Ava Risk Group Limited's (ASX:AVA) 34% Dip In Price Shows Sentiment Is Matching Earnings

Ava Risk Group Limited (ASX:AVA) shareholders that were waiting for something to happen have been dealt a blow with a 34% share price drop in the last month. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 50% in that time.

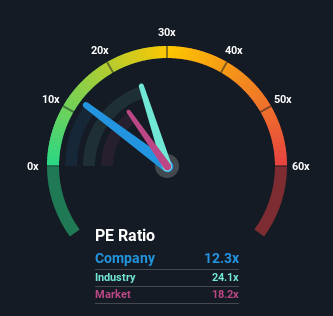

After such a large drop in price, given close to half the companies in Australia have price-to-earnings ratios (or "P/E's") above 19x, you may consider Ava Risk Group as an attractive investment with its 12.3x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

Ava Risk Group hasn't been tracking well recently as its declining earnings compare poorly to other companies, which have seen some growth on average. It seems that many are expecting the dour earnings performance to persist, which has repressed the P/E. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Check out our latest analysis for Ava Risk Group

Is There Any Growth For Ava Risk Group?

The only time you'd be truly comfortable seeing a P/E as low as Ava Risk Group's is when the company's growth is on track to lag the market.

Retrospectively, the last year delivered a frustrating 56% decrease to the company's bottom line. This has erased any of its gains during the last three years, with practically no change in EPS being achieved in total. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Shifting to the future, estimates from the lone analyst covering the company suggest earnings growth is heading into negative territory, declining 32% over the next year. Meanwhile, the broader market is forecast to expand by 22%, which paints a poor picture.

In light of this, it's understandable that Ava Risk Group's P/E would sit below the majority of other companies. However, shrinking earnings are unlikely to lead to a stable P/E over the longer term. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

The Bottom Line On Ava Risk Group's P/E

Ava Risk Group's P/E has taken a tumble along with its share price. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of Ava Risk Group's analyst forecasts revealed that its outlook for shrinking earnings is contributing to its low P/E. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

Before you take the next step, you should know about the 3 warning signs for Ava Risk Group that we have uncovered.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a P/E below 20x.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:AVA

AVA Risk Group

Provides risk management technologies in Australia, Europe, Asia Pacific, India, Middle East, North Africa, the United States, and internationally.

Undervalued with excellent balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success