How Codan’s Strong FY25 Results and Kägwerks Acquisition Could Impact ASX:CDA Investors

Reviewed by Sasha Jovanovic

- Codan Limited recently reported a strong financial result for FY25, achieving 22% group revenue growth and marked increases in EBIT and NPAT, following the acquisition of Kägwerks to strengthen its U.S. defense market presence.

- The Communications division, including Zetron and DTC, posted a 26% revenue rise, while Minelab benefited from elevated gold prices and expanded distribution channels for a 16% increase.

- We’ll examine how Codan’s successful acquisition of Kägwerks and uplift in core businesses could influence the company’s future outlook.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Codan Investment Narrative Recap

To be a Codan shareholder, you need to believe in the company's ability to drive growth through expanding its communications portfolio and strengthening its position in defense and gold detection markets, even as competitive and regulatory headwinds remain a reality. The recent solid FY25 result highlights ongoing momentum, but the biggest short term catalyst, successfully integrating acquisitions like Kägwerks to secure higher-margin contracts, faces the immediate risk of revenue volatility, particularly if U.S. government procurement cycles shift more than expected. While the recent news affirms operational progress, its impact on the timing of large new defense orders may not be material right now.

Among Codan's recent announcements, the integration of Kägwerks stands out as closely tied to this news. Kägwerks strengthens the U.S. defense communications footprint at a time when defense contract momentum is crucial to offsetting the cyclical nature of Minelab’s gold detection business and helps mitigate risks tied to project-based revenue patterns, especially in a market known for procurement delays. Despite this, investors should be aware that if government spending patterns change, especially in the U.S., then...

Read the full narrative on Codan (it's free!)

Codan's narrative projects A$961.4 million revenue and A$185.4 million earnings by 2028. This requires 12.6% yearly revenue growth and an increase in earnings of A$81.9 million from the current A$103.5 million.

Uncover how Codan's forecasts yield a A$28.41 fair value, a 18% downside to its current price.

Exploring Other Perspectives

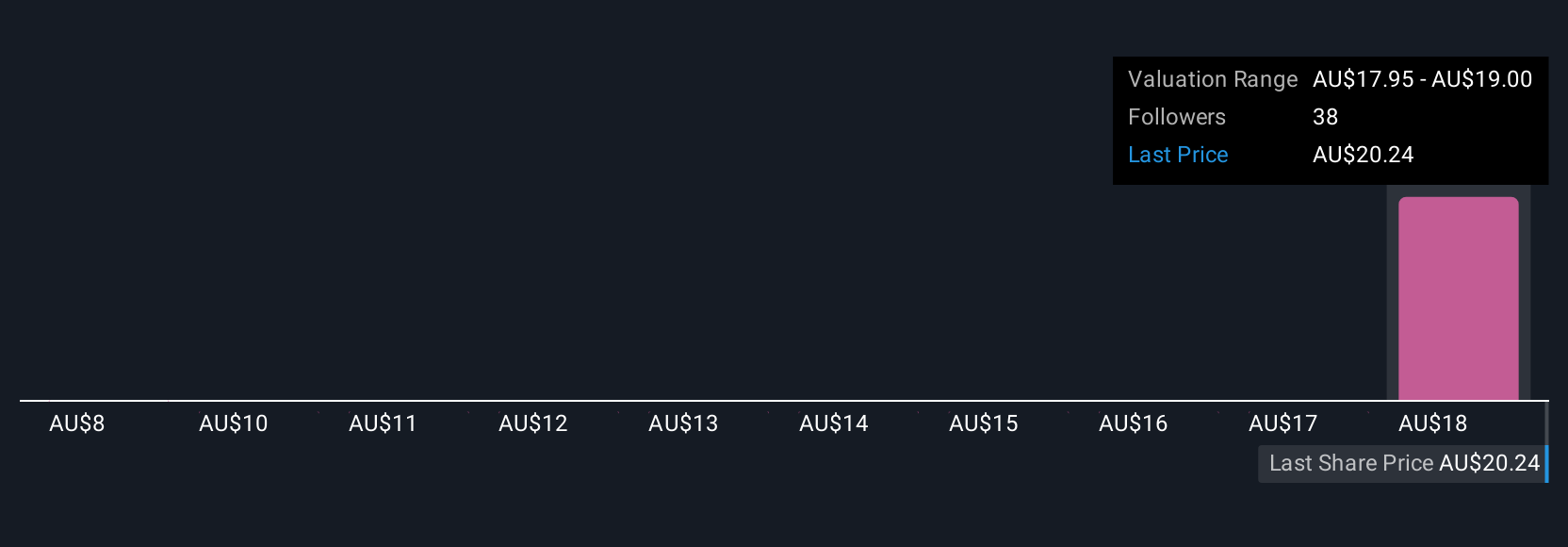

Five different Simply Wall St Community fair value estimates for Codan range from A$11.78 to A$28.41 per share. With government procurement cycles still posing timing risks, you can explore alternate views on what drives the company’s future performance.

Explore 5 other fair value estimates on Codan - why the stock might be worth less than half the current price!

Build Your Own Codan Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Codan research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Codan research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Codan's overall financial health at a glance.

Interested In Other Possibilities?

Our top stock finds are flying under the radar-for now. Get in early:

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:CDA

Codan

Develops technology solutions for United Nations organizations, security and military agencies, government departments, corporates, individuals consumers, and small-scale miners.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives