Telstra (ASX:TLS) Valuation in Focus as Market Dynamics Challenge Growth Prospects

Reviewed by Simply Wall St

Telstra Group (ASX:TLS) is navigating a market shaped by mobile pricing competition, regulatory uncertainty, and the effects of Australia’s mature telecom industry. These factors are currently limiting growth and drawing investor attention to Telstra’s infrastructure strategy for future gains.

See our latest analysis for Telstra Group.

Telsra’s share price has climbed steadily this year, now at $4.88, with a 21% year-to-date share price return reflecting renewed optimism in its strategy, even as headlines focus on short-term regulatory headwinds and mobile pricing pressures. Adding in dividends, the 1-year total shareholder return jumps to an impressive 33%, and long-term holders have more than doubled their money in five years, though some recent momentum has cooled.

If Telstra’s turnaround has you curious about broader market opportunities, now is an ideal moment to expand your search and discover fast growing stocks with high insider ownership

With Telstra’s strong recent returns and upcoming regulatory and competitive headwinds, investors are left to ponder whether the stock is trading below its true value or if the market has already priced in all potential upside.

Most Popular Narrative: 20% Undervalued

Telstra's most widely followed narrative suggests its fair value is meaningfully higher than the current share price, implying room for upside if key initiatives deliver. With a last close of A$4.88, the narrative indicates Telstra could be trading at an attractive discount based on expected growth and cash flow improvements.

Increased monetization of digital infrastructure, such as the intercity fibre network and towers (Amplitel), along with the structural separation from InfraCo, is expected to unlock new high-margin revenue streams, improve capital efficiency, and underpin stronger free cash flow, enabling enhanced shareholder returns through dividends and buybacks. (Impacts: Free cash flow, net margins, shareholder returns)

Curious what bold cash flow and margin projections support this optimistic valuation? The narrative hints at future profit drivers you might not expect, plus unique capital allocation moves that could separate Telstra from sector peers. Want to uncover the financial chess moves shaping this story? Dive in and see what is moving the numbers.

Result: Fair Value of $4.89 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing fixed-line revenue losses and rising mobile competition could challenge Telstra's growth path and could change the current optimistic outlook.

Find out about the key risks to this Telstra Group narrative.

Another View: Market Multiples Paint a Different Picture

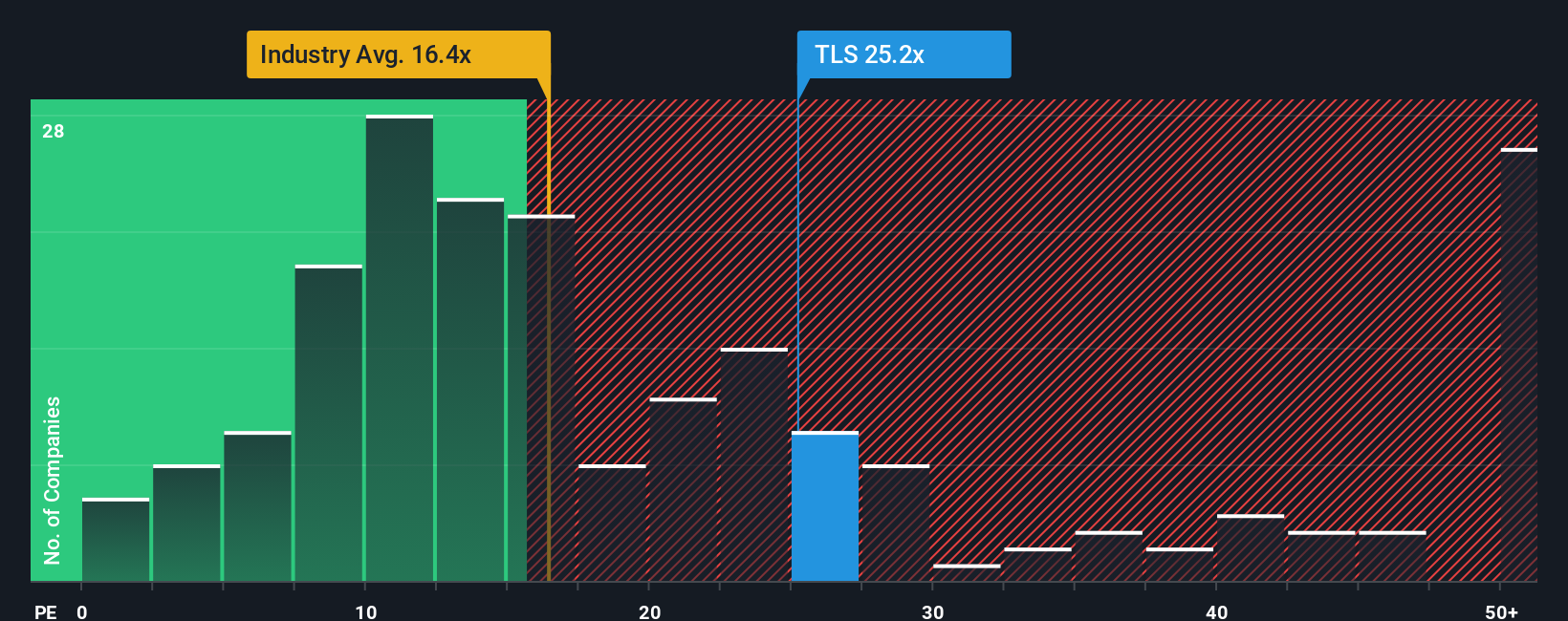

Looking from a different angle, Telstra’s price-to-earnings ratio sits at 25.4x, higher than the global telecom industry average of 16.6x and closely matching its peer average of 25.6x. While this suggests a premium, the fair ratio is estimated at 33.4x, which hints there could be more headroom. Is the market expecting slower growth, or could sentiment turn if results impress?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Telstra Group Narrative

If you see the numbers differently or have your own perspective, you can build your own story about Telstra in just a few minutes. Do it your way

A great starting point for your Telstra Group research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Don’t settle for just one perspective when smarter options are just a click away. Uncover tomorrow’s winners with the right screen and stay ahead of the curve every time.

- Tap into rising market trends by checking out these 26 AI penny stocks, which are transforming industries through intelligent automation and machine learning breakthroughs.

- Boost your search for stable income by reviewing these 24 dividend stocks with yields > 3%, featuring companies delivering attractive yields and consistent cash returns.

- Get ahead of mainstream investors by researching these 831 undervalued stocks based on cash flows that the market may be overlooking and position yourself for potential outsized returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Telstra Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:TLS

Telstra Group

Provides telecommunications and information services in Australia and internationally.

Solid track record and fair value.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion