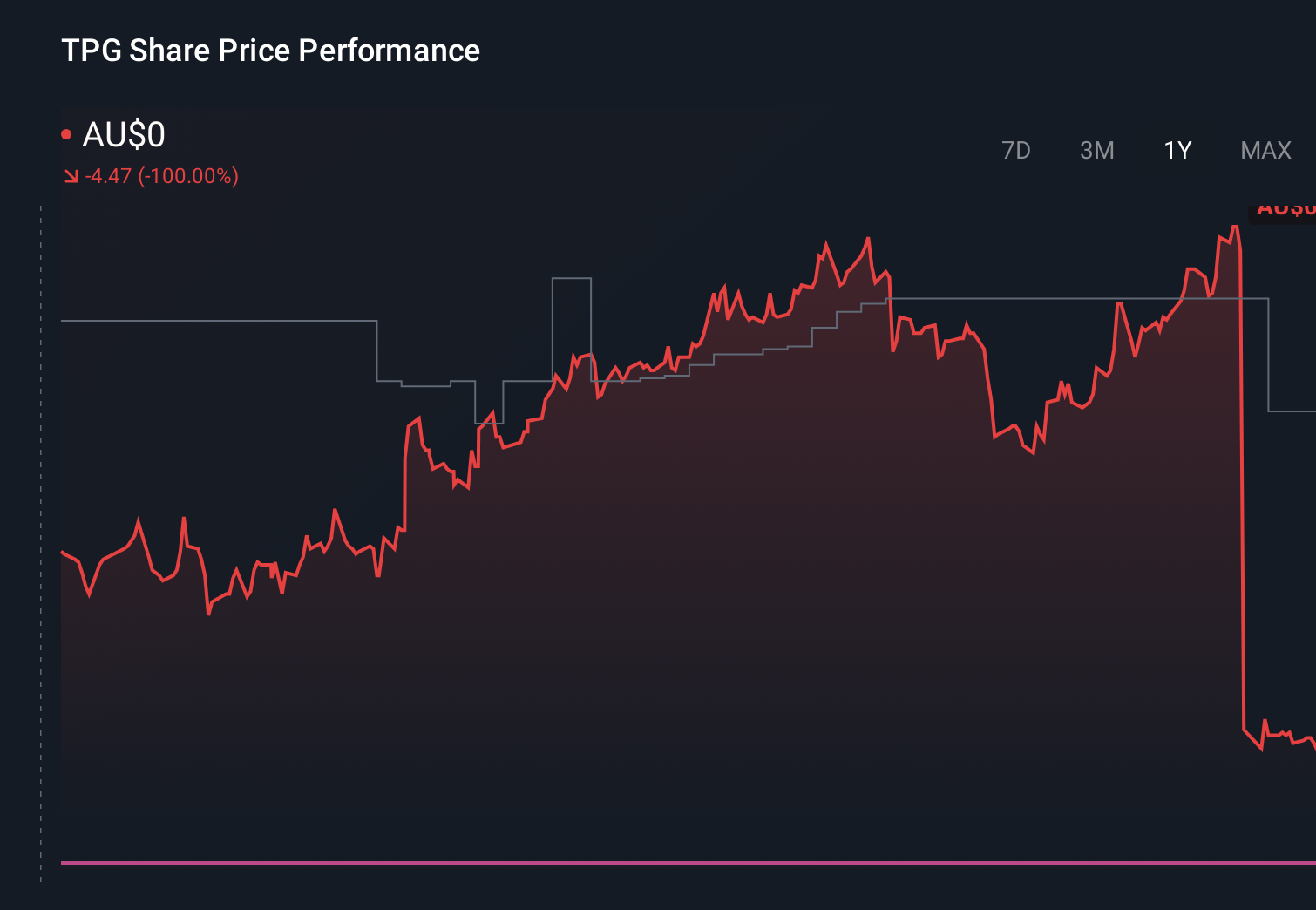

Uncover how TPG Telecom's forecasts yield a A$5.00 fair value, a 33% upside to its current price.

Exploring Other Perspectives

Four Simply Wall St Community fair value estimates for TPG Telecom span a wide A$4.77 to A$14.27 per share, underlining how far apart individual views can sit. Against that backdrop, the recent Triple Zero failures and regulatory scrutiny highlight operational and reputational risks that could be just as important to consider as any valuation model when you compare these different perspectives.

Explore 4 other fair value estimates on TPG Telecom - why the stock might be worth just A$4.77!

Build Your Own TPG Telecom Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your TPG Telecom research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free TPG Telecom research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate TPG Telecom's overall financial health at a glance.

No Opportunity In TPG Telecom?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TPG Telecom might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:TPG

TPG Telecom

Provides telecommunications services to consumer, business, enterprise, and government and wholesale customers in Australia.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Mastersystem Infotama will achieve 18.9% revenue growth as fair value hits IDR1,650

Insiders Sell, Investors Watch: What’s Going On at PG?

Waiting for the Inevitable

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion