The Australian market has recently experienced a slight downturn, with the ASX200 down 0.65% at 8,375 points, while the IT sector stands out as a bright spot with a modest gain of 0.35%. In this context of fluctuating indices and regulatory scrutiny following last year's exchange outage, identifying high growth tech stocks requires careful consideration of their resilience and potential to thrive amid these dynamic market conditions.

Top 10 High Growth Tech Companies In Australia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Clinuvel Pharmaceuticals | 21.39% | 26.17% | ★★★★★★ |

| Pureprofile | 14.31% | 71.53% | ★★★★★☆ |

| Pro Medicus | 20.42% | 22.46% | ★★★★★★ |

| Adherium | 86.80% | 73.66% | ★★★★★★ |

| AVA Risk Group | 25.54% | 77.32% | ★★★★★★ |

| Mesoblast | 49.13% | 55.01% | ★★★★★★ |

| Pointerra | 56.62% | 126.45% | ★★★★★★ |

| Wrkr | 37.21% | 98.46% | ★★★★★★ |

| Opthea | 52.75% | 60.67% | ★★★★★★ |

| SiteMinder | 18.83% | 60.68% | ★★★★★☆ |

Click here to see the full list of 56 stocks from our ASX High Growth Tech and AI Stocks screener.

We'll examine a selection from our screener results.

Codan (ASX:CDA)

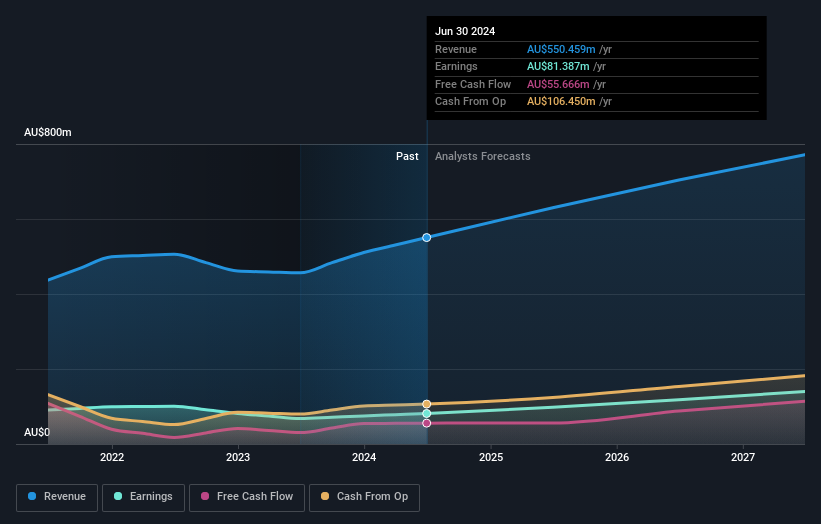

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Codan Limited is a company that develops technology solutions for various clients, including United Nations organizations, security and military groups, government departments, individuals, and small-scale miners, with a market capitalization of A$2.82 billion.

Operations: The company generates revenue primarily from its Communications and Metal Detection segments, contributing A$326.91 million and A$219.85 million, respectively.

Codan, an Australian tech firm, has demonstrated robust financial health with a 20.1% increase in earnings over the past year, outpacing the electronics industry's growth of 3.6%. With revenues expected to rise by 10.6% annually and earnings forecasted to grow at 17.4% per year, Codan is outperforming the broader Australian market's growth rates of 6% for revenue and 12.6% for earnings respectively. This performance is underpinned by significant investment in R&D, reflecting a commitment to innovation despite not reaching the high threshold of over 20% annual earnings growth considered significant. The company's strategic focus on developing high-quality electronic solutions could position it well for sustained future growth amidst evolving technological demands.

- Click here and access our complete health analysis report to understand the dynamics of Codan.

Evaluate Codan's historical performance by accessing our past performance report.

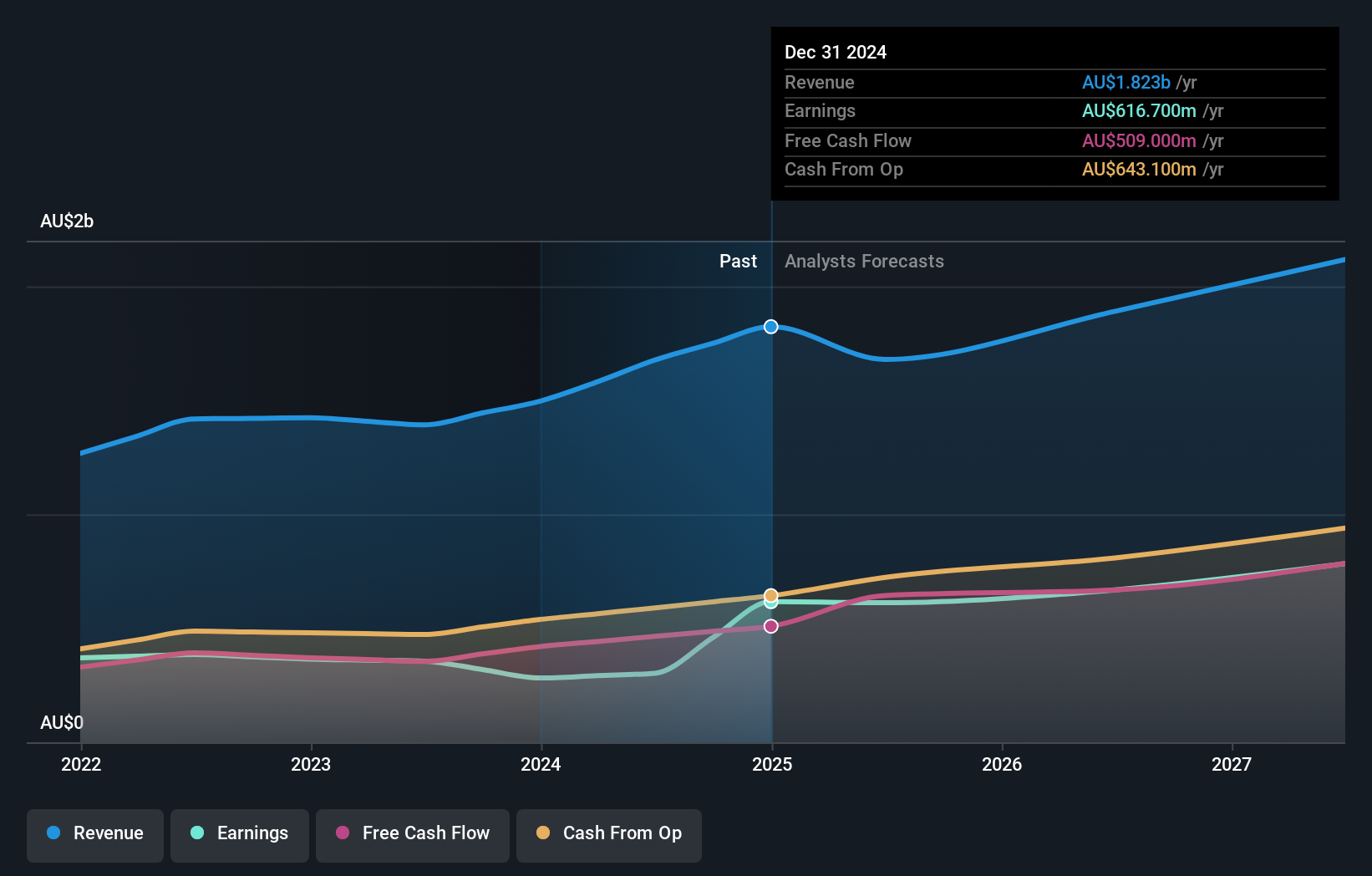

REA Group (ASX:REA)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: REA Group Limited operates an online property advertising business across Australia, India, the United States, Malaysia, Singapore, Thailand, Vietnam, and other international markets with a market capitalization of approximately A$31.58 billion.

Operations: With a focus on online property advertising, REA Group generates significant revenue from its Australia Property & Online Advertising segment (A$1.25 billion) and Australia Financial Services (A$320.60 million), complemented by operations in India contributing A$103.10 million. The company leverages its digital platforms to connect property seekers with real estate professionals across diverse international markets, enhancing its global footprint in the industry.

REA Group, an Australian tech firm, is navigating through a transformative phase with the recent appointment of Vikas Wadhawan as Chief Operating Officer at REA Cyber City. This strategic move underscores a commitment to fostering a culture of innovation and operational excellence. Despite facing challenges such as a significant one-off loss of A$153.6 million last year, REA's financial outlook remains positive with projected annual revenue growth at 7.2% and earnings expected to increase by 18.6%. These figures outpace the broader Australian market's growth projections, indicating potential resilience and upward trajectory in its sector.

- Click to explore a detailed breakdown of our findings in REA Group's health report.

Understand REA Group's track record by examining our Past report.

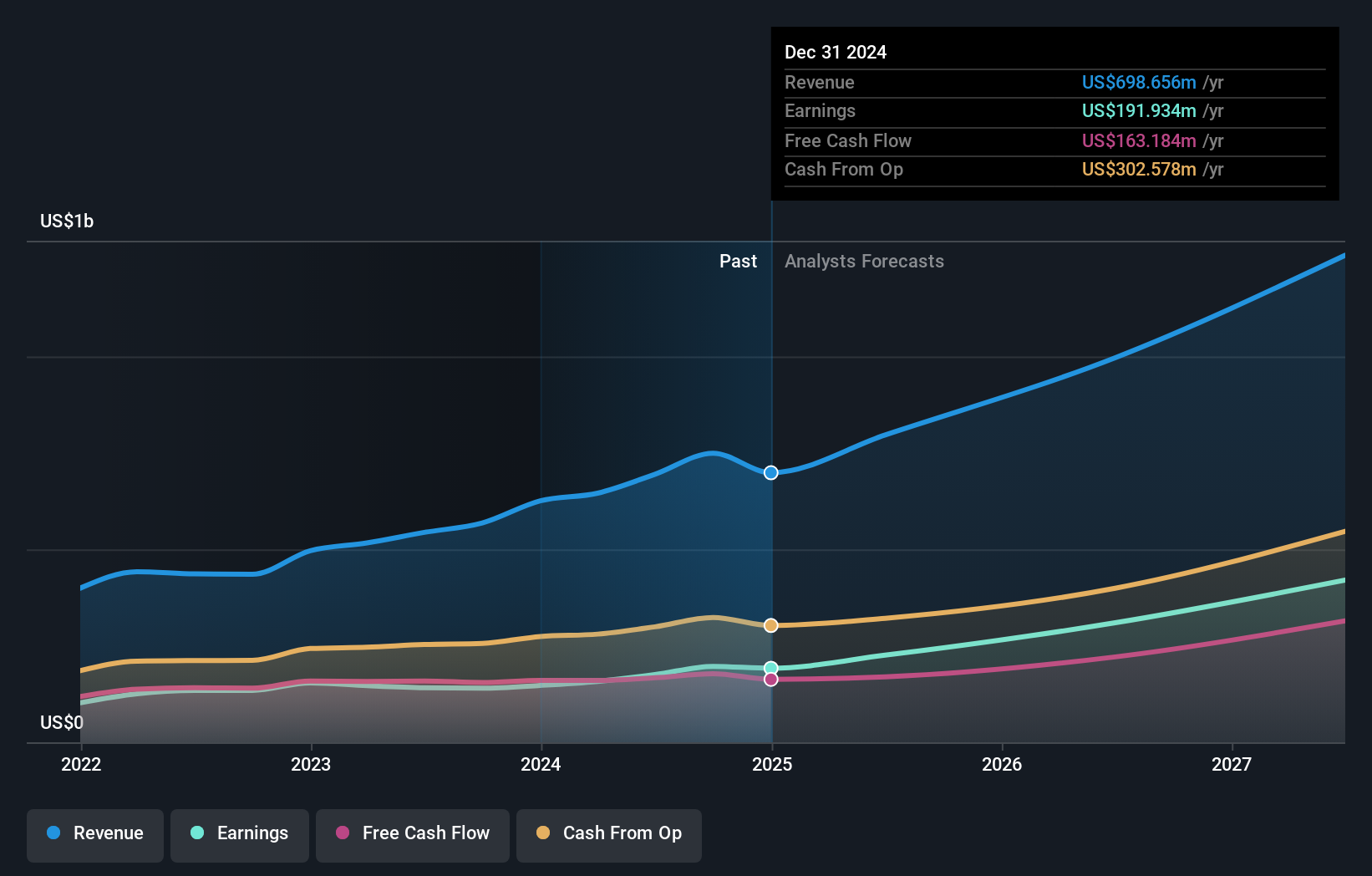

WiseTech Global (ASX:WTC)

Simply Wall St Growth Rating: ★★★★★☆

Overview: WiseTech Global Limited develops and provides software solutions for the logistics execution industry across various regions, with a market cap of A$40.62 billion.

Operations: WiseTech Global Limited generates revenue primarily from its Internet Software & Services segment, amounting to A$1.04 billion. The company focuses on providing software solutions tailored for the logistics execution industry across multiple regions, including the Americas, Asia Pacific, Europe, the Middle East, and Africa.

WiseTech Global, amidst leadership transitions and robust financial forecasts, is poised to redefine logistics through technology. With a projected revenue growth of 15% to 25% for fiscal year 2025, amounting to AUD 1.2 billion to AUD 1.3 billion, the company demonstrates resilience and potential in a competitive sector. The departure of CEO Richard White ushers in a new era under interim leadership, yet his ongoing involvement as a consultant ensures continuity in innovation and strategic vision. This period of change coincides with significant earnings growth outpacing the Australian market's average; WiseTech's earnings have surged by 23.8% over the past year compared to the software industry’s growth of 6.8%. Such dynamic shifts underscore WiseTech’s capacity for sustained growth and adaptation in global logistics operations.

Summing It All Up

- Gain an insight into the universe of 56 ASX High Growth Tech and AI Stocks by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:REA

REA Group

Engages in online property advertising business in Australia, Asia, and North America It provides property and property-related services on websites and mobile applications.

Outstanding track record with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion