The Bull Case For Telstra Group (ASX:TLS) Could Change Following Infosys AI Partnership Announcement - Learn Why

Reviewed by Simply Wall St

- Earlier in July 2025, Telstra Group announced an expanded collaboration with Infosys, appointing Infosys as the strategic partner for Telstra International to bolster technology leadership and support its Connected Future 30 strategy with an AI-first approach.

- This partnership underscores Telstra International's commitment to accelerating digital modernization and leveraging artificial intelligence to streamline operations and boost customer value.

- We'll explore how Infosys's AI-driven modernization efforts could influence Telstra Group's investment narrative and long-term digital transformation goals.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 25 best rare earth metal stocks of the very few that mine this essential strategic resource.

Telstra Group Investment Narrative Recap

To be a Telstra Group shareholder, you need to believe in the company’s ability to deliver sustainable growth and returns by investing in advanced digital infrastructure and modernizing its global operations. While the expanded collaboration with Infosys signals further commitment to AI-driven efficiency, it does not have a material short-term impact on the main catalyst, capitalizing on major digital infrastructure projects, or on the risk of delays and higher costs in intercity fiber rollout.

Recently, Telstra and Accenture launched an AI Silicon Valley innovation hub, aligning with the AI-first approach announced in the Infosys partnership. These efforts support the company’s ambition to accelerate digital modernization and improve operational efficiency, directly feeding into its ongoing transformation agenda.

On the other hand, investors should watch for any emerging signs of cost pressure or timeline slippage in Telstra’s largest infrastructure projects, especially as...

Read the full narrative on Telstra Group (it's free!)

Telstra Group is forecast to generate A$25.0 billion in revenue and A$2.5 billion in earnings by 2028. This projection assumes a 2.6% annual revenue growth rate and a A$0.8 billion increase in earnings from A$1.7 billion today.

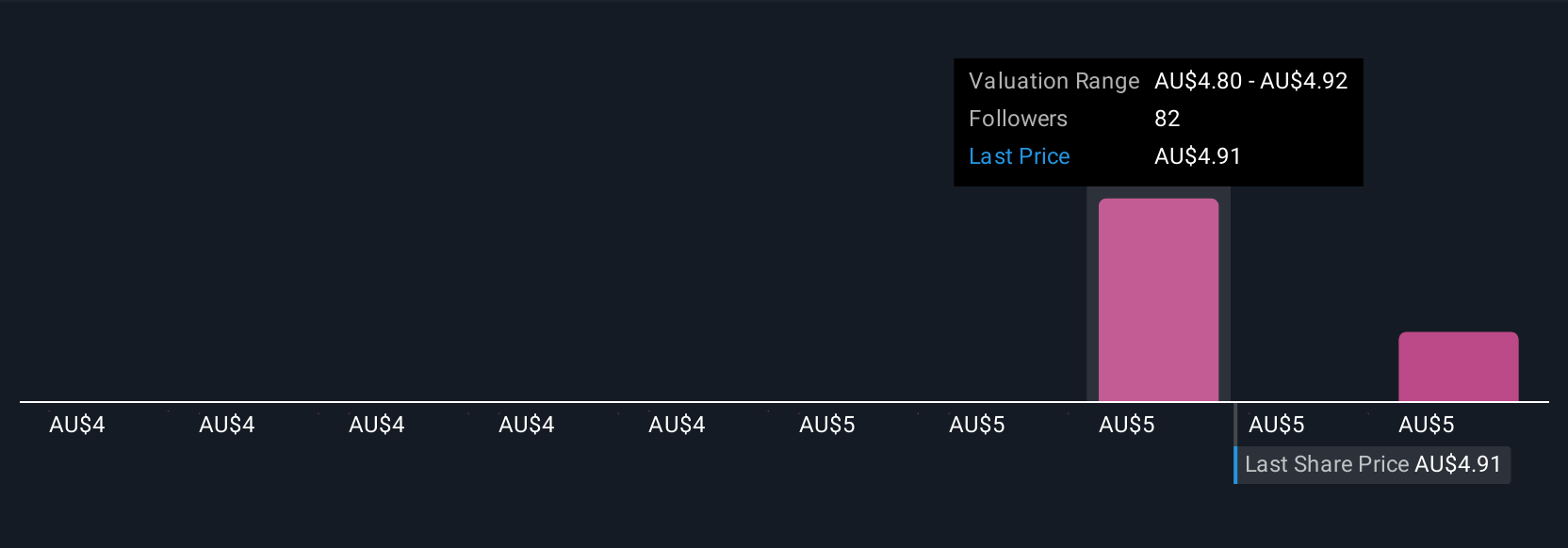

Uncover how Telstra Group's forecasts yield a A$4.86 fair value, in line with its current price.

Exploring Other Perspectives

With four Simply Wall St Community fair value estimates for Telstra ranging from A$4.02 to A$5.14, investor outlooks reflect diverse expectations. As many weigh efficiency gains from new digital partnerships, these varying perspectives invite you to consider several angles before forming your own view.

Explore 4 other fair value estimates on Telstra Group - why the stock might be worth as much as A$5.14!

Build Your Own Telstra Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Telstra Group research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Telstra Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Telstra Group's overall financial health at a glance.

Seeking Other Investments?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- AI is about to change healthcare. These 25 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Telstra Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:TLS

Telstra Group

Engages in the provision of telecommunications and information services to businesses, government, and individuals in Australia and internationally.

Mediocre balance sheet low.

Similar Companies

Market Insights

Community Narratives