Exploring Three ASX Stocks Estimated To Be Up To 27.8% Below Intrinsic Value

Reviewed by Simply Wall St

Despite a slight downturn this week, the ASX200 has shown varied sector performance with notable movements in Health Care and Materials. As investors navigate these shifts, identifying stocks that appear undervalued relative to their intrinsic value could present opportunities for those looking to potentially enhance their portfolios amid current market conditions.

Top 10 Undervalued Stocks Based On Cash Flows In Australia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| GTN (ASX:GTN) | A$0.43 | A$0.85 | 49.2% |

| MaxiPARTS (ASX:MXI) | A$2.04 | A$4.00 | 49% |

| Ansell (ASX:ANN) | A$25.64 | A$49.46 | 48.2% |

| Elders (ASX:ELD) | A$8.42 | A$16.28 | 48.3% |

| Strike Energy (ASX:STX) | A$0.23 | A$0.45 | 48.8% |

| IPH (ASX:IPH) | A$6.21 | A$11.95 | 48% |

| ReadyTech Holdings (ASX:RDY) | A$3.25 | A$6.22 | 47.7% |

| Millennium Services Group (ASX:MIL) | A$1.145 | A$2.24 | 48.9% |

| Airtasker (ASX:ART) | A$0.29 | A$0.57 | 49.1% |

| SiteMinder (ASX:SDR) | A$5.30 | A$9.96 | 46.8% |

We'll examine a selection from our screener results

Codan (ASX:CDA)

Overview: Codan Limited is a technology solutions provider serving United Nations organizations, mining companies, security and military groups, government departments, and individuals, with a market capitalization of approximately A$2.16 billion.

Operations: Codan Limited generates revenue through its communications and metal detection segments, amounting to A$291.50 million and A$212.20 million respectively.

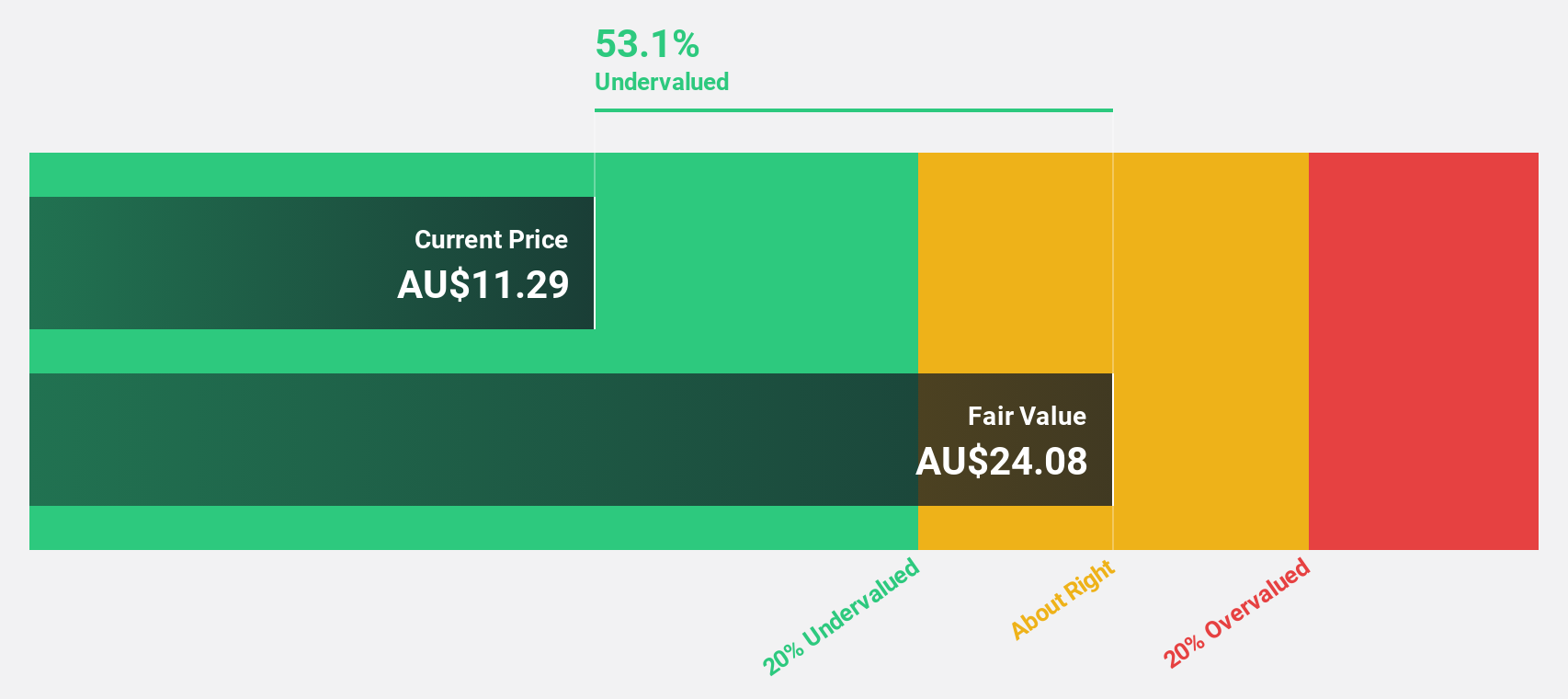

Estimated Discount To Fair Value: 27.8%

Codan is considered undervalued based on discounted cash flow analysis, trading at A$11.91 against a fair value estimate of A$16.49, reflecting a notable discount. The company's earnings are expected to grow by 16.2% annually, outpacing the Australian market's forecast growth of 13.1%. Additionally, Codan's revenue growth projection stands at 9.1% per year, surpassing the broader market expectation of 5.3%. This financial performance suggests potential for increased investor interest due to its robust growth forecasts and current valuation levels.

- In light of our recent growth report, it seems possible that Codan's financial performance will exceed current levels.

- Click here to discover the nuances of Codan with our detailed financial health report.

Nickel Industries (ASX:NIC)

Overview: Nickel Industries Limited is a company focused on nickel ore mining and the production of nickel pig iron and nickel matte, with a market capitalization of approximately A$3.51 billion.

Operations: The company generates revenue through three primary segments: nickel ore mining in Indonesia (A$36.81 million), HPAL projects in Indonesia and Hong Kong (A$32.58 million), and RKEF projects in Indonesia and Singapore (A$1.81 billion).

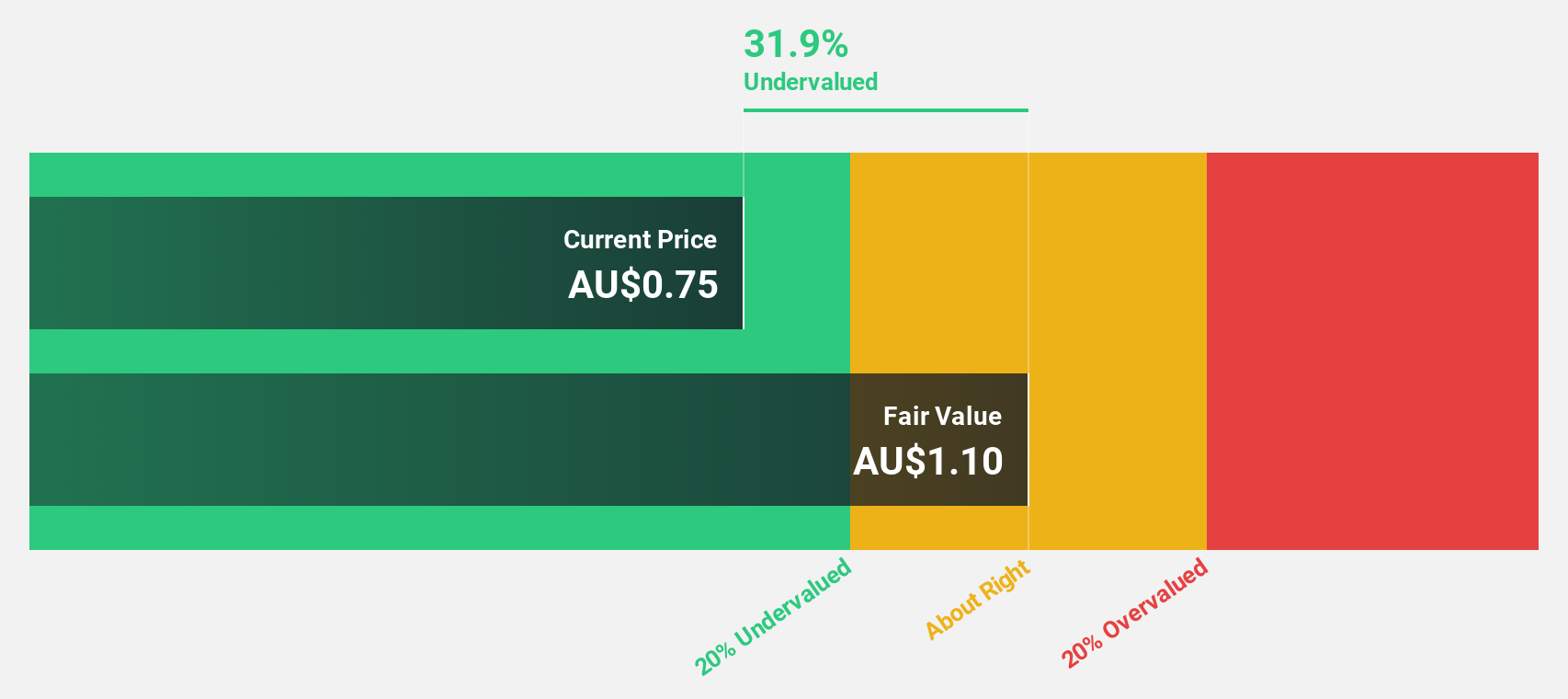

Estimated Discount To Fair Value: 15.2%

Nickel Industries, priced at A$0.82, is currently valued below its estimated fair value of A$0.97, presenting a moderate undervaluation based on discounted cash flow analysis. Despite this, the company's earnings are expected to grow by 37.1% annually, significantly outpacing the Australian market's growth rate of 13.1%. However, its dividend sustainability is questionable as it is not well-covered by cash flows. Recent financial activities include securing a substantial USD 250 million term loan to support strategic acquisitions and expansions.

- The analysis detailed in our Nickel Industries growth report hints at robust future financial performance.

- Get an in-depth perspective on Nickel Industries' balance sheet by reading our health report here.

Sandfire Resources (ASX:SFR)

Overview: Sandfire Resources Limited is a mining company that focuses on the exploration, evaluation, and development of mineral tenements and projects, with a market capitalization of approximately A$4.15 billion.

Operations: The company generates revenue primarily through its MATSA Copper Operations and Degrussa Copper Operations, which contributed $581.75 million and $94.49 million respectively.

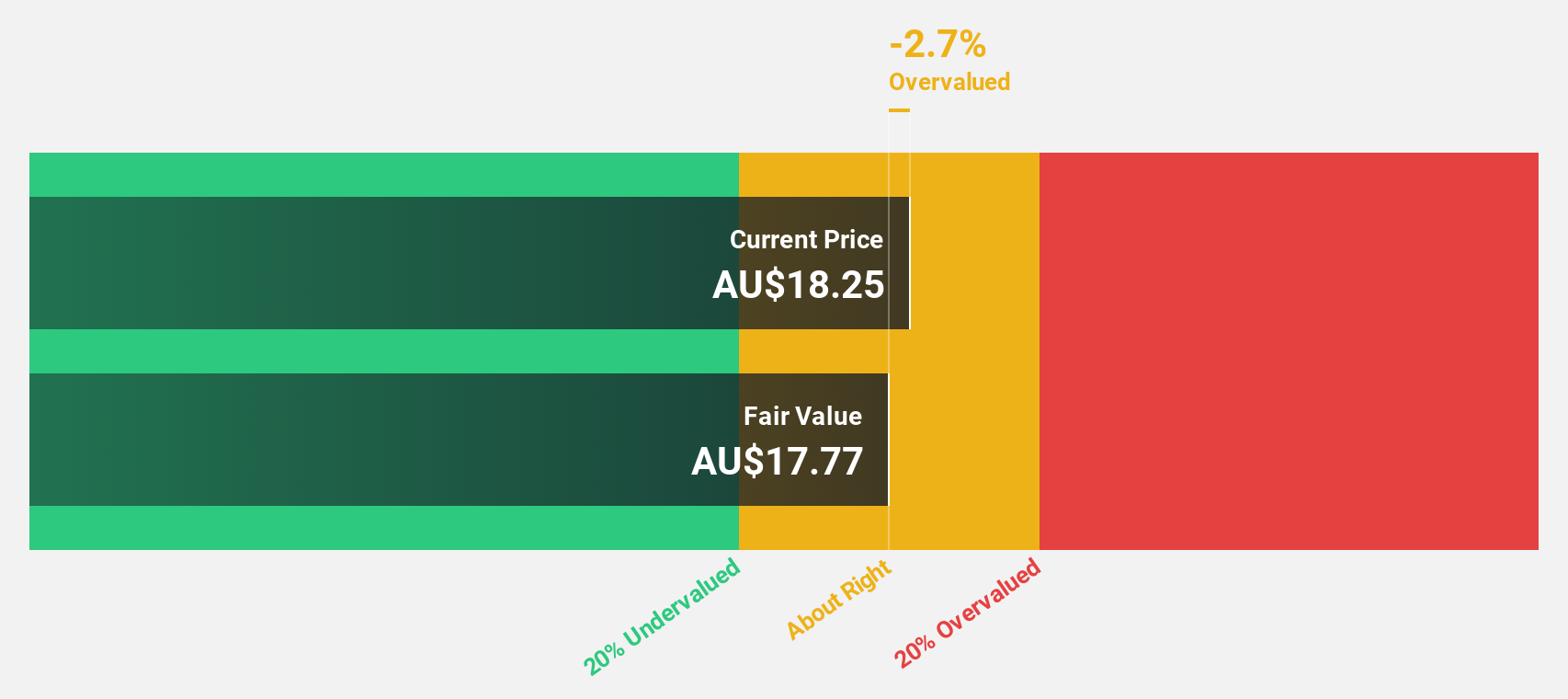

Estimated Discount To Fair Value: 17.4%

Sandfire Resources, trading at A$9.08, is considered undervalued with its price sitting 17.4% below the calculated fair value of A$10.99. Analysts predict robust annual earnings growth of 52.64%, significantly outpacing general market expectations, and revenue growth forecasted at 15.5% annually, surpassing the Australian market's average of 5.3%. However, its Return on Equity is expected to remain modest at 9.9% in three years' time.

- Our earnings growth report unveils the potential for significant increases in Sandfire Resources' future results.

- Unlock comprehensive insights into our analysis of Sandfire Resources stock in this financial health report.

Seize The Opportunity

- Reveal the 53 hidden gems among our Undervalued ASX Stocks Based On Cash Flows screener with a single click here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:CDA

Codan

Develops technology solutions for United Nations organizations, security and military groups, government departments, individuals, and small-scale miners.

Excellent balance sheet and good value.