A Rising Share Price Has Us Looking Closely At Macquarie Telecom Group Limited's (ASX:MAQ) P/E Ratio

It's really great to see that even after a strong run, Macquarie Telecom Group (ASX:MAQ) shares have been powering on, with a gain of 38% in the last thirty days. That brought the twelve month gain to a very sharp 93%.

All else being equal, a sharp share price increase should make a stock less attractive to potential investors. In the long term, share prices tend to follow earnings per share, but in the short term prices bounce around in response to short term factors (which are not always obvious). The implication here is that deep value investors might steer clear when expectations of a company are too high. Perhaps the simplest way to get a read on investors' expectations of a business is to look at its Price to Earnings Ratio (PE Ratio). Investors have optimistic expectations of companies with higher P/E ratios, compared to companies with lower P/E ratios.

See our latest analysis for Macquarie Telecom Group

How Does Macquarie Telecom Group's P/E Ratio Compare To Its Peers?

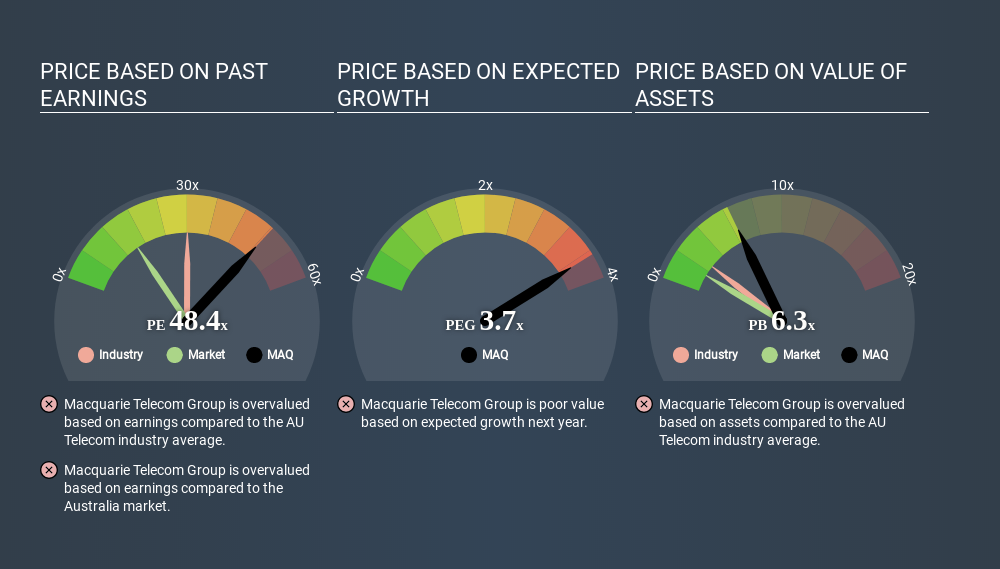

We can tell from its P/E ratio of 54.86 that there is some investor optimism about Macquarie Telecom Group. The image below shows that Macquarie Telecom Group has a higher P/E than the average (31.6) P/E for companies in the telecom industry.

Macquarie Telecom Group's P/E tells us that market participants think the company will perform better than its industry peers, going forward. Shareholders are clearly optimistic, but the future is always uncertain. So investors should always consider the P/E ratio alongside other factors, such as whether company directors have been buying shares.

How Growth Rates Impact P/E Ratios

Generally speaking the rate of earnings growth has a profound impact on a company's P/E multiple. When earnings grow, the 'E' increases, over time. Therefore, even if you pay a high multiple of earnings now, that multiple will become lower in the future. So while a stock may look expensive based on past earnings, it could be cheap based on future earnings.

Macquarie Telecom Group saw earnings per share decrease by 14% last year. But over the longer term (3 years), earnings per share have increased by 16%.

Don't Forget: The P/E Does Not Account For Debt or Bank Deposits

It's important to note that the P/E ratio considers the market capitalization, not the enterprise value. So it won't reflect the advantage of cash, or disadvantage of debt. The exact same company would hypothetically deserve a higher P/E ratio if it had a strong balance sheet, than if it had a weak one with lots of debt, because a cashed up company can spend on growth.

While growth expenditure doesn't always pay off, the point is that it is a good option to have; but one that the P/E ratio ignores.

How Does Macquarie Telecom Group's Debt Impact Its P/E Ratio?

Macquarie Telecom Group's net debt is 0.02% of its market cap. So it doesn't have as many options as it would with net cash, but its debt would not have much of an impact on its P/E ratio.

The Bottom Line On Macquarie Telecom Group's P/E Ratio

Macquarie Telecom Group's P/E is 54.9 which suggests the market is more focussed on the future opportunity rather than the current level of earnings. With modest debt but no EPS growth in the last year, it's fair to say the P/E implies some optimism about future earnings, from the market. What we know for sure is that investors have become much more excited about Macquarie Telecom Group recently, since they have pushed its P/E ratio from 39.9 to 54.9 over the last month. For those who prefer to invest with the flow of momentum, that might mean it's time to put the stock on a watchlist, or research it. But the contrarian may see it as a missed opportunity.

Investors have an opportunity when market expectations about a stock are wrong. People often underestimate remarkable growth -- so investors can make money when fast growth is not fully appreciated. So this free visualization of the analyst consensus on future earnings could help you make the right decision about whether to buy, sell, or hold.

But note: Macquarie Telecom Group may not be the best stock to buy. So take a peek at this free list of interesting companies with strong recent earnings growth (and a P/E ratio below 20).

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.

About ASX:MAQ

Macquarie Technology Group

Provides telecommunication, cloud computing, cybersecurity, and data center services to corporate and government customers in Australia.

Excellent balance sheet with acceptable track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026