Shareholders May Be A Bit More Conservative With DTI Group Limited's (ASX:DTI) CEO Compensation For Now

Key Insights

- DTI Group will host its Annual General Meeting on 28th of November

- Salary of AU$309.8k is part of CEO Matt Strack's total remuneration

- The overall pay is comparable to the industry average

- DTI Group's three-year loss to shareholders was 18% while its EPS grew by 81% over the past three years

The underwhelming share price performance of DTI Group Limited (ASX:DTI) in the past three years would have disappointed many shareholders. However, what is unusual is that EPS growth has been positive, suggesting that the share price has diverged from fundamentals. Shareholders may want to question the board on the future direction of the company at the upcoming AGM on 28th of November. Voting on resolutions such as executive remuneration and other matters could also be a way to influence management. Here's our take on why we think shareholders may want to be cautious of approving a raise for the CEO at the moment.

View our latest analysis for DTI Group

How Does Total Compensation For Matt Strack Compare With Other Companies In The Industry?

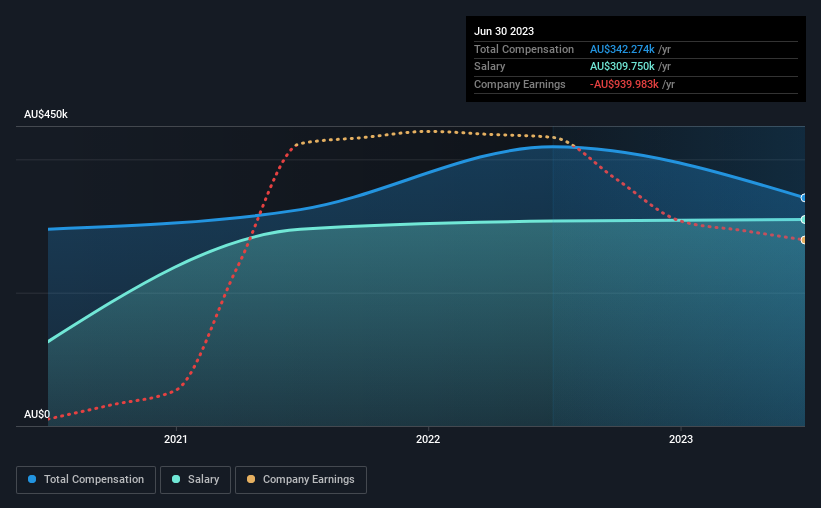

At the time of writing, our data shows that DTI Group Limited has a market capitalization of AU$8.0m, and reported total annual CEO compensation of AU$342k for the year to June 2023. Notably, that's a decrease of 18% over the year before. In particular, the salary of AU$309.8k, makes up a huge portion of the total compensation being paid to the CEO.

In comparison with other companies in the Australia Electronic industry with market capitalizations under AU$305m, the reported median total CEO compensation was AU$415k. So it looks like DTI Group compensates Matt Strack in line with the median for the industry.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | AU$310k | AU$307k | 90% |

| Other | AU$33k | AU$112k | 10% |

| Total Compensation | AU$342k | AU$419k | 100% |

On an industry level, roughly 66% of total compensation represents salary and 34% is other remuneration. It's interesting to note that DTI Group pays out a greater portion of remuneration through salary, compared to the industry. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

A Look at DTI Group Limited's Growth Numbers

DTI Group Limited's earnings per share (EPS) grew 81% per year over the last three years. Its revenue is down 17% over the previous year.

This demonstrates that the company has been improving recently and is good news for the shareholders. It's always a tough situation when revenues are not growing, but ultimately profits are more important. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has DTI Group Limited Been A Good Investment?

Given the total shareholder loss of 18% over three years, many shareholders in DTI Group Limited are probably rather dissatisfied, to say the least. So shareholders would probably want the company to be less generous with CEO compensation.

In Summary...

Despite the growth in its earnings, the share price decline in the past three years is certainly concerning. A huge lag in share price growth when earnings have grown may indicate there could be other issues that are affecting the company at the moment that the market is focused on. Shareholders would be keen to know what's holding the stock back when earnings have grown. These concerns should be addressed at the upcoming AGM, where shareholders can question the board and evaluate if their judgement and decision making is still in line with their expectations.

While it is important to pay attention to CEO remuneration, investors should also consider other elements of the business. We did our research and spotted 2 warning signs for DTI Group that investors should look into moving forward.

Important note: DTI Group is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:DTI

DTI Group

Develops, manufactures, and sells integrated surveillance and passenger communication systems, and fleet management solutions in Australia, Europe, North America, and internationally.

Moderate risk with mediocre balance sheet.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion