Codan (ASX:CDA) Is Up 17.2% After Posting Higher Earnings and Dividend for FY25 - Has The Bull Case Changed?

Reviewed by Simply Wall St

- Codan Limited recently reported its full year results, with sales reaching A$674.23 million and net income totaling A$103.49 million for the period ended June 30, 2025, and announced an ordinary dividend of A$0.16 per share to be paid on September 17, 2025.

- This marks an increase in both earnings and dividends from the previous year, signaling ongoing operational momentum and a greater return to shareholders.

- With Codan announcing both higher earnings and an increased dividend, we'll now assess how this supports the company's investment outlook.

Find companies with promising cash flow potential yet trading below their fair value.

Codan Investment Narrative Recap

To own Codan, investors need to be confident in the company’s ability to expand its Communications segment and integrate recent acquisitions without straining margins or increasing financial risk. The recent announcement of stronger earnings and a higher dividend underlines Codan’s operational momentum, but this news does not significantly change the principal short-term catalyst: demonstrating continued organic and acquisition-driven growth, or the biggest current risk, which is maintaining profitability amid rising costs and debt.

The most relevant announcement to the recent results is Codan’s declaration of a A$0.16 per share ordinary dividend for the six months ended June 30, 2025. This higher payout aligns with the company’s improved net income and supports the view that ongoing growth in Communications remains a core focus, but the durability of this dividend boost will depend on how well Codan manages integration challenges from its acquisition strategy.

However, investors should be aware that if integration costs or rising debt begin impacting margins, then ...

Read the full narrative on Codan (it's free!)

Codan's narrative projects A$838.5 million revenue and A$149.2 million earnings by 2028. This requires 12.4% yearly revenue growth and a A$59.8 million earnings increase from A$89.4 million.

Uncover how Codan's forecasts yield a A$25.59 fair value, a 10% downside to its current price.

Exploring Other Perspectives

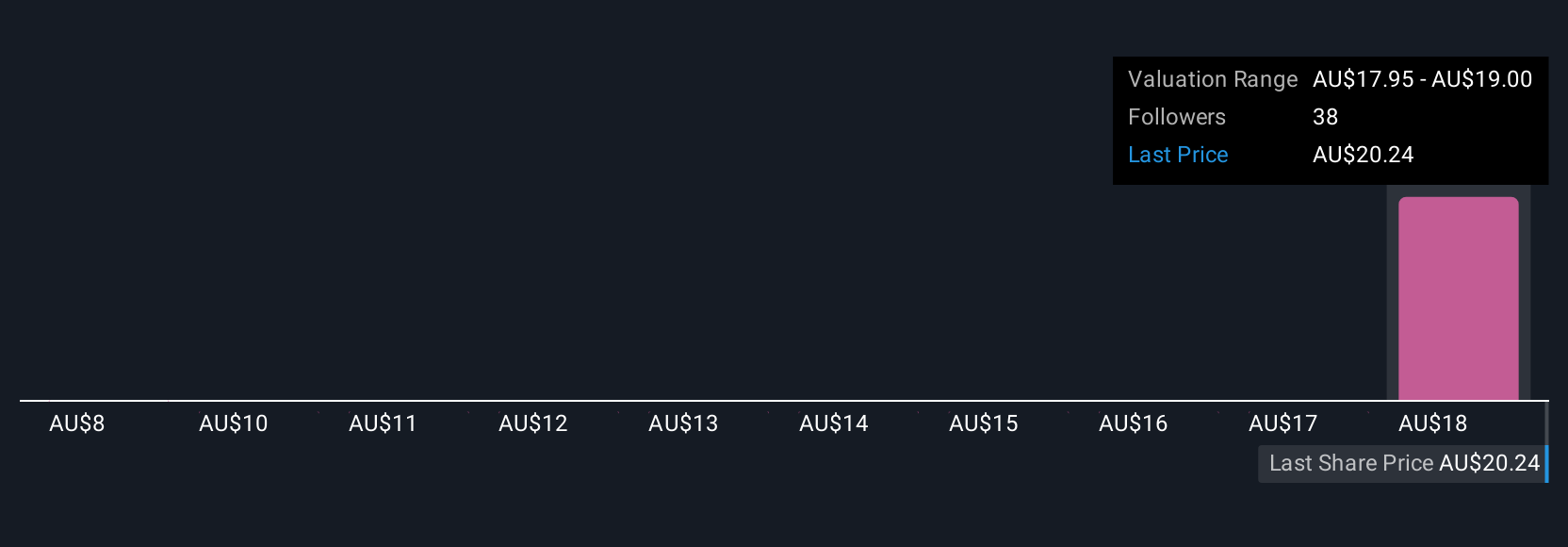

Five fair value estimates from the Simply Wall St Community range widely, from A$11.78 to A$25.59 per share. While some anticipate significant growth from Communications, the potential for higher expenses tied to acquisitions suggests careful monitoring for future margin pressure.

Explore 5 other fair value estimates on Codan - why the stock might be worth as much as A$25.59!

Build Your Own Codan Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Codan research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Codan research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Codan's overall financial health at a glance.

Interested In Other Possibilities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 20 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:CDA

Codan

Develops technology solutions for United Nations organizations, security and military agencies, government departments, corporates, individuals consumers, and small-scale miners.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives