Shareholders Are Thrilled That The Macquarie Telecom Group (ASX:MAQ) Share Price Increased 184%

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

When you buy a stock there is always a possibility that it could drop 100%. But on a lighter note, a good company can see its share price rise well over 100%. For instance, the price of Macquarie Telecom Group Limited (ASX:MAQ) stock is up an impressive 184% over the last five years.

View our latest analysis for Macquarie Telecom Group

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

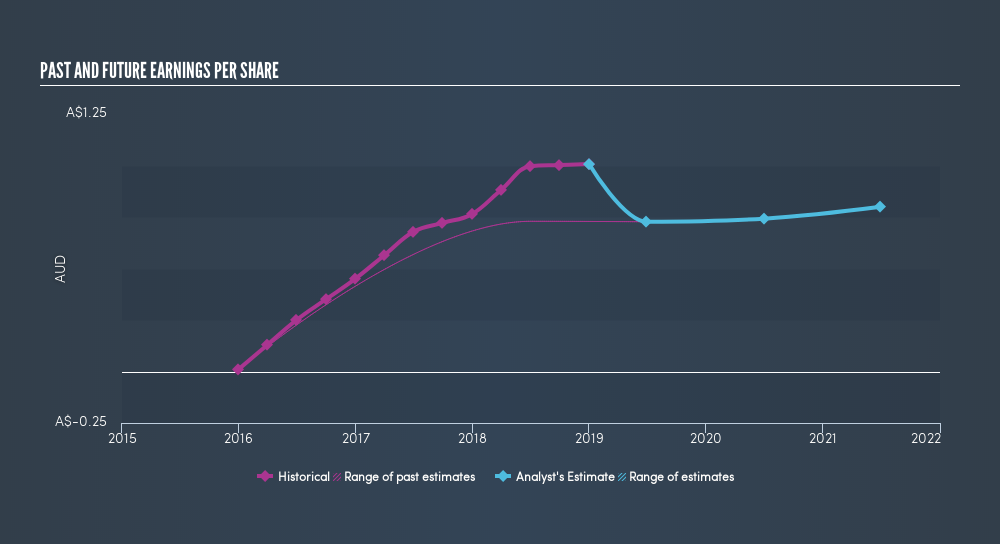

During five years of share price growth, Macquarie Telecom Group achieved compound earnings per share (EPS) growth of 37% per year. The EPS growth is more impressive than the yearly share price gain of 23% over the same period. So it seems the market isn't so enthusiastic about the stock these days.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

We know that Macquarie Telecom Group has improved its bottom line over the last three years, but what does the future have in store? It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Dividend Lost

The value of past dividends are accounted for in the total shareholder return (TSR), but not in the share price return mentioned above. Many would argue the TSR gives a more complete picture of the value a stock brings to its holders. Macquarie Telecom Group's TSR over the last 5 years is 228%; better than its share price return. Although the company had to cut dividends, it has paid cash to shareholders in the past.

A Different Perspective

Macquarie Telecom Group shareholders gained a total return of 7.6% during the year. But that was short of the market average. If we look back over five years, the returns are even better, coming in at 27% per year for five years. Maybe the share price is just taking a breather while the business executes on its growth strategy. If you would like to research Macquarie Telecom Group in more detail then you might want to take a look at whether insiders have been buying or selling shares in the company.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About ASX:MAQ

Macquarie Technology Group

Provides telecommunication, cloud computing, cybersecurity, and data center services to corporate and government customers in Australia.

Excellent balance sheet with acceptable track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion